When Russia slashed European gas exports in 2022, Europe’s regas terminal infrastructure suddenly became a critical focus for security of supply.

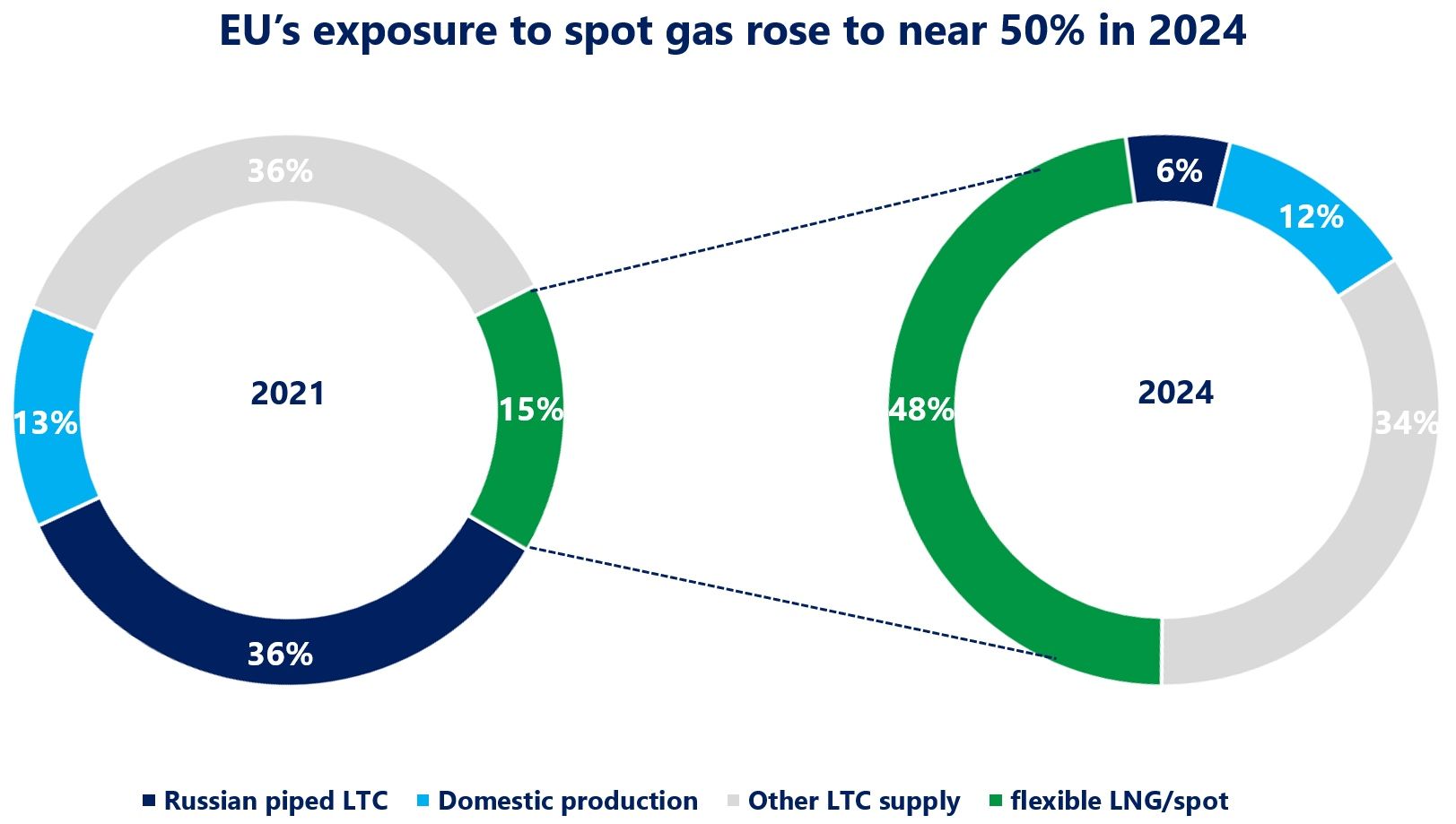

Russian pipeline supplies to Europe fell from around 30% of the European supply mix (pre Ukraine invasion) to around 5% in 2023.

This drove a sharp pivot in European supply towards LNG and a recognition that regas capacity was inadequate, especially in markets that were most dependent on Russian gas (e.g. Germany & Italy).

The ensuing energy crisis saw a jump in regas utilisation, the emergence of significant bottlenecks (particularly accessing key continental NW European hubs) and a surge in the merchant value of regas capacity.

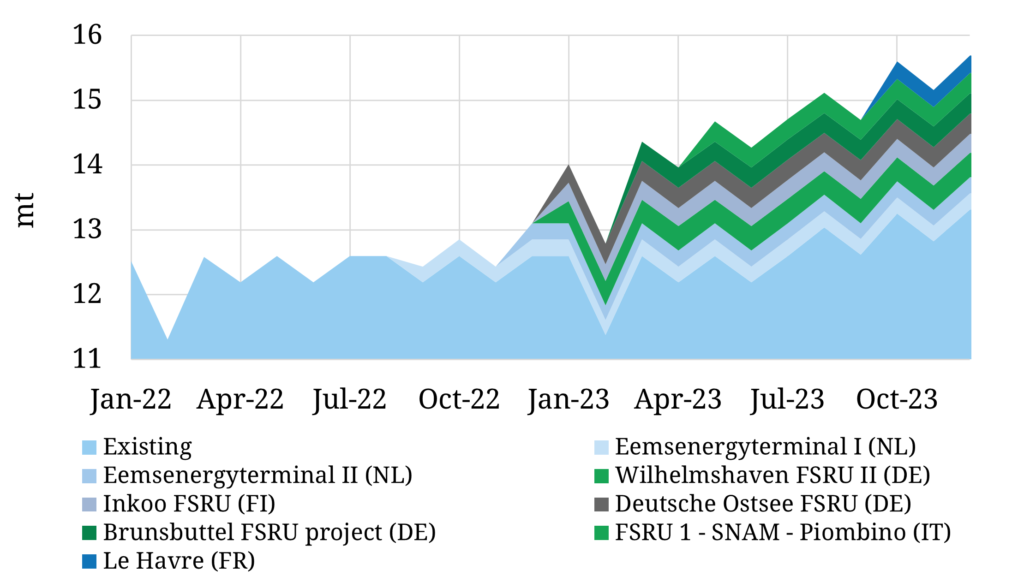

This shocked both policy makers and industry players into pursuing a wave of investment in new regas capacity (both FSRUs & fixed capacity).

In today’s article we use 4 charts to check in on European LNG imports, regas capacity utilisation and how the wave of new regas investment is impacting market price signals.

LNG imports at record levels

There was a step change increase in European LNG imports from Q2 2022 as a result of Russian supply cuts. This can be clearly seen in Chart 1.

Chart 1: European LNG imports across last 5 years

Chart Source: Timera Energy, LNG Unlimited

Read the full article by Timera Energy