Overseas international benchmarks in Europe have dropped for the eighth consecutive day in a row.

The TTF, which had reached peaks of $60 a mere two weeks ago, has sunk all the way to $23, as much-sought-after warmer weather hits Europe and an influx of LNG cargoes arrive into European ports.

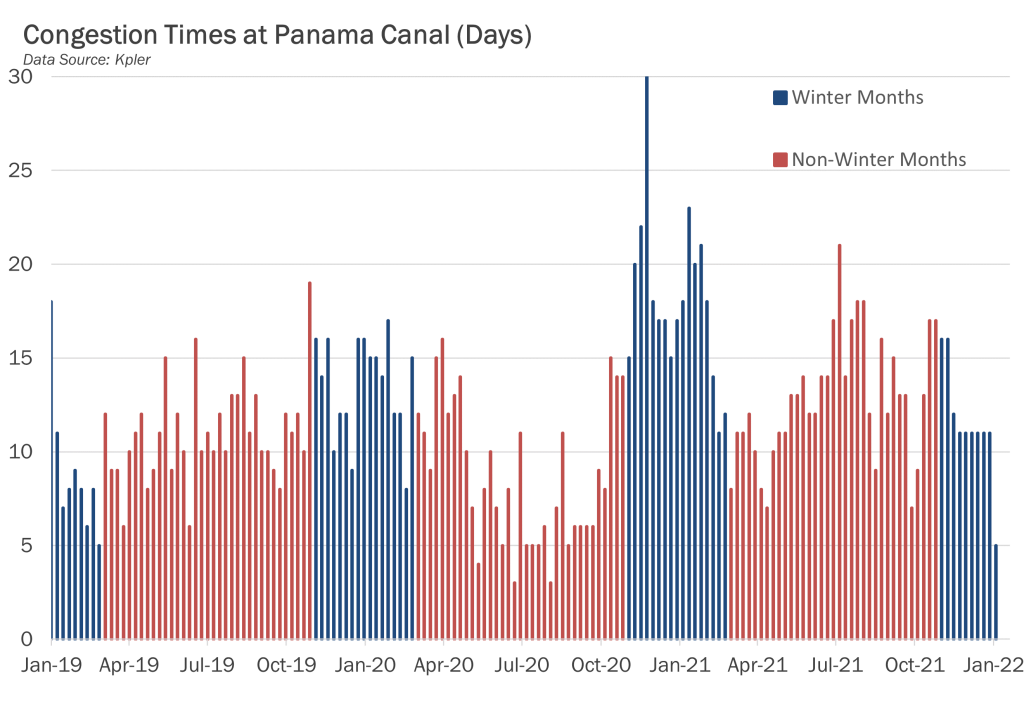

The graph below displays Congestion Times at the Panama Canal, which can sometimes be used as a proxy calculation to evaluate the destinations of cargoes. Despite higher prices this winter, congestion at the Panama Canal has not risen to the levels first witnessed in the winter of 20/21 – this is largely a result of the fact that elevated gas pricing has made a multitude of shipping routes available to the average LNG ship – the extra time it takes to traverse around the Cape of Good Hope or through the Suez Canal to reach Asian ports matters less due to the fact that the high netbacks available offset the cost of additional days of travel.

The Panama Canal is no longer the only profitable route to Asia, though it still remains the one with the largest profit margins. The last wick on the bar chart below highlights the fact that the current congestion time at the Panama Canal is just above 5 days – astonishingly low.

This latest move downwards indicates that something more is occurring internationally other than the economic viability of every international trade route; in fact, this last wick highlights the fact that more ships are opting to head towards Europe, as opposed to Asia.

Over the last month, LNG imports into Europe have risen by nearly 2 Mt, while flows into Asia have remained relatively stable. This move can also be justified through the observation that for a period of time throughout the last month, European prices outbid those of Asian prices.

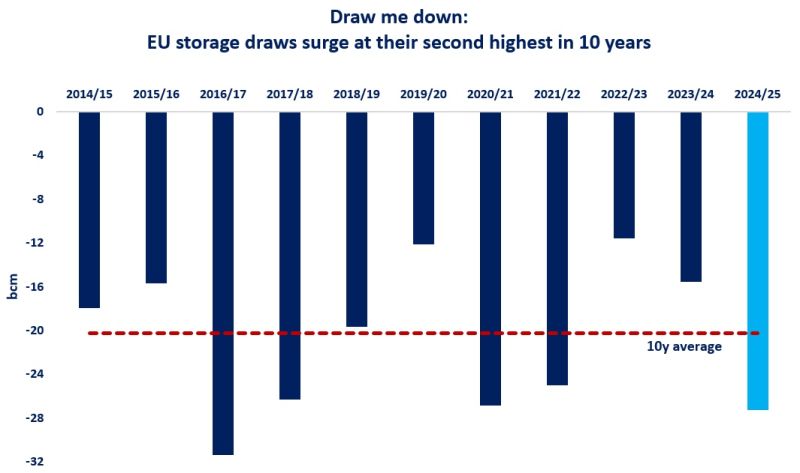

Current price weakness in Europe is based on these higher flows, as well as the relief they’ve received from forecasts that have trended on the warmer side. Yet, risk for higher prices still remains, and a number of variables, from the possible approach of colder temperatures to the potential for further-reduced Russian flows, could exacerbate the European storage crisis.

Source: Gelber and Associates