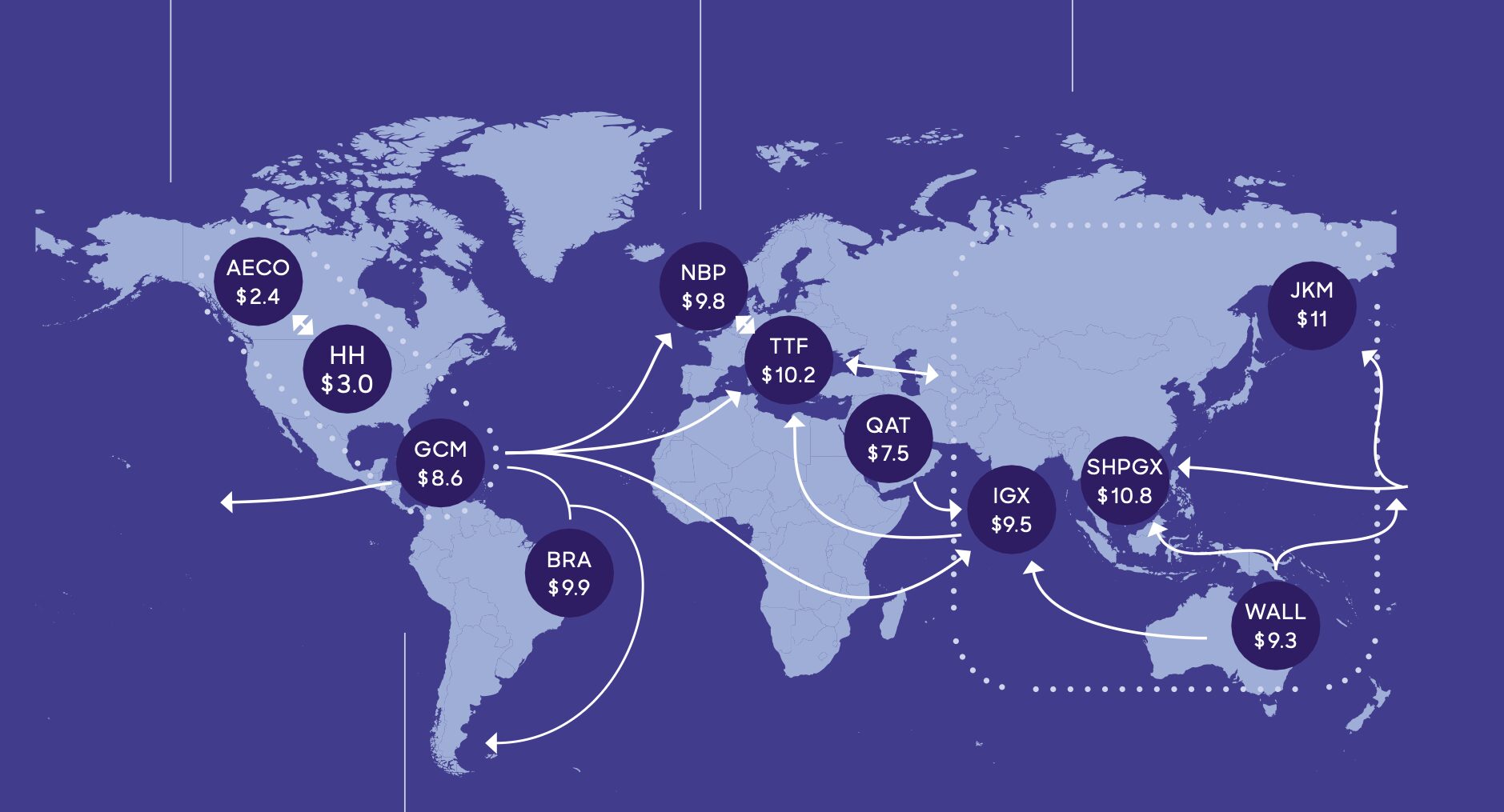

This paper first shows that, contrary to conventional wisdom, the European Central Bank (ECB) can influence global energy prices. Second, through Lucas critique-robust counterfactual analysis, we uncover that the ECB’s ability to affect fast-moving energy prices plays an important role in the transmission of monetary policy. Third, we empirically document that, to optimally fulfill its primary mandate, the ECB should […]