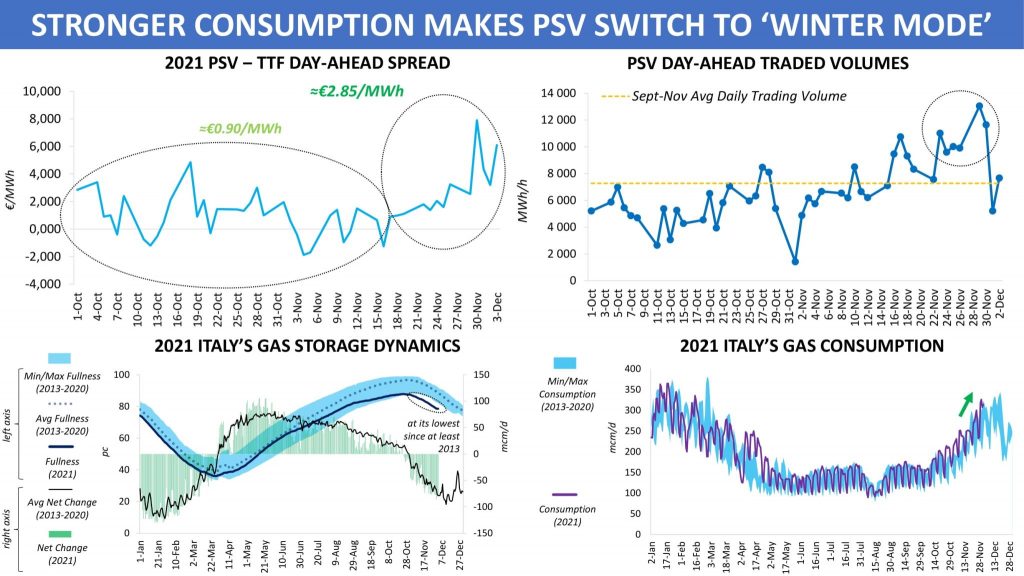

Nothing has captivated the attention of players in the European gas market more in recent weeks than Russian gas flow dynamics and changing weather patterns across the continent. With no monthly entry capacity booked at the Mallnow point for December, RBP platform data on the results of daily Day-Ahead capacity auctions, which are made available to the public at around 17:00 CET, has become crucial to see the region’s supply picture. Meanwhile, the weather factor historically has a critical influence on gas hubs in the winter period, as clearly illustrated this time by late November’s price movements on the Italian PSV.

Before winter arrived on the meteorological calendar, Italy had already been affected by a spell of cold weather. Temperatures dropped sharply throughout the country at the very end of November, while some regions, Sardinia among them, were hit by snowfalls. Amid colder weather, gas consumption in Italy, which was rising steadily since October, jumped more than 30pc on 29 November from the previous day to reach the level last seen in February 2021. It was the first time in November since at least 2013 that the country’s gas consumption rose above 320 mcm/d.

Extreme weather events in Italy caused a significant widening of the Day-Ahead spread between the PSV and neighbouring market areas, which had already become wide in the previous few weeks on lower temperatures. The difference between the Day-Ahead prices on the Italian hub and the TTF increased to about €7.9/MWh on 30 November, the highest level since February 2018. On that same day, aggregated volume of trades on the contract, which was improving in line with heating demand over the course of the previous month, was 1.5 times as high as the average daily level over the period from September to November 2021.

In other supply situation, PSV prompt prices would likely have responded to colder weather in a different manner, but given limited scope for increasing imports from Austria, lower Algerian supplies, the TAP route being fully utilized as well as restricted send-out from the country’s LNG terminals, Italy had no choice other than to take more gas from the UGSs and attract imports from NWE. Between mid-November and early December, Italian storage withdrawals rose on average to 70 mcm/d, putting the country in the same league as other parts of Europe where gas stocks stand at record lows for the time of year. Flows from Switzerland via the Passo Gries entry point averaged 22.5 mcm/d from 29 November to 2 December, as compared with just 0.5 mcm/d for the period from 1 January to 28 November 2021.

It is impossible to say what particular type of weather Europe, or any other major gas region, will have during the whole winter. However, it is clear that players will have to deal with far more risks than in the previous months, and prices feel it perfectly.

Source: Yakov Grabar (LinkedIn)