The latest IEA Quarterly Gas Report was released today and in this article, one of the report’s authors, Greg Molnar, highlights his 5 key forecasts.

(1) new year, new record: global gas demand is expected to reach another all-time high in 2025, with Asia alone accounting for almost 45% of incremental gas demand;

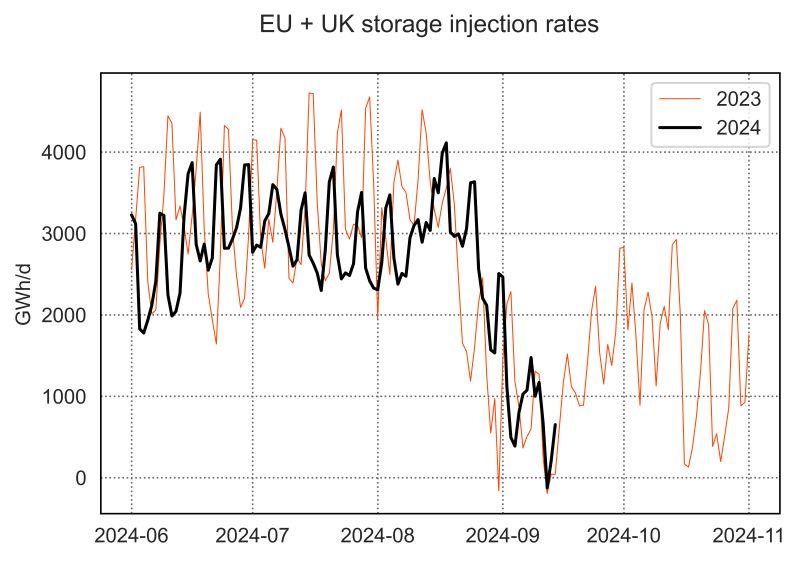

(2) tight me up: despite stronger LNG supply growth (+26 bcm), markets are expected to remain tight in 2025, amid lower Russian piped gas deliveries to Europe (-15 bcm) and stronger storage injections in the EU (+15 bcm yoy);

(3) thirsty for gas: after a decline in 2024, European LNG imports are expected to surge by around 25% yoy through the summer season, with Europe replenishing its vast storage facilities;

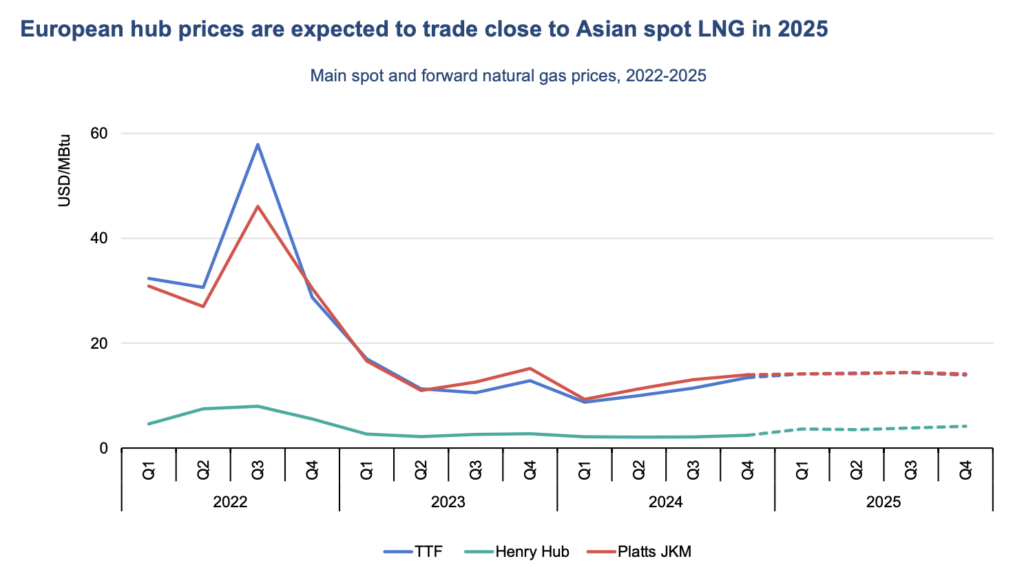

(4) European premium: TTF prices could trade above Asian spot LNG prices, especially in Q1-3, as the Old Continent will desperately need more LNG and is ready to outcompete the more price sensitive Southeast Asian markets;

(5) let me flex: after a strong growth in 2024, gas-fired generation is expected to increase only marginally in 2025. This hides the growing importance of gas as a balancing fuel in energy systems which are increasingly reliant on weather-dependent renewables and are facing more extreme weather patterns.

This is a macro trend which extends well-beyond 2025 and highlights the importance of flexible gas assets.

+(1) geopolitical tensions are here to stay, but who would dare to predict what will be their exact impact. Year of snake, here we go!

What is your view? How will gas markets evolve this year? What are the key opportunities and challenges ahead? Do you expect more volatility this year?

Source: Greg Molnar