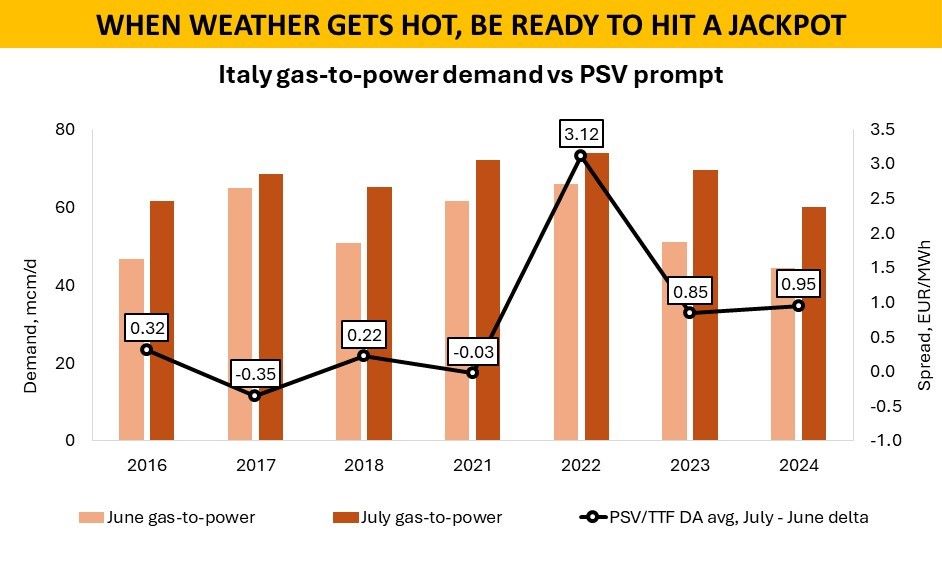

Southern Europe is unique in many senses. As Italy approaches August when the country’s gas demand is at its lowest throughout the year, the month preceding it usually sees the strongest swings in gas-to-power consumption and 2024 is no different. In the post-2022 environment, this creates challenges and therefore opens up opportunities for players.

Amid daytime temperatures above 30C across Lombardy and Emilia-Romagna in the last ten days or so, gas demand in Italy’s power sector has jumped up from about 50 mcm/d to above 80 mcm/d. No surprise though as more than half of Italian households have air conditioning, compared to 3% in Germany or less than 5% in the United Kingdom.

Effect on prices? The most direct one actually, as Italy needs molecules for meeting higher domestic demand in the midst of injection season in a highly regulated market.

Add to that the works on the French/Swiss route, and a wide PSV premium will become a prerequisite for smoothly getting through the period of extreme heat.

But that hasn’t always been the case. Pre-war, Italy was able to mitigate the weather effect in July nominating more gas from Russia under long-term contracts, with a lot of flexibility in them. Access to it kept PSV mostly under control, with prompt prices not making moves as strong before 2022 as in the past three years when June turns into July.

The reduction in coal-fired capacity together with higher exposure to solar and wind on a day-to-day basis also added to increased volatility, but much less so.

Those days are gone, though, and the new reality is dictating its own rules. With no access to Russian contractual volumes, it is an accurate forecasting of Italian gas-to-power demand that becomes of particular importance for traders.

In the next couple of years at least, as long as the global market remains structurally tight, daily swings in Italian gas consumption of 20/30/40 mcm/d will continue making the difference in companies’ P&L when trading on PSV in summer.

Source: Yakov Grabar