After the issue with German storage neutrality fee was solved and Russia/Ukraine gas transit saga ended (sequel to come at some point?), it is the uncertainties around the EU filling targets that now draws players’ attention. The bloc’s regulatory framework on storages is going through its first serious test this winter, and the closer market is getting to injection season the more questions are arising on the matter.

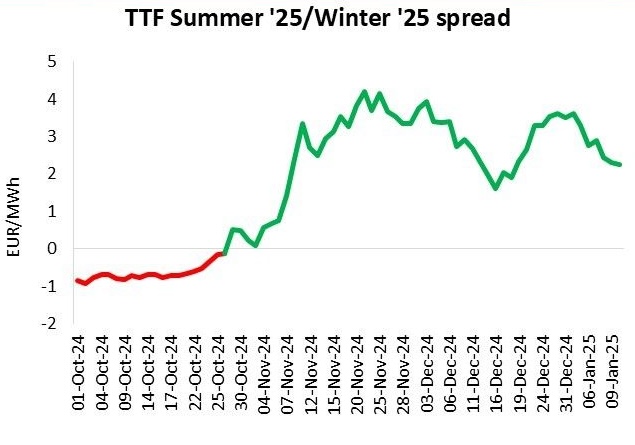

Many words have been said about the reversion of a summer/winter spread, with it reaching a record high of >4 EUR/MWh and not dropping below 2 EUR/MWh on close since about mid-December. No less has been said also on bullish fundamentals that drive up Q2-Q3 ’25 against a looser Q4 ‘25-Q1 ‘26 part of the forward curve.

With each new bcm taken out of store across Europe, the task of refilling underground sites to the required level in summer 2025 is becoming tougher to achieve.

But to understand exactly how tough it would be, more certainty from regulators needed on what the level is, especially considering all the exclusions for individual countries as well as differences between national and EU targets/trajectories.

One will find the whole thing even more interesting when it comes to the enforceability of the mandated storage levels. While there are nations like Italy or France that have a long history of regulated storages with specified injection/withdrawal profiles and fees for not filling them, most others leave lots of room for interpretation in their legislation.

Even the EU seems surprisingly shy to give clear instructions in its storage regulation 2022/2301, instead going for ‘should’ 17 times in a four-page document.

As there is still two and a half months left before the end of winter, a wait-and-see approach considered by so many policymakers as the safest option may in the end prove to be not the worst one.

But not responding proactively to emerging challenges, there is always a risk for the state of ending up in a situation when really costly measures would be needed to have the goal achieved.

Source: Yakov GRABOR