Natural gas prices continued their downward trend in May amidst subdued demand and improving supply fundamentals.

In Europe, TTF month-ahead prices were down by 65% compared to last year, averaging at $10/mmbtu.

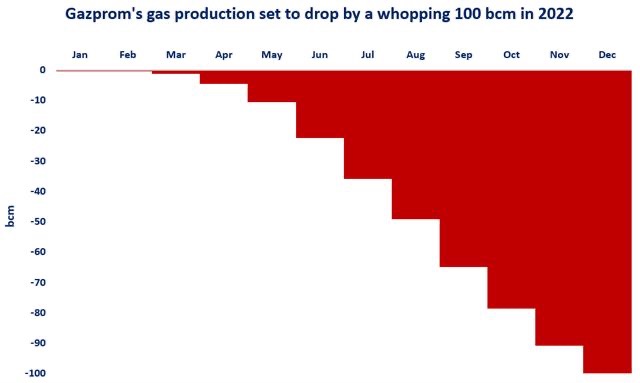

Lower demand (-9%), strong LNG inflows and high storage levels (nearly 70% full) are putting downward pressure on European prices – despite the dry up of Russian piped gas and higher number of outages in Norway.

In Asia, JKM prices continued a similar downward trend, although the slide was less steep, meaning that JKM recovered its premium vs TTF.

If sustained, this could incentivise stronger LNG flows towards Asia.

And China’s LNG appetite continues to recover: the country’s LNG imports were up by 18% yoy in May, although remaining below their 2021 levels.

In the US, Henry Hub prices remained broadly stable compared to last month, but are down by over 70% compared to last year’s May.

High storage, strong production growth and muted demand amidst slowing economy growth are weighing on gas prices.

What is your view for this summer? Will it be Coco Jambo all the time? Any upside risks for gas? Could we see a sustained JKM premium? How this could impact LNG flows?

Source: Greg Molnar (LinkedIn)