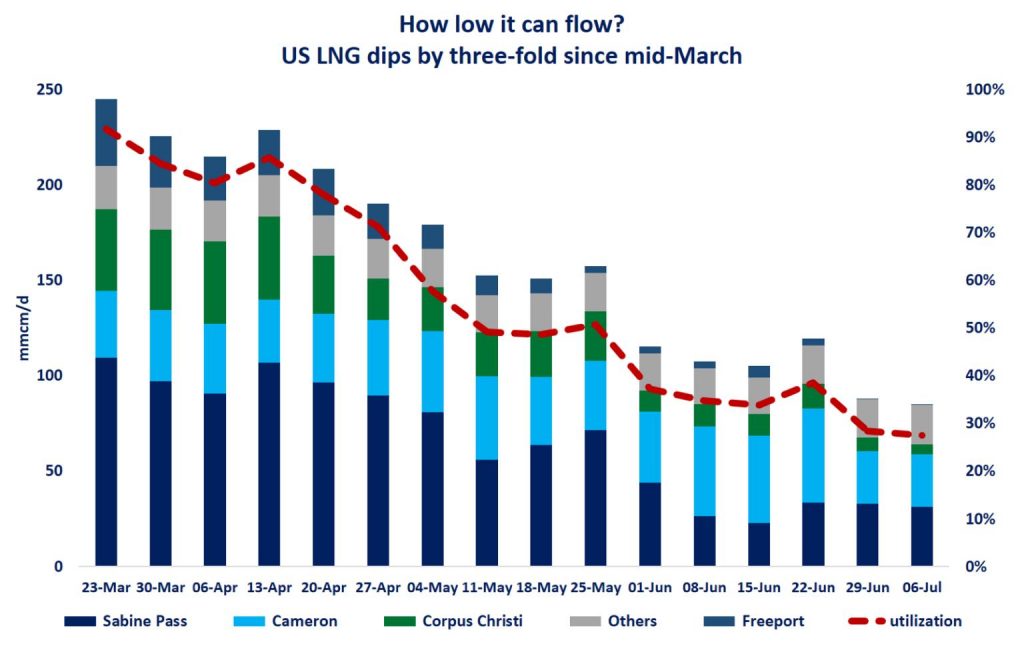

According to the EIA more than 110 cargo deliveries (~10 bcm) has been cancelled for this summer, heavily weighing on the utilization level of US LNG terminals, falling from over 90% in March to a below 30%.

Whilst all terminals feel the pain, the most heavily impacted were Corpus Christi (down by 8-fold), Sabine Pass (down by 3-fold) and Freeport (which did not receive any interstate flows since a week and is close to shut-in).

Interestingly, those terminals are the ones which have a higher exposure to European offtakers and portfolio players.

Cameron and Cove Point, both reliant more on the Asian market, have been somewhat less impacted by the downturn, with Cove Point also benefitting from cheaper gas from Marcellus.

What is your view? What is next for US LNG? According the EIA, LNG exports will be down at 2.2 bcf/d through July and August (vs 3 bcf/d) last week, but what about September and the heating season? Will prices as steeply as the forward curve suggest? Could there be any frisky surprises amidst record high storage stocks?

Source: Greg MOLNAR

Follow & connect with Greg on LinkedIn