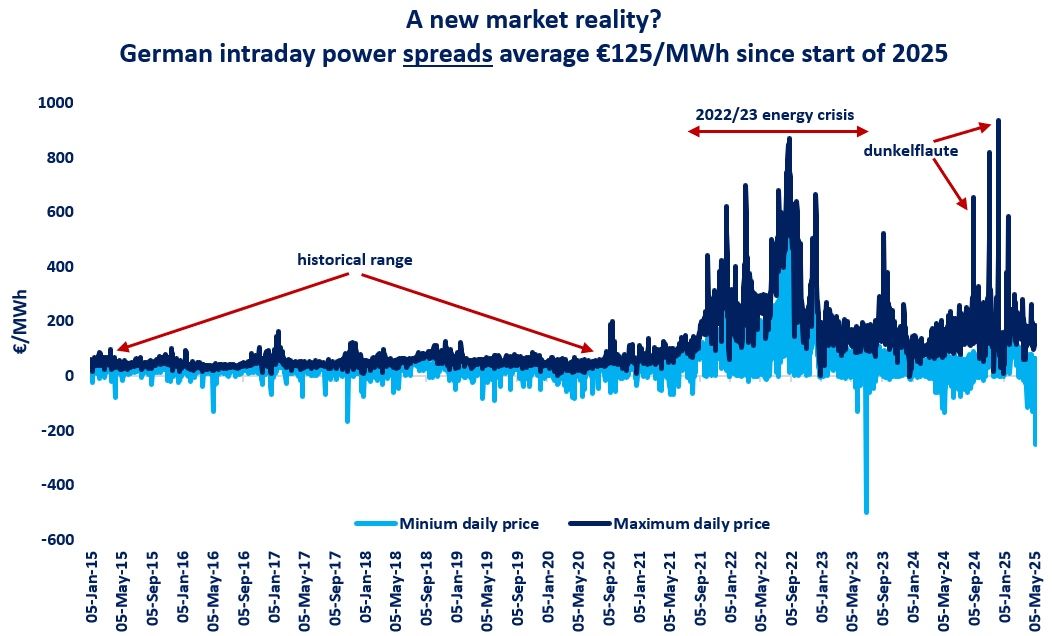

Early October 2021 will go down in history as the most volatile period in the European gas market since liberalization.

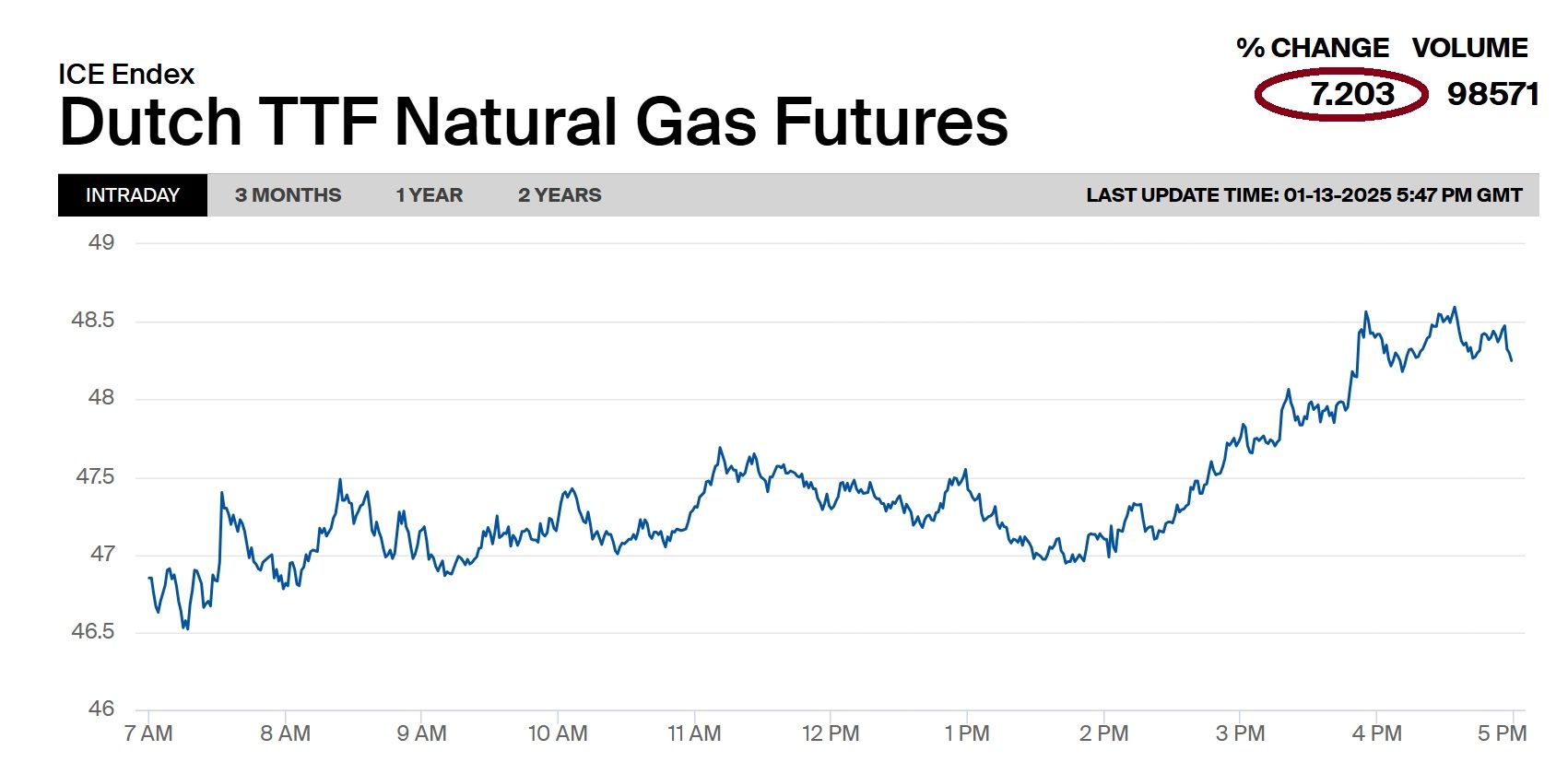

This week, in only one day, the TTF front-month contract jumped by 30pc first and then recorded a drop of 35pc. A well-received meme comparing this Wednesday’s price movement with Burj Khalifa, the world’s tallest building, describes so perfectly what happened on October 6.

Prices were fluctuating against the backdrop of poor liquidity across the market areas, an issue that has been seen in recent months and has become particularly pronounced starting from September.

Given the incredible rise in gas values in late third quarter, the risks associated with inadequately covered positions multiplied, making a huge number of players curb their trading activities. In September 2021, the average daily OTC volumes of trade on the Day-Ahead and Front-Month products on the TTF hub decreased by around 80pc and 73pc respectively, as compared to the corresponding period in 2020.

At the beginning of October gas price rise speeded up, with market participants borrowing more from banks or going into their own funds to meet large margin calls on their positions. In the current environment, major trading houses were forced to add billions of dollars to their credit lines so that they can manage high volatility. Bloomberg and Reuters have written excellent stories on this particular theme earlier this week. You should read them, if you haven’t yet.

Whether liquidity issue continues to affect the market depends on further price developments, which in turn will be primarily determined by fundamentals. As winter rolls around, not only supply side is a key focus of attention now but also fuel consumption for this heating season. Amid colder temperatures expected across much of Europe next week, gas demand may soon come to the fore.

Source: Yakov Grabar (LinkedIn)