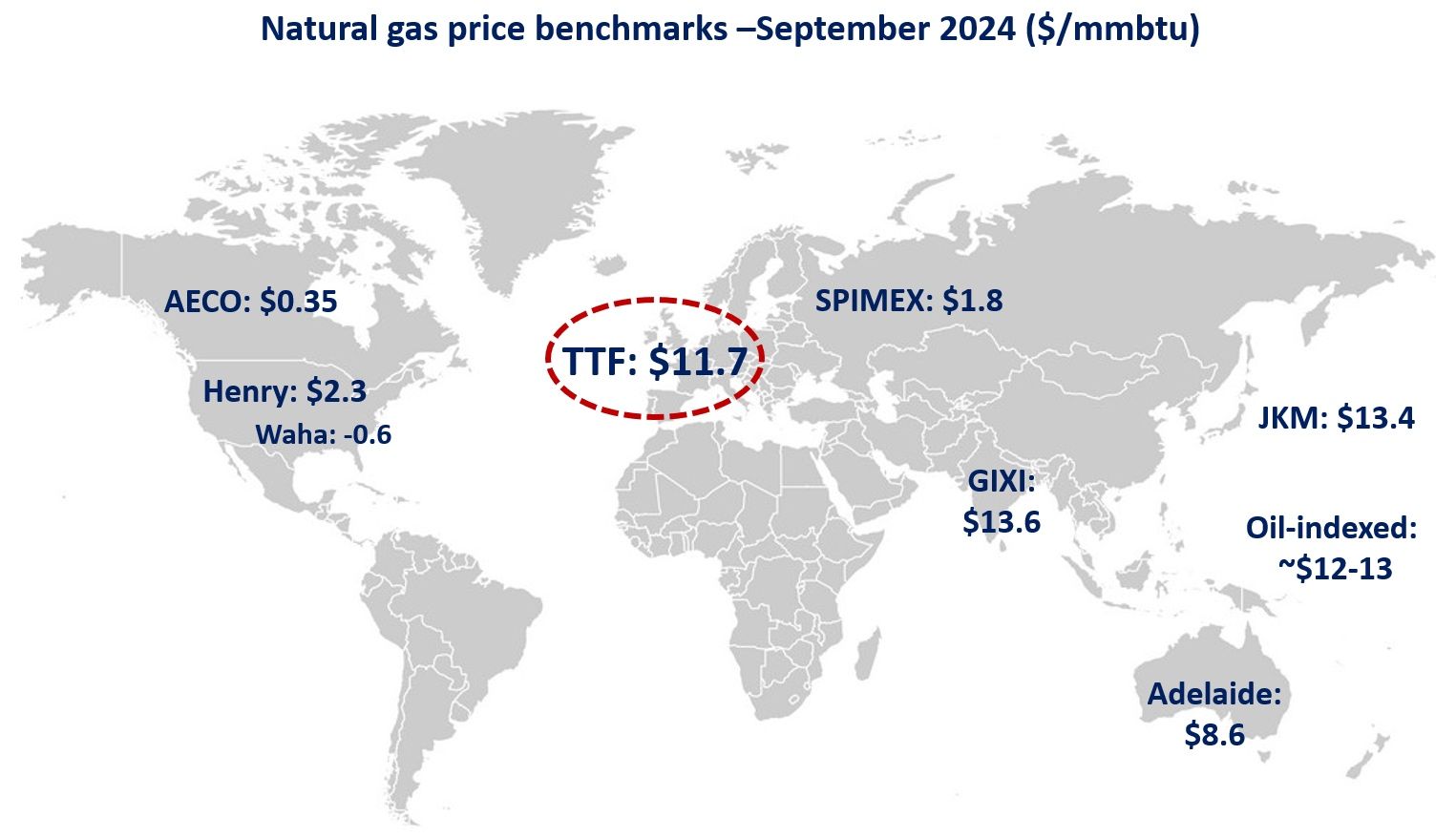

Natural gas prices continued to strengthen in December amid colder weather, tighter supply fundamentals and raging geopolitical tensions.

In Europe, TTF month-ahead prices rose by 20% compared to last year’s December to an average of $13.8/mmbtu.

Gas demand was up by around 5% yoy, with colder temperatures boosting space heating requirements, while underperforming wind drove-up gas-fired powgen by nearly 20% yoy.

On the supply side, European LNG imports continue to slide, down by almost 10% yoy amid limited supply growth and fierce competition with Asia. unplanned outages in Norway and the uncertainties around the Ukrainian transit fuelled additional price volatility.

In Asia, JKM prices rose to $14.5/mmbtu -their highest level in 2024. stiff competition with Europe and limited LNG supply growth provided upward pressure on gas prices. notably, these price levels are now depressing demand growth, with China slowing down, while southeast Asian countries recording demand declines.

In the US, Henry Hub prices surged by 45% month-on-month to average at $3/mmbtu. cold weather boosted rescom demand by 15% yoy, while gas-fired powgen was up by 3% yoy.

In contrast, production remained depressed amid earlier shut-ins and was down by 1% yoy.

Meanwhile, AECO in Canada traded at just $1.3/mmbtu -its lowest Dec price level since 1995. strong production growth together with near full storage sites kept gas prices depressed despite the cold winter weather.

What is your view? How will gas prices evolve in 2025?

Source: Greg Molnar