In early 2022, it seems as if the weather is returning the favour to the European gas market for what it had to go through during the previous winter. Amid record-low storage levels, many players might have had serious difficulties in case of colder temperatures across the region this winter. But so far those pessimistic expectations have not been met, with the weather not destabilizing the supply/demand situation on the regional market.

Apart from the first few days of January, which in fact formed part of the unusual heatwave hitting Europe in this holiday season, the last two weeks have seen the warmest weather conditions since the start of the year. And in addition to above seasonal temperatures during this period, wind blew at its highest speed in much of Western Europe, within NWE in particular, since early December 2021. In late January 2022, wind speeds in Germany reached 8 m/s, compared to the seasonal norm of around 4 m/s.

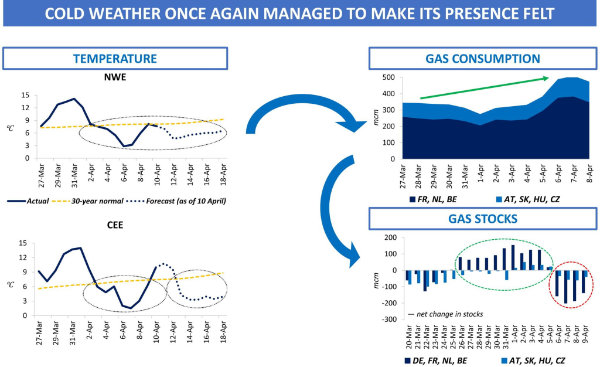

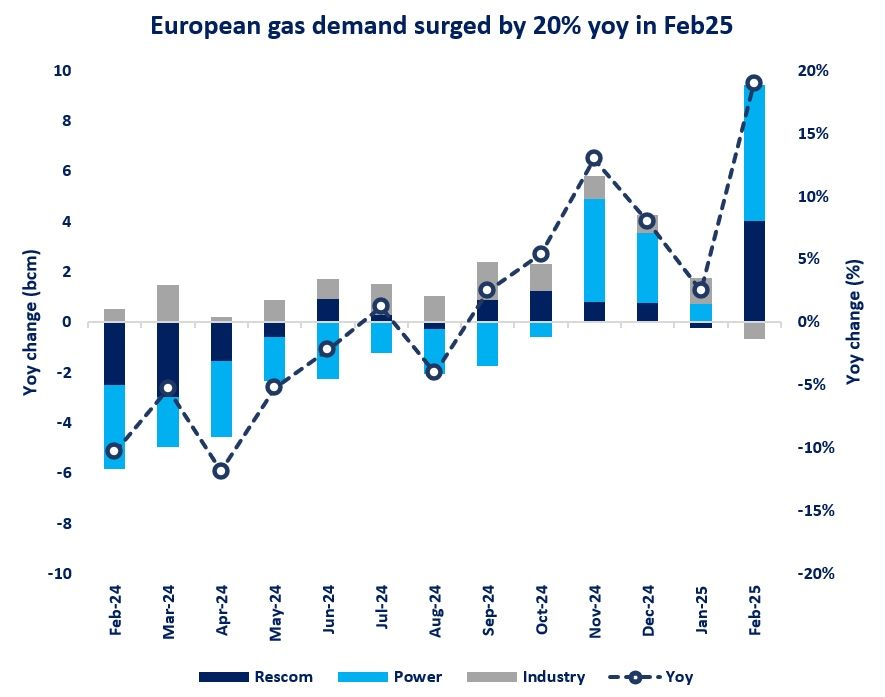

The combination of warmer temperatures and stronger winds had an immediate impact on European gas demand, in both absolute and relative terms. Between 27 January to 3 February, the average daily consumption in NWE was approximately 10pc lower than for the period from 15 to 26 January. As the share of wind energy in Germany’s electricity mix jumped to 47pc in week 5, that of gas declined to below 10pc.

The reaction of European gas hub prices was not long in coming, especially given that the geopolitical factor took a back seat in early February while LNG cargoes continued to be delivered to the region in large quantities. On Friday, 4 February, the TTF Day-Ahead contract was assessed at €82/MWh, a 11pc decline from early last week.

Favourable weather conditions across Europe have brought some relief to the regional gas market, which was really on edge in recent months. For how long, that is the question.

Source: Yakov Grabar (LinkedIn)