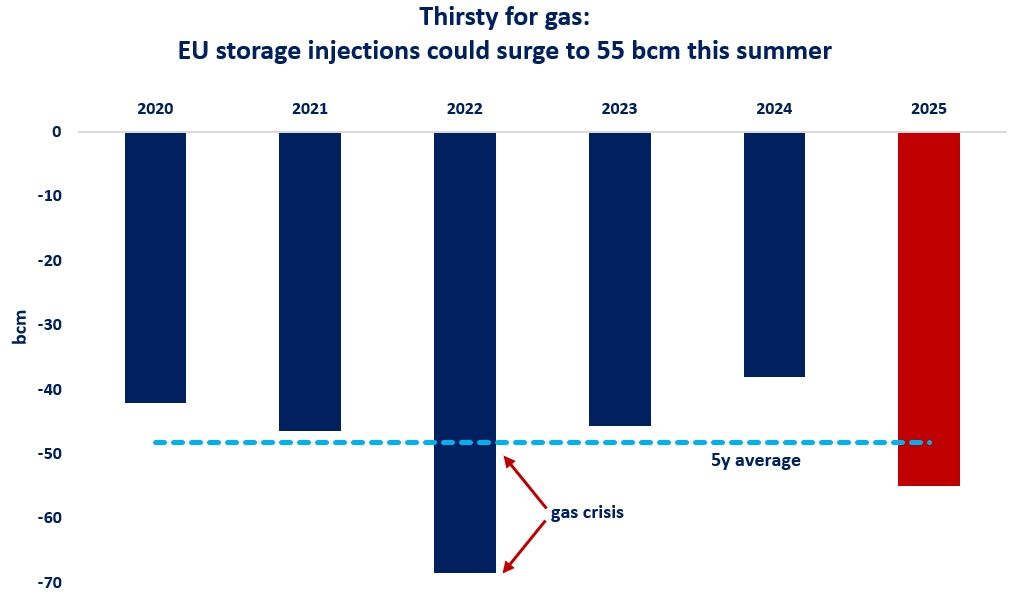

European gas storage fill levels fell below 50% this weekend, meaning that Europe’s storage injections could surge to 55 bcm this gas summer.

Colder weather and lower wind power output drove-up European gas consumption by 7% yoy this heating season, with most of the incremental demand met by stronger storage draws, which surged by nearly 50% yoy.

Consequently, EU storage levels dropped below 50% of capacity this weekend, with inventories now standing almost 19 bcm below their last year’s levels and 7 bcm below their 5y average.

Assuming 5y average withdrawals, EU storage fill levels could drop just below 40% by the end of this heating season, meaning that Europe would need to inject 55 bcm of gas into storage this summer to meet its 90% fill target.

Hence, EU storage injections could be 17 bcm higher compared to last year, while Russian piped gas imports will be 15 bcm lower and global LNG supply is expected to increase by just 25-30 bcm.

In addition, Ukraine’s gas storage levels are trending towards historical lows, which should further increase Europe’s overall storage injections needs this summer (by around 2-4 bcm).

