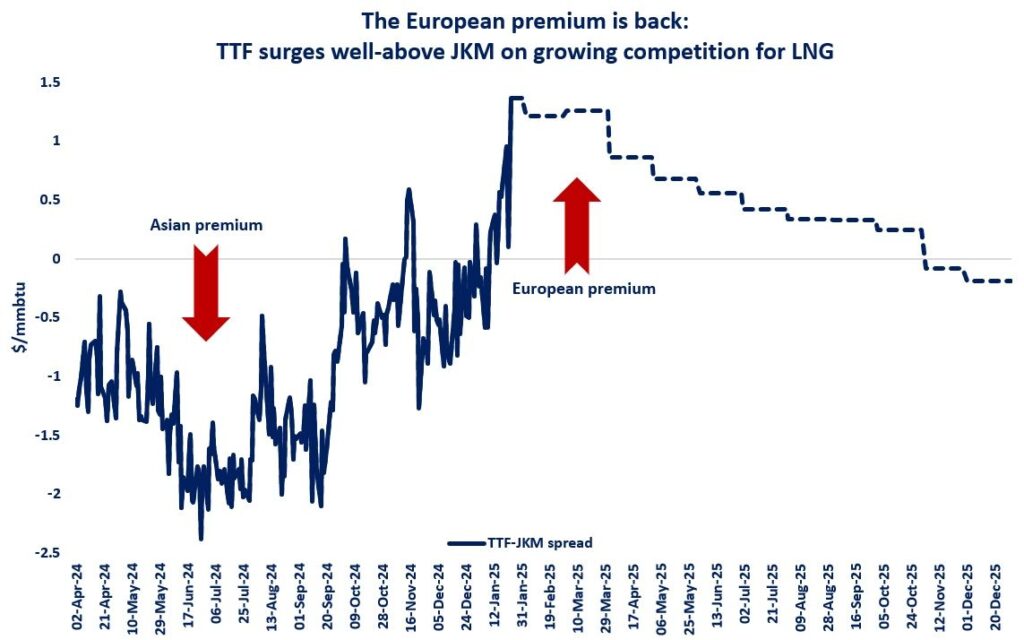

The European gas premium is back: TTF closed last week $1.4/mmbtu above JKM prices, its highest premium since June 2023, while forward curves suggest that the European premium is here to stay for the summer season.

TTF averaged $1/mmbtu below Asian spot LNG prices through 2024, which incentivised stronger LNG flows towards Asia (up by near 10%) and led to a steep decline in European LNG imports (-18%).

Tighter European fundamentals and rapidly falling storage levels gradually closed the JKM-TTF spread through Q4 2024, with TTF now surging $1.4/mmbtu above JKM on growing competition for flexible LNG.

Current forward curves suggest that TTF would retain its premium for most of 2025 and average $0.65/mmbtu above the Asian benchmark through Feb-Oct, necessary to attract more LNG and fill-up European storage site.

There are 4 key factors which will influence the TTF-JKM spread in the coming months:

(1) EU storage levels: lower inventories would translate into higher injection demand through the summer and hence support a higher European premium. in contrast, higher EU stock levels could tighten the TTF-JKM spread. The most important driver for EU storage levels will be weather: temperatures and wind speeds are by far the most important determining factors;

(2) global LNG supply: a lower than expected LNG supply growth could further increase the competition between Asia and Europe for flexible LNG and hence support a stronger European premium. In contrast, improved LNG supply availability could soften competition and tighten the TTF-JKM spread. the ramp-up rates of new North American projects will be crucial;

(3) LNG charter rates: low charter rates usually contribute to tighter regional spreads. With charter rates hitting an historical low of 9000/day last week, the question is if they could fall even lower… higher LNG charter rates could of course support a wider TTF-JKM spread;

(4) Asian demand: a weaker Asian demand could support further the European premium. Especially China’s LNG appetite will be a key determining factor. for now, China has been displaying a great deal of flexibility, with its LNG imports plummeting by near 17% yoy since the start of the year. but a lot of this is driven by weather. Of course, this could change in the coming months…

+(1) geopolitics is the real jolly joker, including the availability of Russian gas for Europe. more limited volumes could support a wider TTF-JKM spread.

What is your view? How will gas markets play out in the coming months? Is the European premium here to stay? What will be the impact on Asian demand?

Source: Greg MOLNAR