Gas prices have skyrocketed on 24 February after Russia invaded Ukraine, a move fueled by panic buying and concerns about what could happen next.

But, from the strict point of view of gas supply, there was no particular tension as Russian flows continued to flow and even increased. This triggered a sharp price drop on Friday 25 February, with, however, prices rising sharply week-on-week.

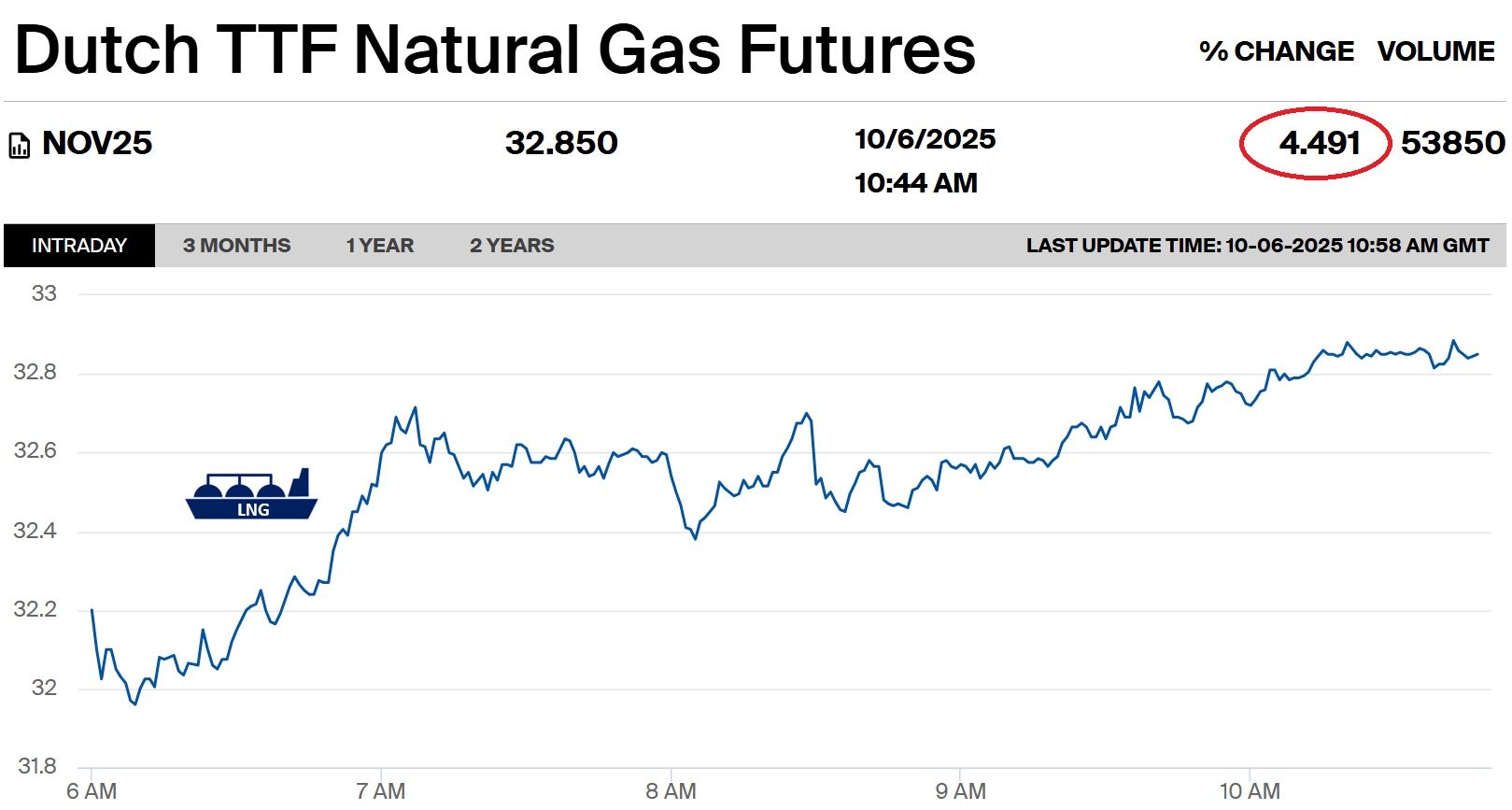

TTF ICE March 2022 prices were up by €20.66 week-on-week (+28.01%), closing at €94.422/MWh on Friday. On the far curve, TTF ICE Cal 2023 prices were up by €10.03 (+19.4%), closing at €61.690/MWh on Friday.

But the sentiment seems to have changed over the week-end. Yes, Russian flows have continued to increase. But the market is now wondering if this will last.

Reflecting this change in market sentiment, gas prices are rebounding today, inflated by the risk premium on a possible drop in Russian flows.

On TTF 1st nearby prices, the 1-Year High target is opposing a resistance. Prices could remain in the zone between the 5-day High target and the 1-Year High target, inside which is the price of the most expensive gasoil switching possibilities (estimated currently around €110/MWh).

But any drop in Russian supply would trigger a price rally, at least temporarily.

Source: EnergyScan