European gas prices interrupted their strong downward correction to rebound slightly on Friday. Spot fundamentals were unchanged, with Russian gas flows slightly up, averaging 268 mm cm/day, compared to 266 mm cm/day on Thursday. Norwegian flows averaged 336 mm cm/day, compared to 335 mm cm/day on Thursday.

Note that European Commission President Ursula von der Leyen said on Friday that the Commission plans to propose by mid-May the phase out of Russian fossil fuels by 2027.

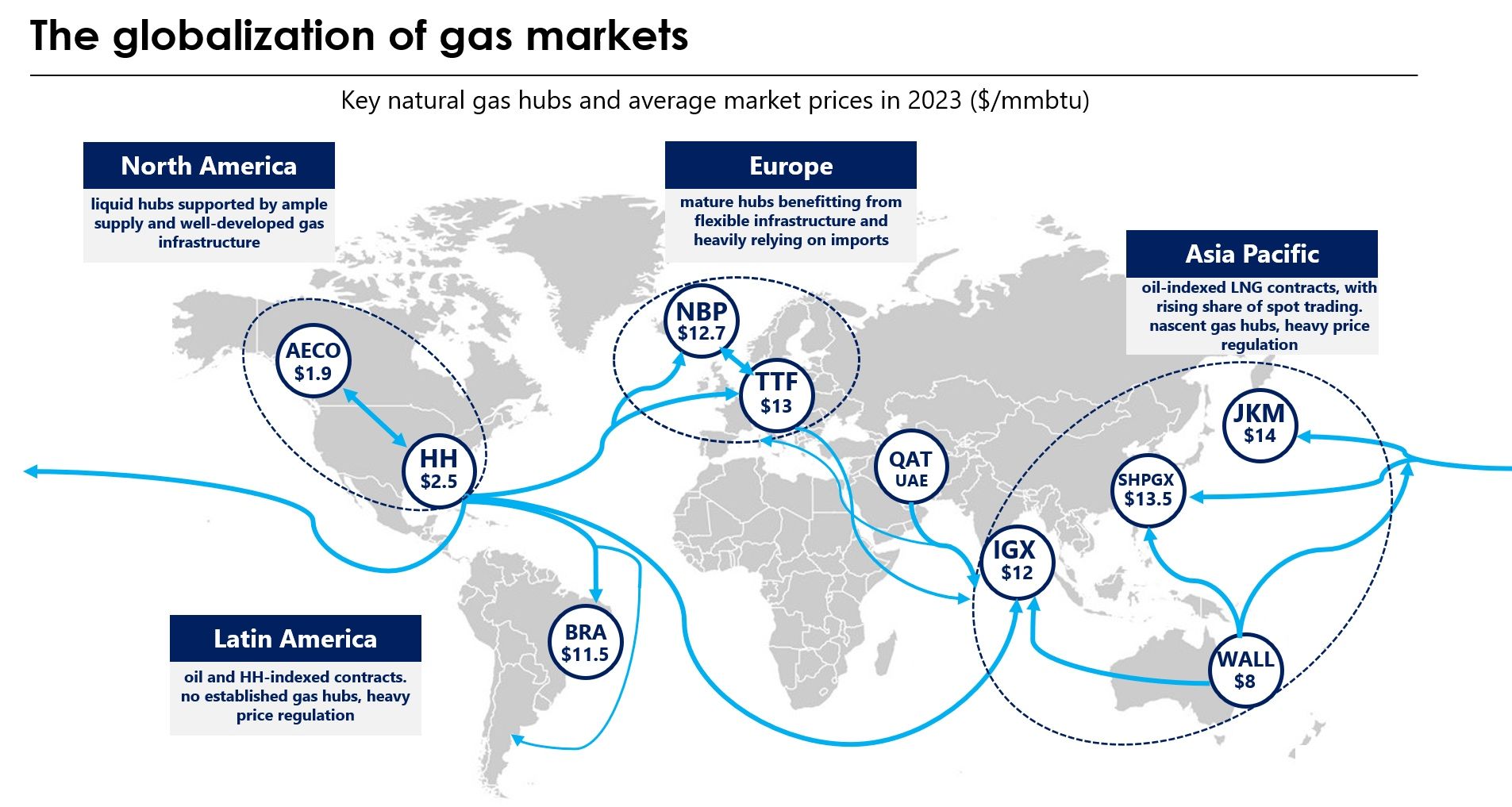

At the close, NBP ICE April 2022 prices increased by 14.170 p/th day-on-day (+4.77%), to 311.060 p/th. TTF ICE April 2022 prices were up by €4.83 (+3.82%), closing at €131.229/MWh. On the far curve, TTF ICE Cal 2023 prices were up by €3.59 (+5.27%), closing at €71.785/MWh.

By contrast, in Asia, JKM spot prices dropped by 20.82%, to €91.661/MWh; April 2022 prices dropped by 2.42%, to €116.183/MWh.

TTF ICE April 2022 prices are weakening this morning, accelerating the “normalization” process, with the 5-day range about to return inside the 1-Year range.

The 1-Year High (€146.83/MWh for today, but on an uptrend) seems therefore to be the new key resistance level. The lower levels of Asia JKM prices and of the most expensive gasoil substitution possibilities (currently around €131/MWh) suggest this resistance level will be difficult to break.

On the downside, the 20-day Low (€98.25/MWh for today) should offer strong support.

Given the lingering risk on Russian supply, the fundamental support of the average coal switching level (currently around €81/MWh) seems difficult to reach for the moment.

Source: EnergyScan