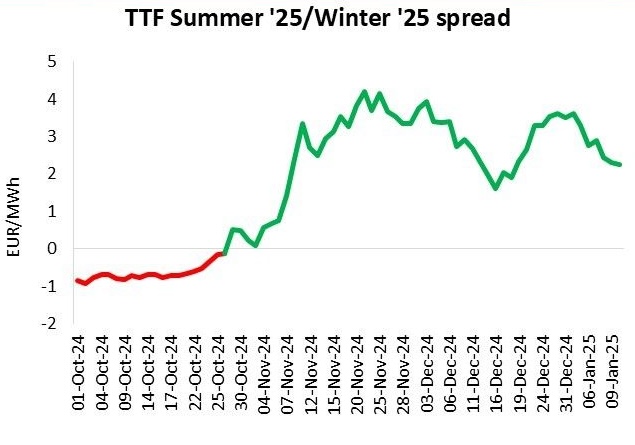

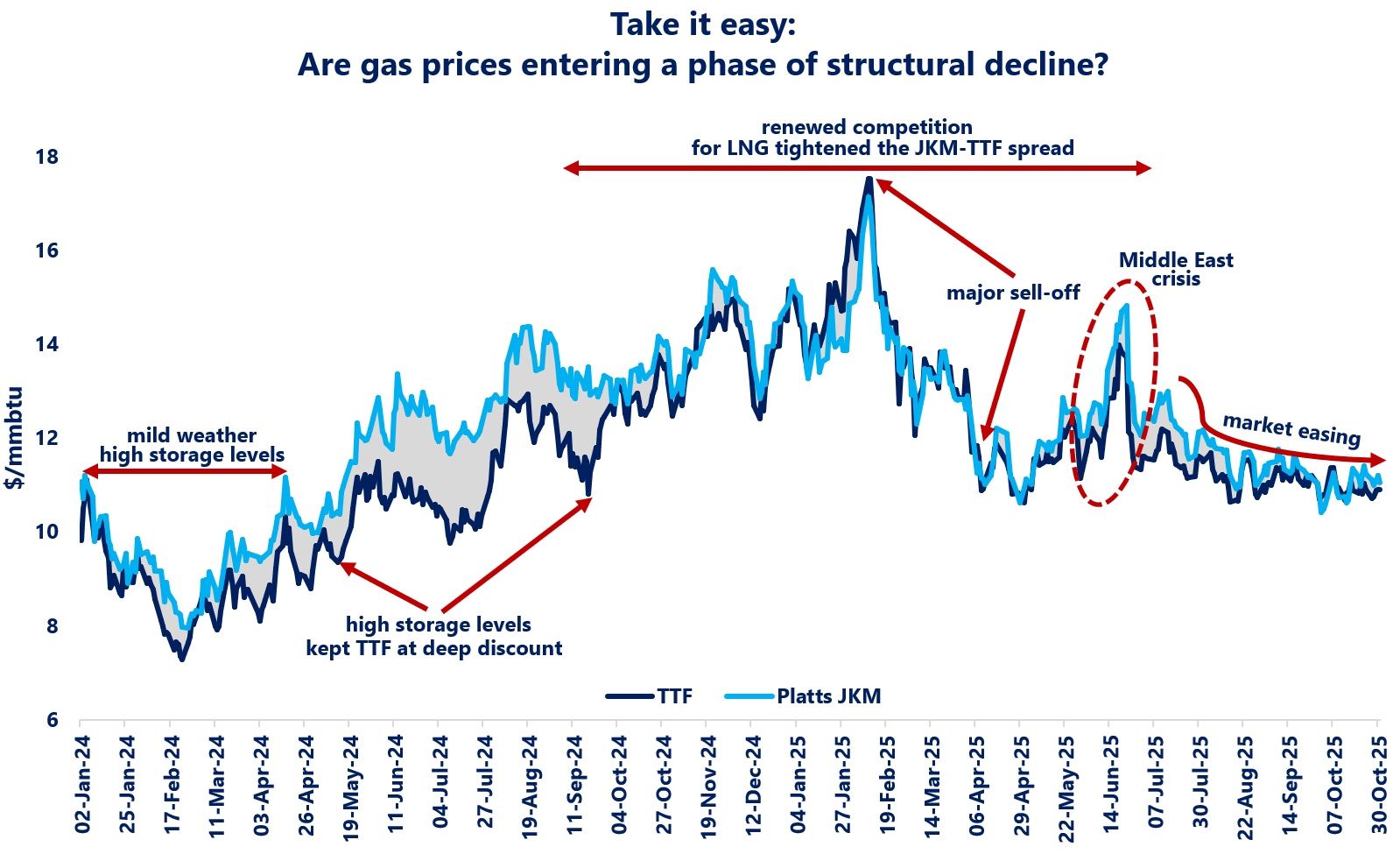

Not surprisingly, Europe will be fiercely competing for flexible LNG cargoes and TTF is set to retain its premium over JKM through the injection season (and potentially beyond).

Egypt’s higher LNG import requirements (around 6 bcm this summer) and Indonesia’s stronger LNG demand (up by 5 bcm) could tighten further the global and European gas balance.

And sizzling heatwaves in Asia could add further pressure on the summer market.

In this context, the timely ramp-up of new LNG projects, in the US, Canada and Africa, will be critical.

The use of peak liquefaction capacity, including at new LNG terminals could provide some relief to a rather heated summer market.

Source: Greg MOLNAR