Now, when the summer of 2022 finally came to end, it has become clear that there is no return to the previous configuration of the European gas market. Even assuming that Russia-EU relations can be restored at some point in the future, with Nord Stream going back into service (sounds like a nearly impossible thing at the moment, does it?), the events of the past six months have taught the continent some life lessons.

Will Europe learn them all is a separate matter. But it seems that floating LNG terminals, which are being put into operation across NWE, should not only be a temporary solution for shippers seeking a substitute for Russian volumes. Given seaborne cargoes’ growing role in the region’s market, FSRU additions must be an integral part of the European infrastructure for receiving natural gas.

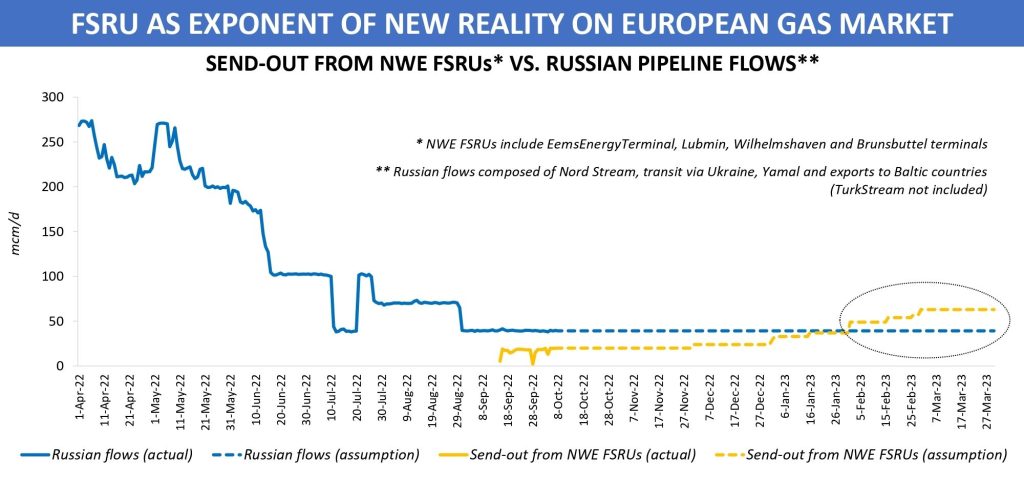

Just a few years ago, it was impossible to imagine that cargoes going through FSRUs could significantly contribute to Europe’s energy security. However, in today’s reality, send-out from the new EemsEnergyTerminal at the Dutch port of Eemshaven is approximately half of what Russia exports to NWE via all the pipelines. Of course, the reason for that is an unprecedented drop in Russian gas flows, but the fact remains.

This coming winter, three more FSRUs are planned to start operations in Germany. Lubmin, Wilhelmshaven и Brunsbuttel floating terminals will have a design capacity of 20 bcm/year, an equivalent of more than 50 mcm/day of send-out. It should take some time for the units to ramp up to full capacity. At the same time, three German FSRUs together with EemsEnergyTerminal, even on reasonably conservative estimates, may outperform Russia in terms of gas volumes sent into the NWE transmission grid already in early 2023.

The installation of new floating terminals across Europe accelerates the process of LNG rising to the next step of the gas market hierarchy. Once a supplement to pipeline gas flows, seaborne cargoes are now rapidly developing into an essential tool for maintaining supply/demand balance within the region.

Source: Yakov Grabar (LinkedIn)