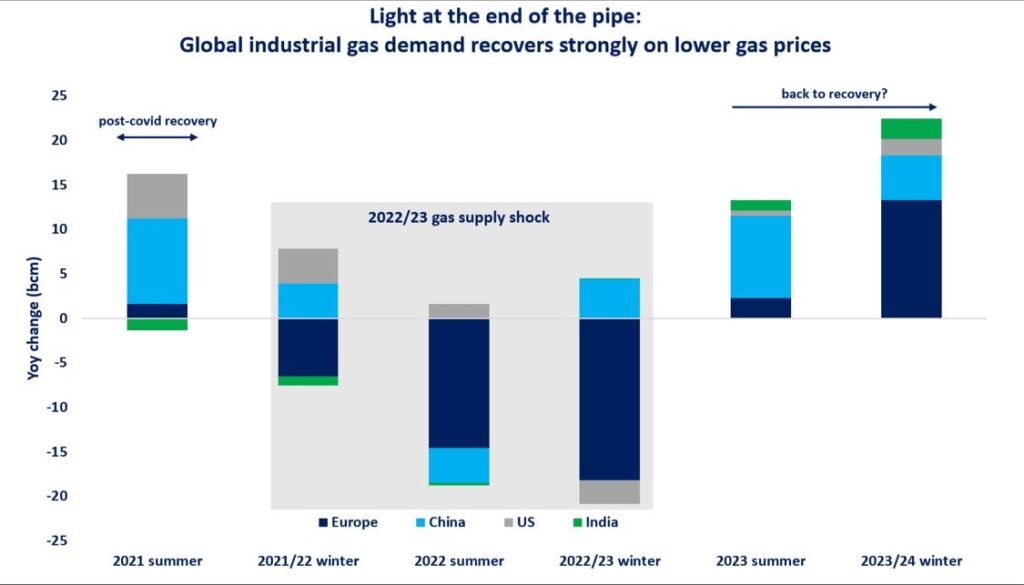

Global industrial gas demand shows signs of recovery after being practically knocked out by the 2022 gas supply shock. improving supply availability together with a lower price environment is supporting demand growth across industrial sectors.

Preliminary data suggests that combined industrial gas demand grew by more than 7% (or over 20 bcm) yoy through the 2023/24 heating season in China, India, Europe and the US. these four markets account for more than half of global industrial gas consumption.

In China, industrial gas demand returned to growth already in winter 2022/23, partly supported by the easing of the lockdowns and partly by lower gas prices (as China benefits from its long-term gas contracts portfolio).

In India, industrial gas demand recovery was delayed but it is now back in full swing. first data suggests, that the India’s industrial gas demand grew by a staggering 20% yoy, primarily supported by refinery, petchem and the fertilisers sectors.

In the US, the collapse of Henry Hub prices to decade lows is supporting additional demand in the most gas and energy intensive industries, including fertilisers.

In Europe, industrial gas demand rose by an estimated 15% yoy during the 2023/24 winter, although demand remains about 10% below its pre-crisis levels. recovery is largely supported by refinery, petchem and fertilisers.

The recovery in global industrial gas demand is good news as it brings macroeconomic benefits and enhances food supply security. nevertheless, this recovery is fragile and is largely dependent on the gas price trajectory in the coming months.

Source: Greg Molnar