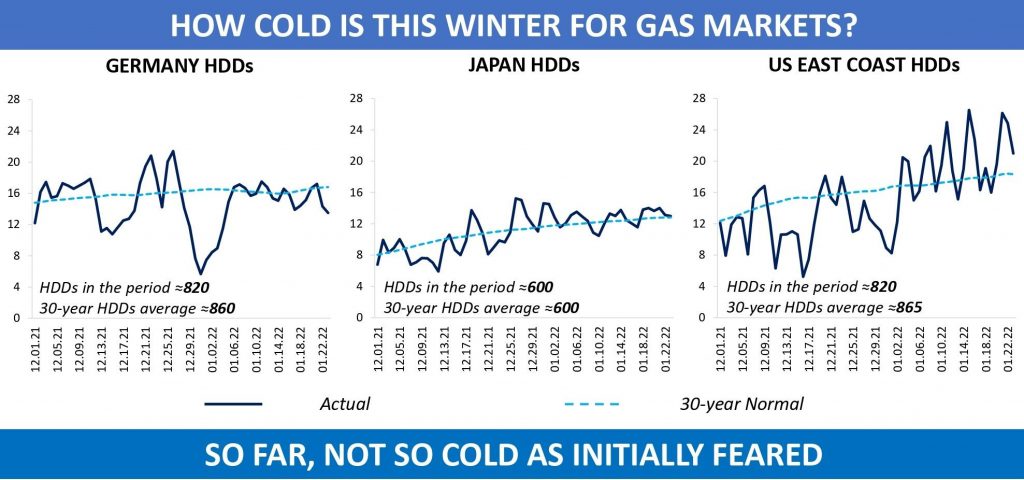

During the coldest part of the northern hemisphere winter the weather usually becomes a major concern for players. And this gas year, particularly close attention has been given to the way temperatures evolve across key trading hubs.

Amid multi-year low inventories at the European sites, market participants feared a repeat of extreme cold that had hit Asia, US and Europe one after another in early 2021. But unlike winter 2020/21, all the three regions so far have seen pretty mild temperatures.

For instance, Germany experienced around 820 heating degree days between 1 December 2021 and 23 January 2022, as compared to the 30-year average of approximately 860 HDDs. The weather was particularly warm during the Christmas season, with average temperatures in some European capital cities soaring more than 10°C above normal. In the first three weeks of January 2022, the average daily gas consumption in Germany, France, Netherlands and Belgium combined was down 7pc from that of the period between 2016-2021.

Despite La Niña´s cooling effect, severe cold waves have bypassed Northeast Asia this winter. Demand for additional cargoes remained limited within the region over the past month, thus paving the way for diversions towards Europe. Thanks to higher-than-average LNG inventories accumulated ahead of winter, some Asian importers now even have the opportunity to issue large sales tenders.

Winter 2021/2022 across the US has also been much calmer than a year ago. Since the beginning of 2022, Henry Hub spot price has gained almost 15pc against the background of higher heating-related consumption, but this month´s cold weather pattern is incomparable to what the country went through last year.

Gas market is already more than halfway through winter, with many fears about colder weather having not materialized. At the same time, February and March still lie ahead, leaving players cause for concern.

Source: Yakov Grabar (LinkedIn)