The natural gas market in Germany finds itself at a crossroads. The fuel that helped the country meet energy demand during the frigid weather earlier this year is now becoming unaffordable because of rising gas and LNG prices globally.

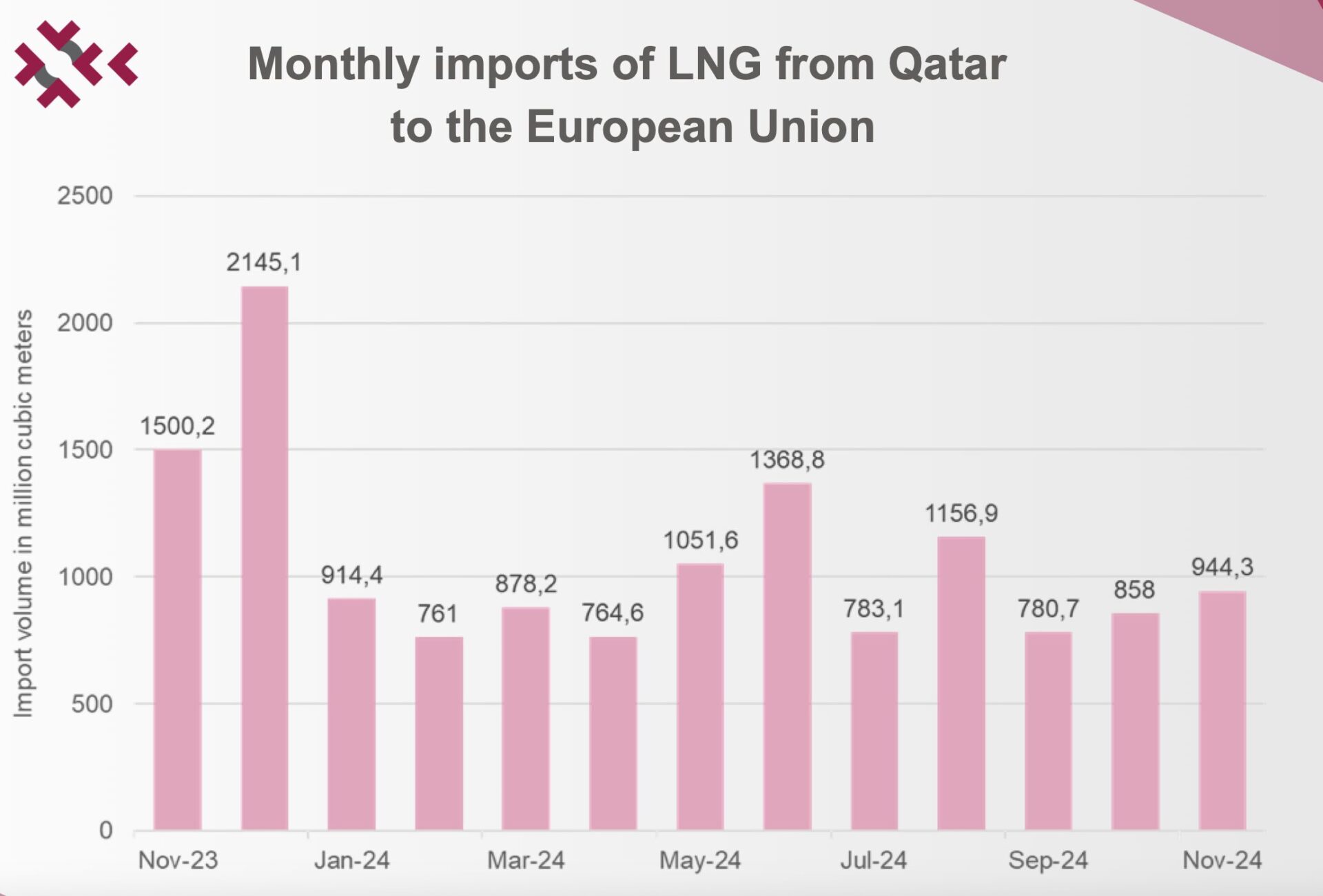

Figure 1: Germany’s gas consumption between January 2020 and August 2021. Source: Energy Projections’ Germany natural gas fundamentals dashboard

Consequently, German consumers are already facing significant energy inflation – a situation that is expected to persist for the rest of this year and early next year. More importantly, it will reinvigorate the debate on the importance of boosting fuel diversification in the country’s energy portfolio.

