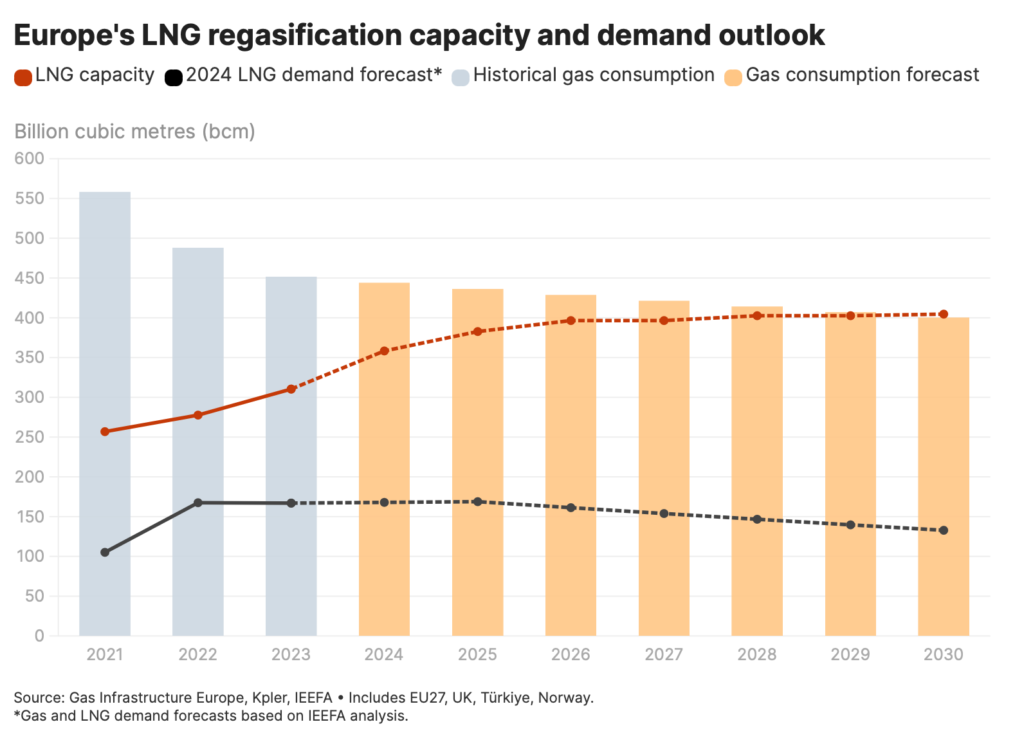

European gas demand in 2023 fell to its lowest level in 10 years as countries scale up efficiency measures and renewables deployment. In the two years since Russia’s full-scale invasion of Ukraine, gas demand has declined by 20% across the continent.

The latest version of IEEFA’s European LNG Tracker reveals that falling gas demand has been driven mainly by Germany, Italy and the UK. The continent’s LNG consumption is forecasted to peak in 2025 as a result.

With markets rapidly curbing their reliance on Russian gas in the wake of the invasion, IEEFA had forecasted that imports of LNG would rise in 2023 to make up for the shortfall; however, Europe’s LNG demand was in fact flat year on year.

Despite this, countries continue constructing new LNG infrastructure: Eight import terminals have come online since February 2022, and a further 13 projects are expected to be operational by 2030. This means that the combined capacity of Europe’s LNG terminals could be three times higher than its expected LNG demand by the end of the decade.

“Two years on from Russia’s invasion of Ukraine, Europe’s energy system is more diversified and resilient. The crisis has been controlled to an extent, efficiency measures have been scaled up and renewables and heat pump installations have accelerated. This has set up the continent to continue reducing gas demand,” said Ana Maria Jaller-Makarewicz, lead energy analyst, Europe, at IEEFA.

“Having experienced the dangers of risking security of energy supply by depending too much on one source, Europe must learn from its past mistakes and avoid becoming over-reliant on the U.S., which provided nearly half of its LNG imports last year.”

Russian LNG imports rise

Europe’s success in slashing Russian piped gas imports contrasts with its rising shipments of LNG from the country. Between 2021 and 2023, Russian LNG supply to Europe increased 11%; shipments to Spain doubled and to Belgium more than tripled. Türkiye and Greece started importing Russian LNG in 2022.

Spain, France and Belgium received 80% of Europe’s Russian LNG imports last year.

The European terminals that imported the most Russian LNG between 2021 and 2023 were Zeebrugge (Belgium), Montoir-de-Bretagne (France), Bilbao (Spain), Gate (the Netherlands), Dunkerque (France) and Mugardos (Spain).

Europe maintains LNG terminal buildout

Since February 2022, Europe has added 53.5 billion cubic metres (bcm) of new LNG regasification capacity. Last year, eight of Europe’s 37 import terminals had utilisation rates under 50%.

An additional 94 bcm of new or expanded LNG import capacity is in the planning stage and is expected to be operational by 2030. This will bring Europe’s LNG capacity to 405 bcm.

“In the last two years, Europe has transformed its energy system and has implemented methods to diminish the effects of the energy crisis. This is the time to examine which policies worked and continue with them while putting in place new strategies that could give Europe the edge to manage risks in the future,” Jaller-Makarewicz said.

Source: IEEFA