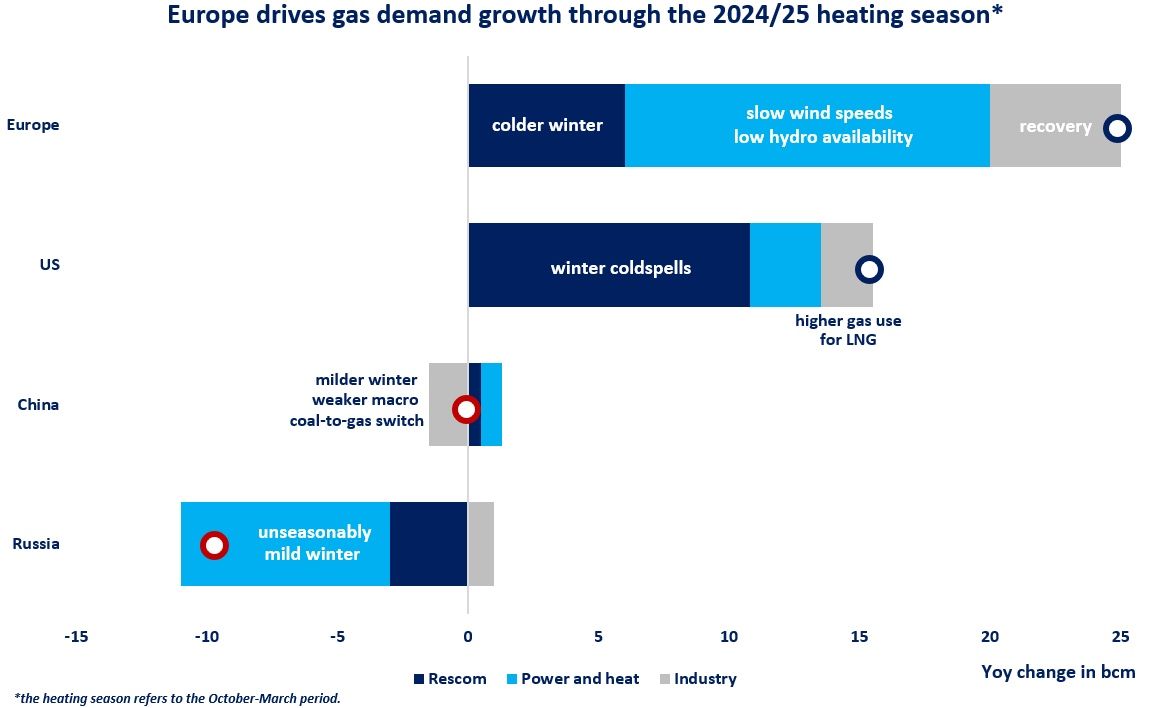

Europe’s LNG imports dropped by 20% yoy in Sep23, leading to their steepest drop since Russia’s invasion of Ukraine.

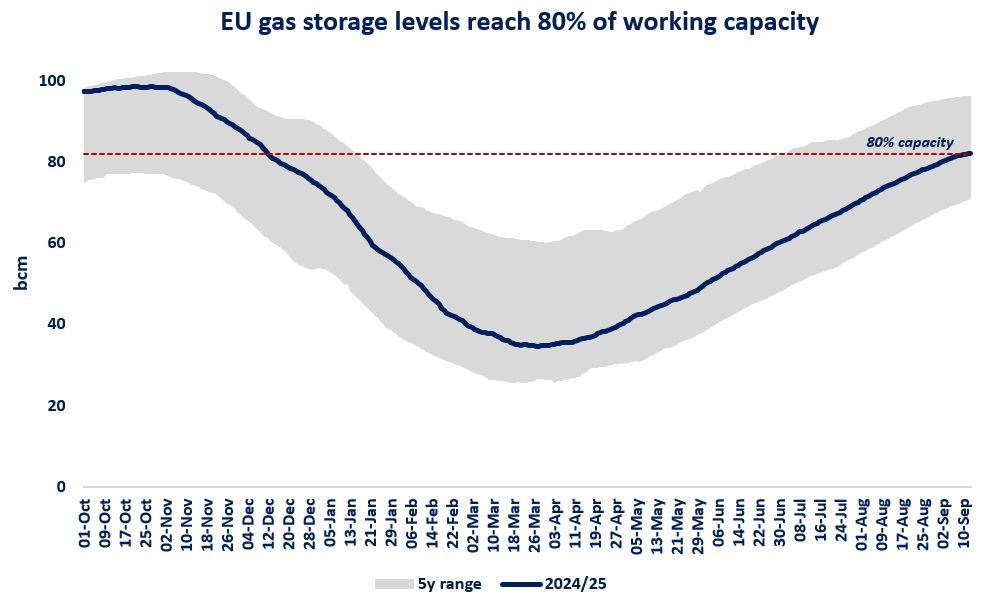

Full storage sites combined with continued demand reductions in Europe widened further JKM’s premium over TTF to an average of $2.5/mmbtu.

This spread incentivised flexible LNG volumes to divert away from Europe towards the more lucrative Asia shores, including to China, which increased its LNG imports by 20% yoy.

These developments highlight once again the growing flexibility and liquidity of global LNG trade, which become increasingly sensitive to price signals. As highlighted recently by IGU almost half of global LNG is traded based on gas-on-gas competition.

While the drop in European LNG imports is reflective of current market dynamics, it is by no mean a structural change: we expect LNG to remain a baseload source for the European market through the medium-term.

What is your view? How will Europe’s LNG imports evolve this winter season? and how will the JKM-TTF spread evolve?

Source: Greg MOLNAR