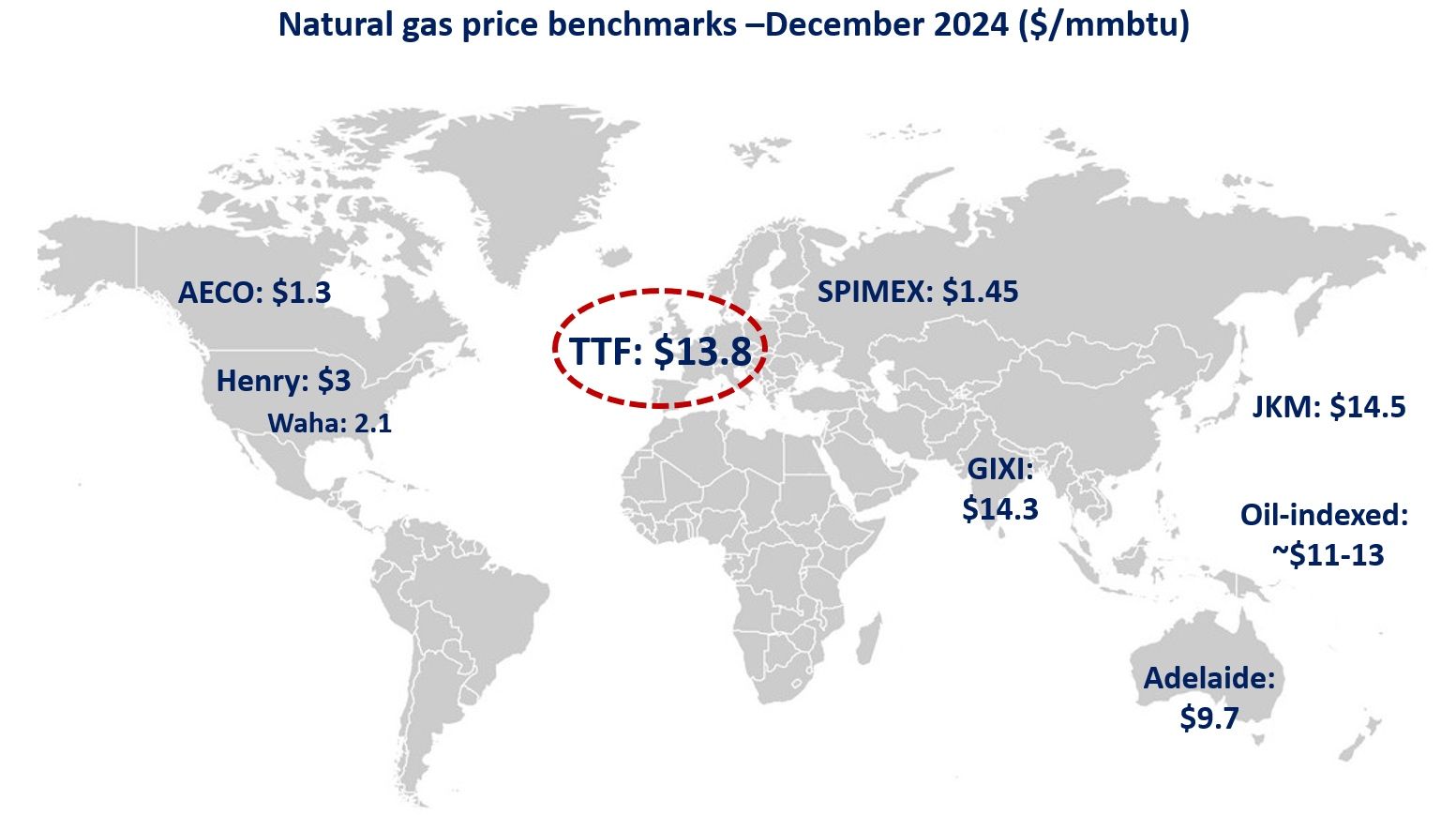

(Greg Molnar) TTF has been on a massive bull ride since end or July, with the September contract gaining over 45% in less than 10 days.

