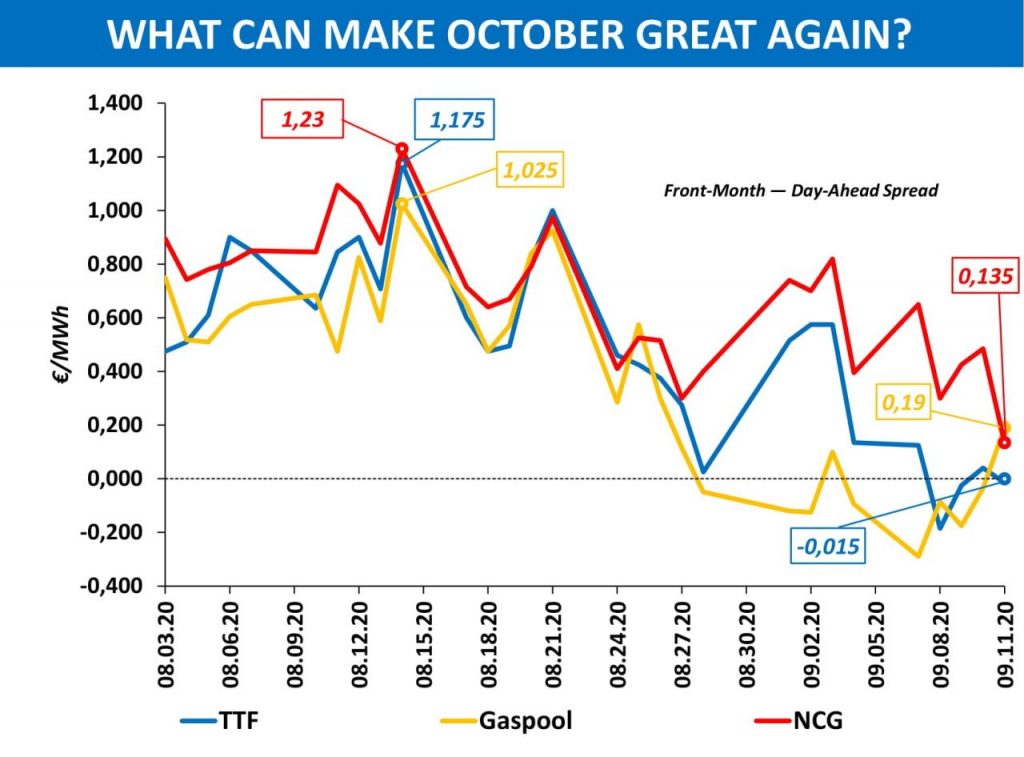

In terms of Front-Month-Day-Spread spread, European gas market has mostly reverted back to what was last seen in March. At that time COVID-19 was rapidly spreading across Europe and market players realized the pandemic’s impact on regional gas consumption during Q2.

The present situation represents a clear improvement with regard to spring, but lower values for October deliveries in comparison with spot quotations demonstrates that the domination of optimism is leaving the market. With the recovery of US LNG supplies expected next month as well as lower maintenance in Norway and high UGS inventories there is practically no ground for assessing October volumes higher.

So what can make market participants rethink their expectations for October?

It seems only cold weather or a new flock of ‘black swans’ can. The former will provide support on the demand side while any unexpected major interruptions or reductions of supply will make the regional balance tighter in a short time.

In the meantime, European nations report new coronavirus cases which does not add any optimism to outlooks for the coming months.

See original post on Linkedin