Source: Raquel Martínez Farreres

Despite the gradual lifting of these measures, the global economic downturn, market uncertainty and the contraction of gas demand have led to the cancellation of numerous LNG charges from the US. With the succession of cancellations and the expectation that demand will remain weakened in the short term, the use of liquefaction capacity in this country is expected to decrease in the coming months.

The market is facing an extraordinary situation, facing a reversal of the export dynamics.

According to a monthly report by Platts Analytics, released on June 8th, the utilization of liquefaction capacity in the U.S. is expected to fall below 50% in the coming months. Total utilization capacity began to decline in January while in the U.S. the steepest drop began in March. The first fall in the U.S. trend (seen in January) was a direct consequence of weakening LNG demand in Asian countries, already under confinement measures, but it is from March on, with the implementation of confinement measures to contain Covid-19 in some states that the drop in liquefaction is significant.

Source: PLATTS and Repsol Economic Research Dpt.

The market is facing an extraordinary situation, facing a reversal of the export dynamics. On June 6th, a cargo from Trinidad and Tobago would have already been received at the Cove Point, (Maryland). In addition, some sources point out that the U.S. would have received another cargo from Zeebrugge (Belgium) at Sabine Pass (Louisiana).

Oversupply and narrowing price spreads would be pushing LNG from the U.S. out of key markets, leaving cargos looking for a place to unload or store the gas until market conditions improve. Given the excess capacity of the U.S., it seems logical to send the gas there, especially when Europe is at 75% of its gas storage capacity and does not have the flexibility to continue to exercise the “balancer” role of the market seen so far.

With the cancellation of charges, which could reach 125 between May and October this year, there would be space available in the U.S. to “park” loads from abroad, waiting for a subsequent recharge. By doing this, liquefaction costs would not be incurred as capacity would be available.

Will the u.s. be the first to function as a “parking-lot” for (homeless) LNG cargos?

U.S. facilities can liquefy and export around 9 Bcf/d, a figure that would increase to nearly 14 Bcf/d with all projects under construction online. Based on GIIGNL (LNG import group) data, more than 4.5 Mcf would be currently available among 34 onshore tanks. If the average load is about 155 thousand Cm, LNG from around 30 cargos could be stored.

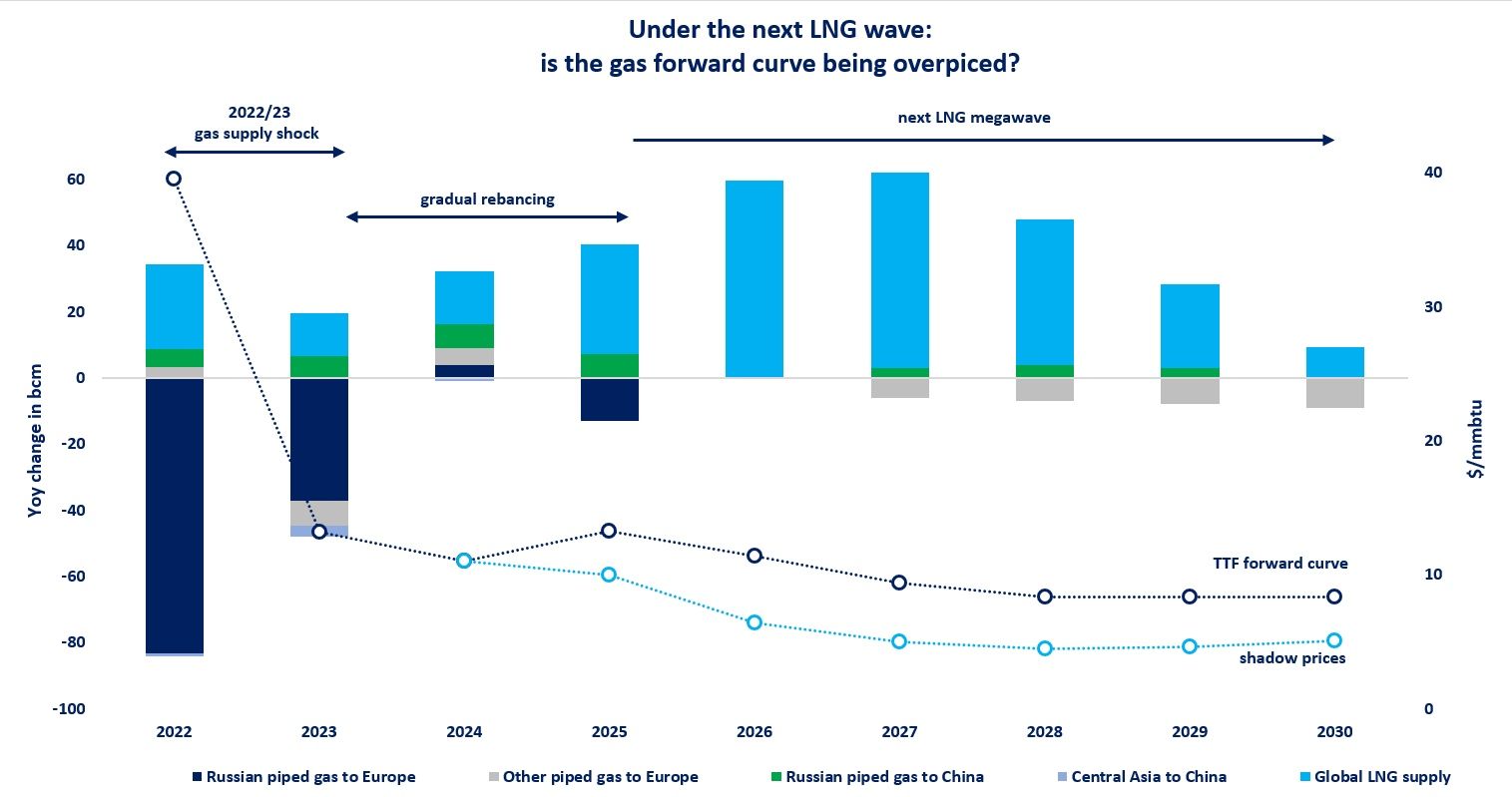

The question is whether this new trend is due to the current situation or will set a precedent. With another wave of new LNG projects adding new capacity at a faster rate than estimated demand growth, could this happen again? Could it be a way to find an extra income for LNG producers in U.S.? U.S. was the first in making LNG contracts more flexible. Will they be the first in working as a “parking-lot” for LNG cargos?

Just wait and see.

Source / author: Raquel Martínez Farreres (LinkedIn Profile)