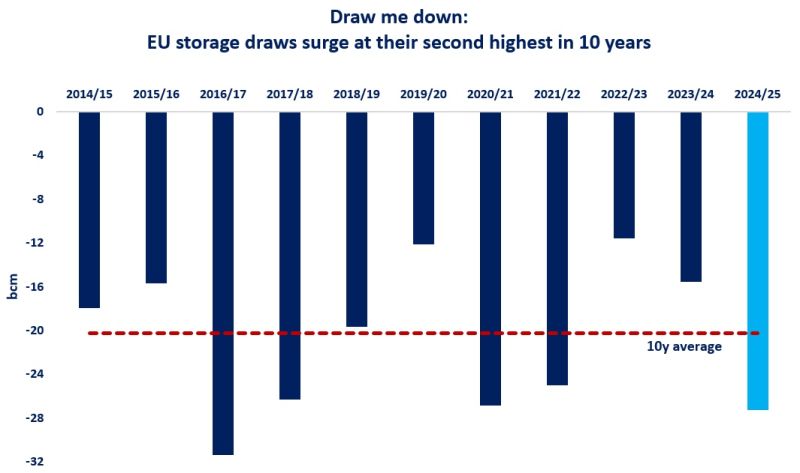

European gas storage draws surged to their second highest in the last ten years, with stocks now standing 15 bcm below last year’s levels, pointing towards a tighter summer market, with above-average filling needs.

EU storage withdrawals totalled at over 27 bcm since the start of the heating season -75% higher compared to last year, and standing 35% above their 5y average.

Several factors have contributed to this strong storage draw:

(1) higher gas demand: European gas consumption was up by 9% (or 10 bcm) yoy in the Q4 2024 amid colder weather and slow wind speeds, driving-up gas-fired powgen;

(2) lower LNG imports: European LNG imports continued to decline through the heating season, down by over 10% yoy amid limited LNG supply growth and strong competition from Asia;

(3) production decline: European gas output dropped by near 7% in 2024, mainly driven by the rapidly declining production rates in the North Sea;

(4) no pipeline flex: European piped gas supplies were rather irresponsive to higher European gas demand. in addition, Norwegian piped gas supplies were down in December yoy due to unplanned outages at key processing facilities.

The halt of Russian piped gas transit via Ukraine is set to speed up storage withdrawals in Q1 2025, especially in Austria and Slovakia.

Strong storage draws this winter will naturally increase the injection demand over the summer 2025, potentially adding 15 bcm of storage fill compared to last year.

Together with the loss of Russian gas via Ukraine (-15 bcm) and potentially lower than expected LNG supplies due to project delays, the summer market looks rather tight…

What is your view? How will European storage draws evolve in the second half of the heating season? Could milder weather in Jan/Feb bring some relief? How do you see the summer25 market? Any bearish factors you would expect?

Source: Greg Molnar