This has been primarily driven by European spot market fundamentals: day-ahead prices rallied by over 60% with gas-fired powgen edging up on higher cooling demand and low wind speeds + news on tightening supply in the US.

But are there any “September bears” on the forward curve? couple of them are:

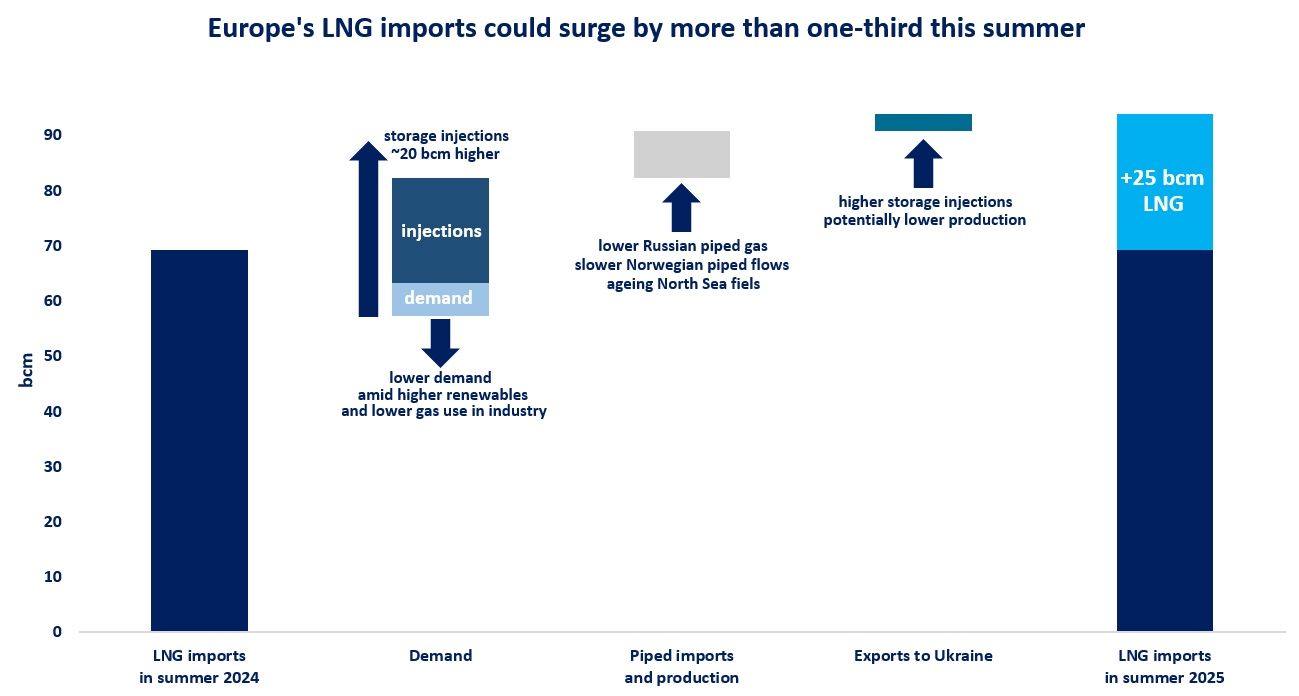

(1) lower US LNG cargo cancellations (20-25 vs 40 in August) for Sep means more LNG supply;

(2) September is the typical shoulder month for LNG, with global demand usually down by 5% vs August (no more cooling, not yet heating);

(3) the spread with JKM close, potentially meaning cargo diversions from Asia to Europe;

(4) Norwegian maintenance season is set to peak by end of August(

(5) with current injection rates European storage would be over 90% full by Sep, and ~95% in northwest Europe;

(6) the infection rate is unfortunately going up.

What is your view? Bull or bears?

Connect with Greg on LinkedIn