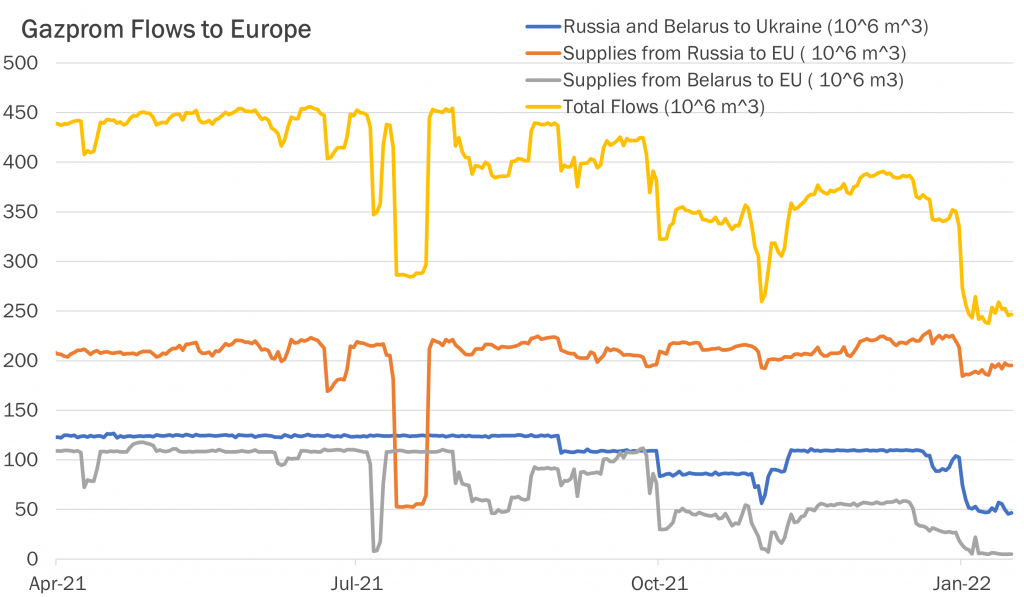

Rising international tensions between Russia and Ukraine threaten to place the European gas market under additional pressure on top of under-average storage totals. A number of gas pipelines run from Russia, through Ukraine, and into Europe.

In the event a full-on invasion occurs, these pipelines – which include the UPU Pipeline – would be at risk to flow lower volumes as Russian flows to Ukraine halt. Russian flows to Europe, have already decreased rather significantly within the past month, dropping nearly 100 million m3 from 350 to 250 million m3.

According to Gazprom, volumes from Russia and Belarus to Ukraine have also halved and volumes from Belarus to the EU have fallen all the way to 0. Reports indicate that the Yamal pipeline is still displaying reversed flows, though this is expected to change given that Russia has booked westbound flows on the pipeline for January.

The European storage crisis could very well exacerbate this winter if diplomatic efforts with Russia fail. Germany has already warned Russia that it could halt the Nord Stream II pipeline in the event of a Russian invasion into Ukraine. Mild weather and an influx of LNG vessels into Europe have been keeping European prices at bay at ~26/MMBtu for the moment; however, there is significant upside risk if geopolitical tensions continue to flare.

European storage is already in a precarious position and the risk of cold weather alone could prompt another price spike, let alone the added risk from an inflated Russia-Ukraine dispute that would ultimately suppress even more Russian flows from entering Europe.

Source: Gelber and Associates