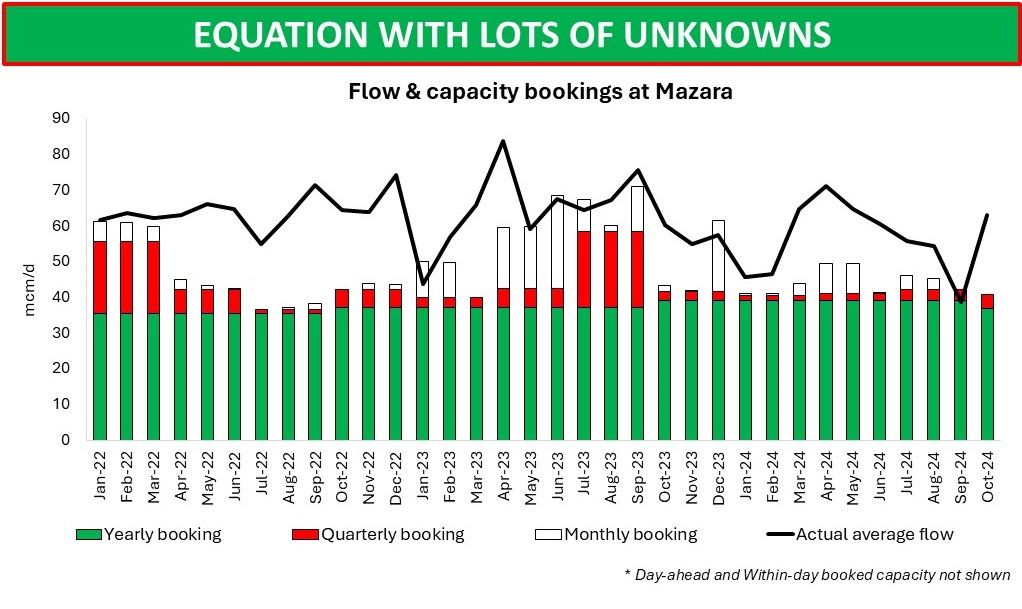

After most of the Russian gas was withdrawn from the EU market, it is probably deliveries from Algerian gas that have become hardest to forecast compared to other pipeline suppliers.

But while in the case of Gazprom contracts the logic of looking at capacity bookings, publicly available ACQs and monthly-indexed pricing worked pretty well for forecasting flows, things are not as easy with Sonatrach deliveries.

Speaking of Algerian supply to Europe and Italy in particular, the word ‘prediction’ best describes the process of assigning a value to a specific month or week.

Forecast models used around do help to avoid ridiculous predictions, but lots of moving parts affecting Mazara imports objectively prevent them from giving really accurate outputs.

And those who have an objective knowledge of the matter – you can basically count them on the fingers of two hands, with three Italian ‘E’ making up the core of the cohort.

Both pricing- and volume-wise, there are more questions than answers. On the former, it is like watching a game ‘guess-me-if-you-can’ that Sonatrach contracts play with market participants, consultancies and commentators.

The rules of the game are far from being simple though, with once Brent-linked contracts now incorporating a portion of hub-based indexation. This is not to mention that contractual arrangements are being regularly reviewed to better reflect market conditions for the parties involved.

Not less is the number of assumptions one has to make on contractual quantities. The game starts already at the stage of defining what the annual volume should be, followed then by considerations around flexibility as provided by the take-or-pay.

Add to that LNG cargoes supplied from Algeria, which may also form a part of flexibility in the pipeline contracts.

The real fun just begins though as it is time for the most peculiar rules to come into play. First is what relates to the Algerian part of the equation, including changes in domestic demand and more importantly, production/transportation issues that periodically happen but the information on them is either not available or operational in any sense.

Second comes the portfolio optimization on the buyers’ side, requiring more subtle interactions to be taken into account.

The system is becoming even more dynamic as new players turn to Algeria for supply, including those who are far remote from North Africa.

Only a few days ago, the Czech ČEZ announced they have signed a gas supply contract with Sonatrach with Germany’s VNG doing the same in early 2024.

For PSV prices, it is hard to think of a more important factor on the supply side than Algeria. With that in mind, traders are unlikely to get bored when another month approaches.

Source: Yakov Grabar