It is now common to see the phrase that prices at European gas hubs decreased significantly in the last month and a half. But while this was true for many contracts, it was not true for some of them. If winter-delivery products did fall markedly during the period, the front summer did not lose much of its value over the period and far-curve prices actually rose since the year start.

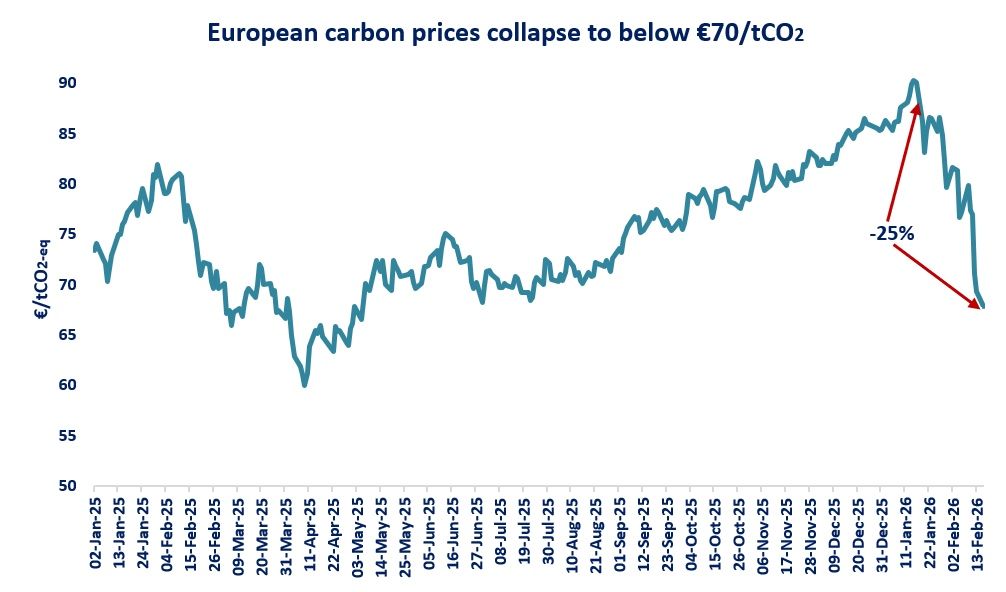

The way demand/supply situation was evolving on the regional market in the first part of Q1 2022 (unseasonably warm and windy weather + record-high LNG imports to Europe) resulted in about 25pc fall in the TTF prompt contracts between 6 January and 18 February 2022.

As the gas winter nears its end, an injection-related demand issue is gradually coming to the forefront, thus supporting summer 2022 products. Tom Marzec-Manser from ICIS made a very good point the other day when pointing out that the total amount of gas in the EU and UK sites is now back to the five-year range. At the same time market participants’ concerns on low European storage levels will likely remain high throughout 2022, given near-record volumes that would be required for refilling tight inventories across the region.

You can find something more interesting further out on the curve. The TTF calendar 2023 and 2024 increased by 1pc and 18pc respectively from the beginning of January. While the 2023 calendar year is trading at far lower levels than prompt contracts, it rose more than twice YoY.

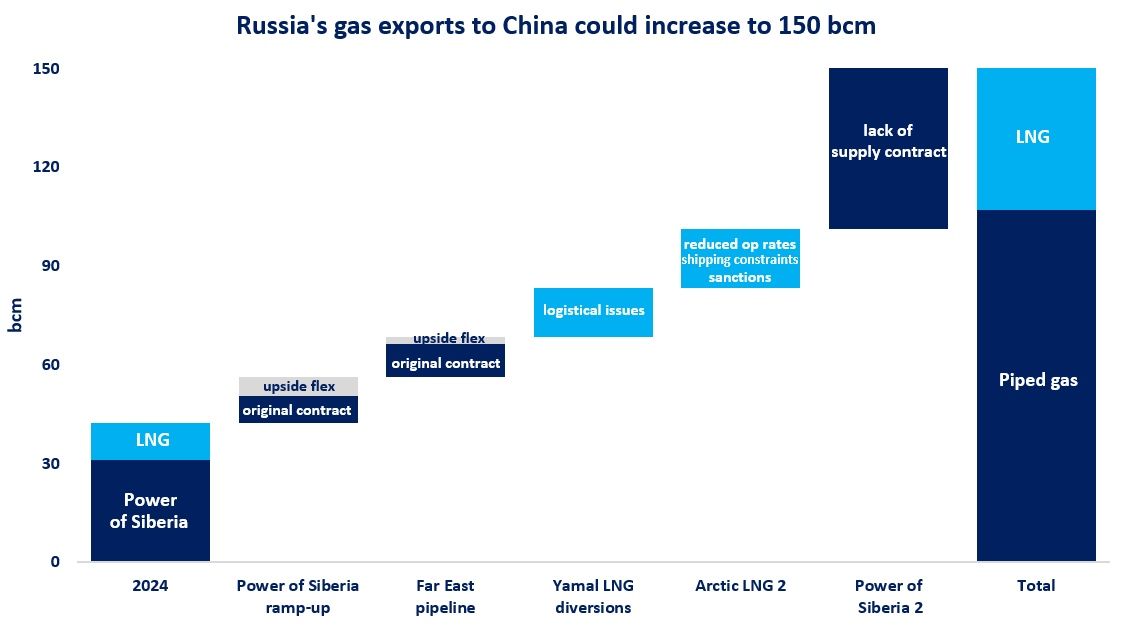

Far-curve price movements provide an understanding of how players assess the market’s fundamentals of the near future. Unlike the record prompt price spike that can be largely attributed to one-off events creating ‘a perfect storm’ for Europe, higher contracts covering 2023 and beyond show that, in the view of market participants, the high-price environment will pertain for quite a long time. The shift away from the period of global oversupply towards a seller’s market can be clearly seen through the back end of the curve.

Yakov Grabar (LinkedIn)