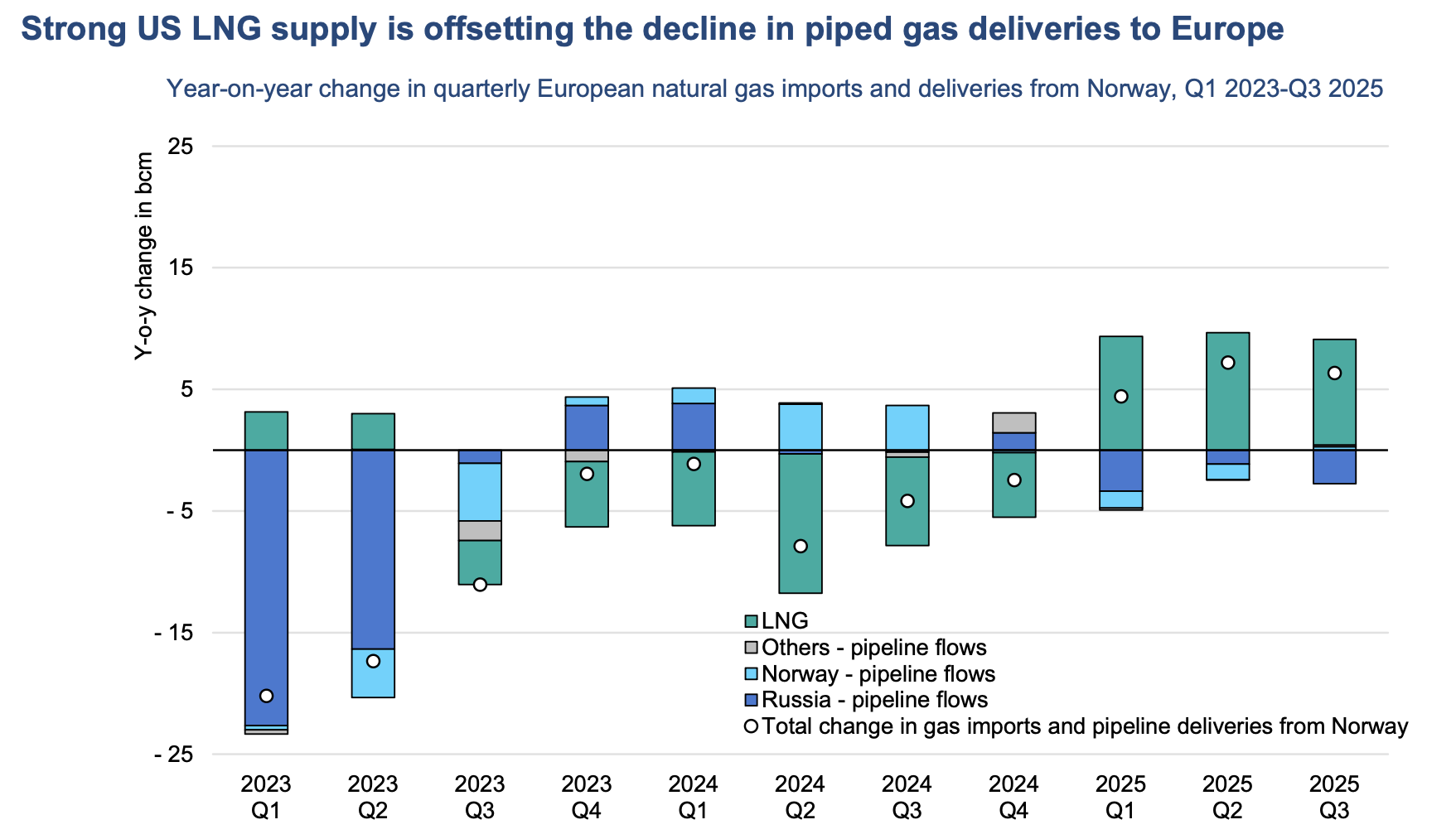

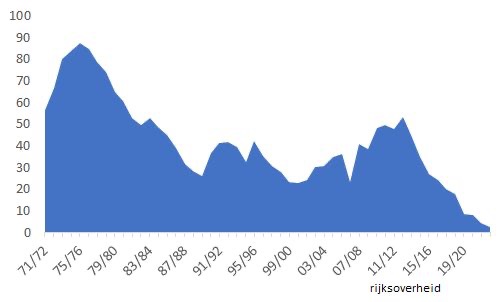

Politics was always inseparable from energy, but in the last few years the political factor has become a key force in the European gas market. Not surprise though, given all the developments since the start of Russia/Ukraine war and changes they brought to the energy market landscape.

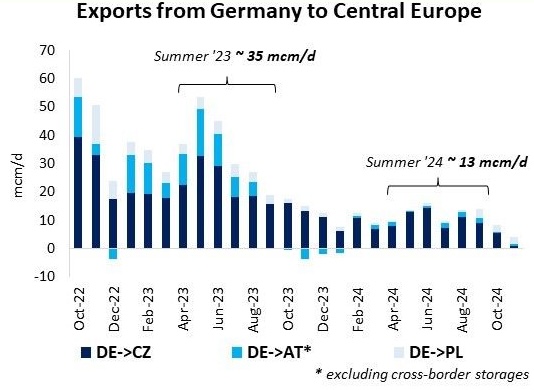

As the saga around Russian transit through Ukraine is getting close to its final stage (or maybe semi-final?), politics has manifested itself yet again – in Germany this time. Amid the collapse of the country’s coalition government, the issue of storage neutrality charge immediately came under the spotlight of players.

With just a few weeks before the start of 2025, folks across Central Europe are becoming increasingly concerned about the long-awaited abolition of what is effectively an export fee.

It is as if someone is putting their nerve to the test, as shown by the moves on Czech VTP and AVTP against THE for delivery in 2025 following the announcement of a planned increase in the storage levy on Nov 20.

Having found itself in a challenging political context, people are now delving into the German legislative process, the peculiarities of the retroactive effect of a law, etc. due to their exposure to uncertainties related to it.

With no clear signal so far from the government on the timing for adopting a law that will abolish the storage charge, forming a view on CEE spreads is becoming an interesting exercise.

And the German uncertainty is just complimented by the one around Russia/Ukraine transit, which makes it even more interesting.

These developments are happening amid the fundamental background that can hardly be described as calm, in contract to the weather across Europe in early November. And while the holiday season is approaching, the rest is what the market can only dream about.

Source: Yakov GRABAR