The most recent German government data showed the country’s CPI accelerated to 3.9% on an annual basis in August 2021 – its highest level since December 1993. This was driven by energy inflation, which rose to 12.6% year on year in August 2021.

Germany is the biggest consumer of gas in the European Union when considering demand for the whole year. Nevertheless, the growing trend seen in the country’s gas consumption earlier this year is well and truly over.

Germany’s total gas consumption amounted to 46.9 billion cubic metres (bcm) in the first five months of 2021, marking a sharp increase of 17.5% when compared with the same period in 2020. However, the country only used 10.2 bcm of the fuel during the summer of 2021 (June-August), a fall of around 9% compared with the 2020 summer.

The scenario unfolding in Germany is a classic case of demand destruction because of rising prices. Germany’s Trading Hub Europe (THE) front-month futures gas price averaged EUR 36.48 per MWh during the summer of 2021. This was much higher than the averages of EUR 20.18/MWh in the first five months of 2021 and EUR 6.38/MWh for the 2020 summer.

Rising prices are also hurting gas consumption in other key EU consumers, albeit with varying severity. For instance, gas demand in Italy – the EU’s second-biggest gas-consuming nation when considering a full year – fell by 1.6% on an annual basis in the summer of 2021.

Gas constitutes a vital part of Germany’s power-generation mix. In 2020, the fuel was the third-largest source of electricity production in Germany after wind and lignite.

Surging carbon and gas prices are adding to the cost of gas-fired power generation in Germany, which in turn is weighing on the country’s gas-to-power demand. The European Union Allowance (EUA) price averaged EUR 54.2 per tonne during the 2021 summer, more than double the average of EUR 25.9 per tonne for the corresponding 2020 period.

Consequently, the country’s electricity generation using gas sharply declined by 37.6% in the 2021 summer compared with the same season in 2020.

Germany’s wind-power generation also fell by 8.4% on an annual basis in the summer of 2021 because of its weather-driven nature. The constrained power production using wind further contributed towards rising electricity costs in Germany.

Grim gas-supply outlook

Germany is in a race against time to replenish its severely depleted gas inventories before the 2021-2022 gas withdrawal season kicks in November. Gas operators in Germany restock inventories between April and October and stored gas becomes a vital supply source during the withdrawal season (November-March).

Unfortunately, Germany has been running low on gas inventories so far during the 2021 injection season, sending yet another bullish price signal to the market. German gas storage sites were only 64% full on average on 20 September 2021, much lower than the 95% fullness on the same day in 2020 and the day’s five-year fullness average of 83%.

Persistently rising gas prices during the 2021 injection season prompted greater use of the stored fuel as opposed to imports. The fuel can be injected or withdrawn from a storage site throughout the year. However, greater use of gas inventories during the injection season has the potential to slow the pace of stock replenishment.

Total gas drawdown from storage sites in Germany amounted to 2.4 bcm between April and August 2021, higher than a drawdown of 1.8 bcm during the corresponding 2020 period.

The current injection season has already been shortened because of spells of cold weather in April 2021, which meant the country used more stored gas to meet demand even at the start of the injection season. Germany witnessed a net gas drawdown from storage of 141 million metric cubic metres (MMcm) in April 2021, which was in stark contrast to the situation in April 2020 when a net injection of 931 MMcm took place.

Such weather events are difficult to predict and cannot be ruled out during the upcoming gas withdrawal season that will worsen Germany’s gas supply crunch.

With dwindling gas stocks, Germany will have to rely more heavily on imported gas from Russia, Norway and the Netherlands during the 2021-2022 withdrawal season, despite high gas prices. Declining gas production from the Groningen gas field in the Netherlands and Norway’s limited flexibility to provide incremental supply are already a concern.

Consequently, Germany will deepen its reliance on Russian gas. Russia completed construction of the Nord Stream 2 pipeline this month and reports suggest the first gas to flow in early October 2021. However, it remains to be seen how quickly the pipeline’s volume can be ramped up and will that be enough to compensate for the reduced supply from other sources.

It is also far from certain if Germany’s renewables power generation capacity will be enough to fill the gap created by the country’s gas supply crunch. This leaves German consumers at the mercy of high energy costs during the upcoming winter.

Source: Abhishek Kumar, Energy Projections

Connect with Abhishek on LinkedIn