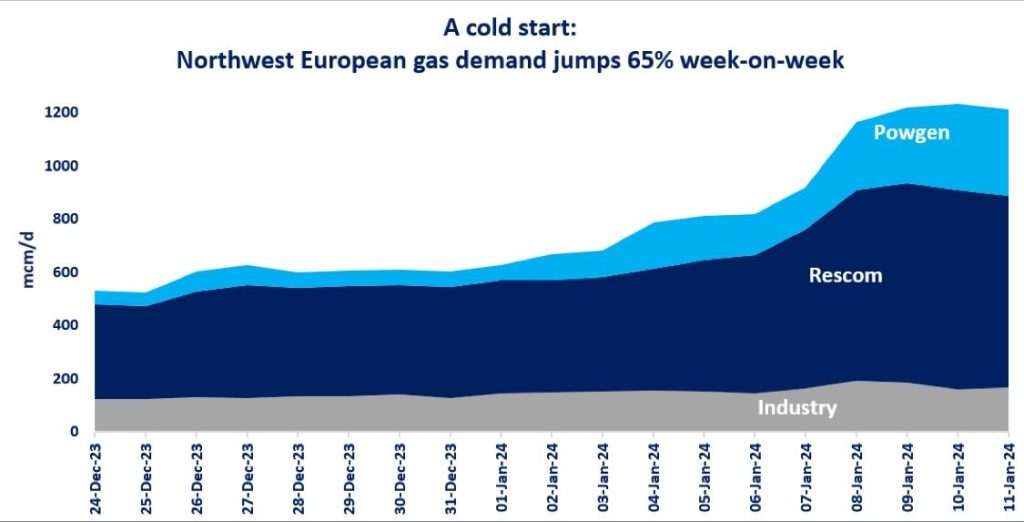

Cold start: natural gas demand in northwest Europe jumped by 65% last week amidst colder temperatures and lower wind generation.

Residential and commercial sectors accounted for around 65% of incremental gas demand, supported by higher space heating requirements.

Gas burn in the power sector more than doubled compared to the previous week, driven both by higher demand and lower wind generation. gas demand in industry remained broadly flat.

Underground gas storage sites met around 45% of gas demand last week, and accounted for over 80% of the incremental gas supply – highlighting once again their crucial role in providing flexibility services to the gas and broader energy system.

In Russia, cold temperatures (at -20°C) drove up gas demand to a new historical record, with 1.8 bcm delivered to domestic consumers on 13 Jan.

And of course, all eyes are now on Texas which is facing another arctic blast. a sharp spike in demand together with well freeze-offs is likely to test once again the Lone Star State’s power and gas system -hopefully without the tragic consequences of the 2021 Feb cold spell.

The cold start of 2024 is a reminder of the crucial flexibility provided by the gas system and key role of gas storage sites in ensuring gas supply security during those cold, dark and less windy days of the year.

What is your view? How will gas demand evolve this winter? And what will be the implications on gas storage levels?

Source: Greg MOLNAR