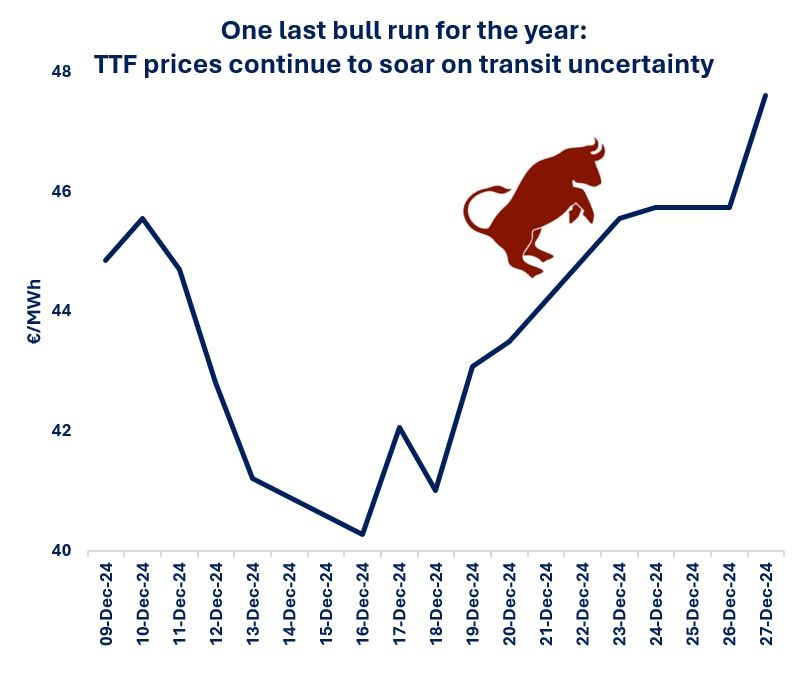

TTF prices soared by near 20% since mid-Dec and recorded another jump of 4% as the market is pricing in the halt of Russian gas flows via Ukraine.

A number of factors are driving the current bull run, including:

(1) Weather matters: colder temperatures together with underperforming is driving up European gas demand, with gas-fired powgen up by 20% yoy since the start of Dec;

(2) Lower LNG inflows: despite stronger demand, European LNG imports have been down by more than 10% yoy in December, partly due to lower global LNG output, which is down on maintenance/feedgas issues;

(3) Storage: EU storage sites are now 12 bcm below their last year’s levels, which is naturally providing upward pressure on the Q1 2025 and summer contracts;

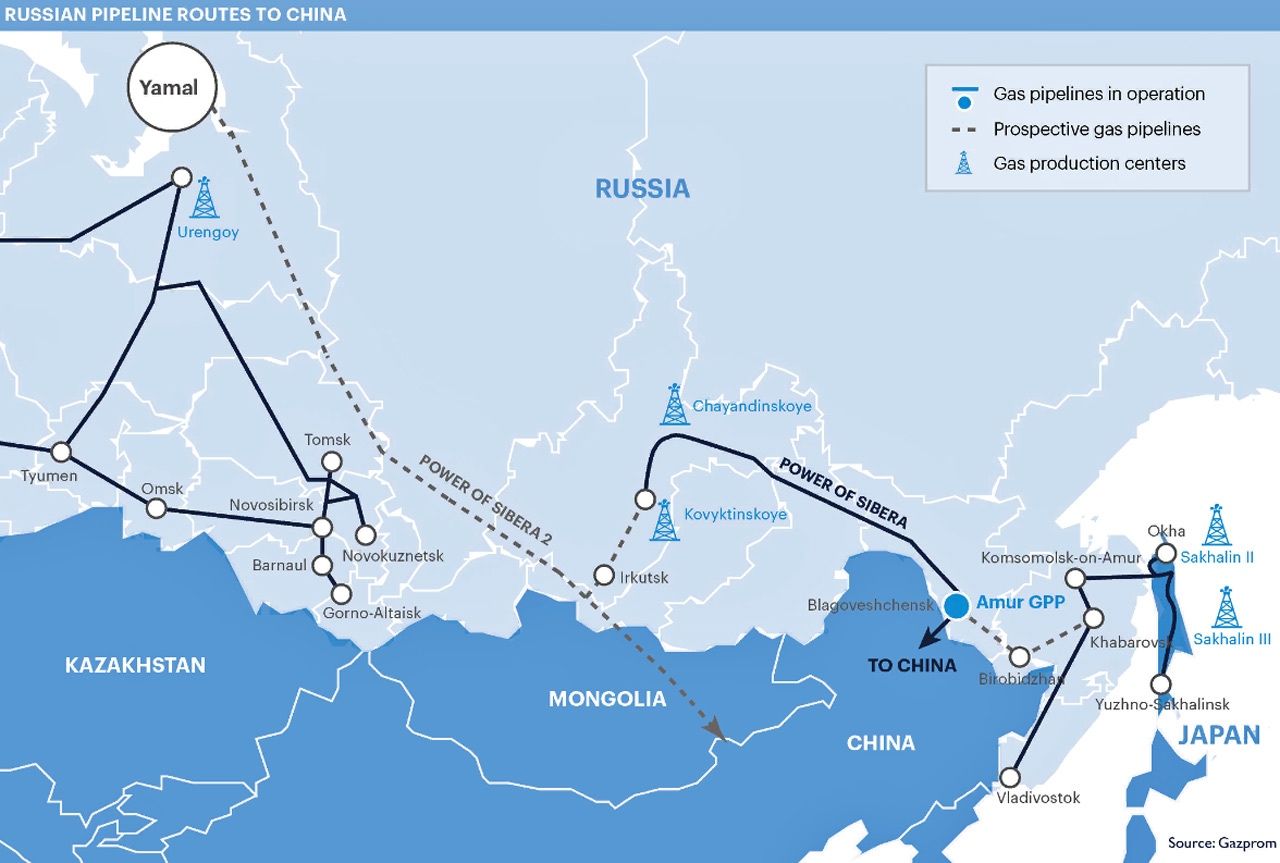

(4) Ukraine transit: following last week’s comments, an agreement between Russia and Ukraine seems to be increasingly unlikely, so the market is pricing in the halt of the Ukrainian transit -a loss of 15 bcm

of gas supplies to the European market in 2025.

The expiration day for the Jan25 contract will be the 30Dec.

What is your view? Will we see more volatility feeding in? The market will be closely watching and reacting for any rumours which might emerge in the coming days…

Source: Greg Molnar