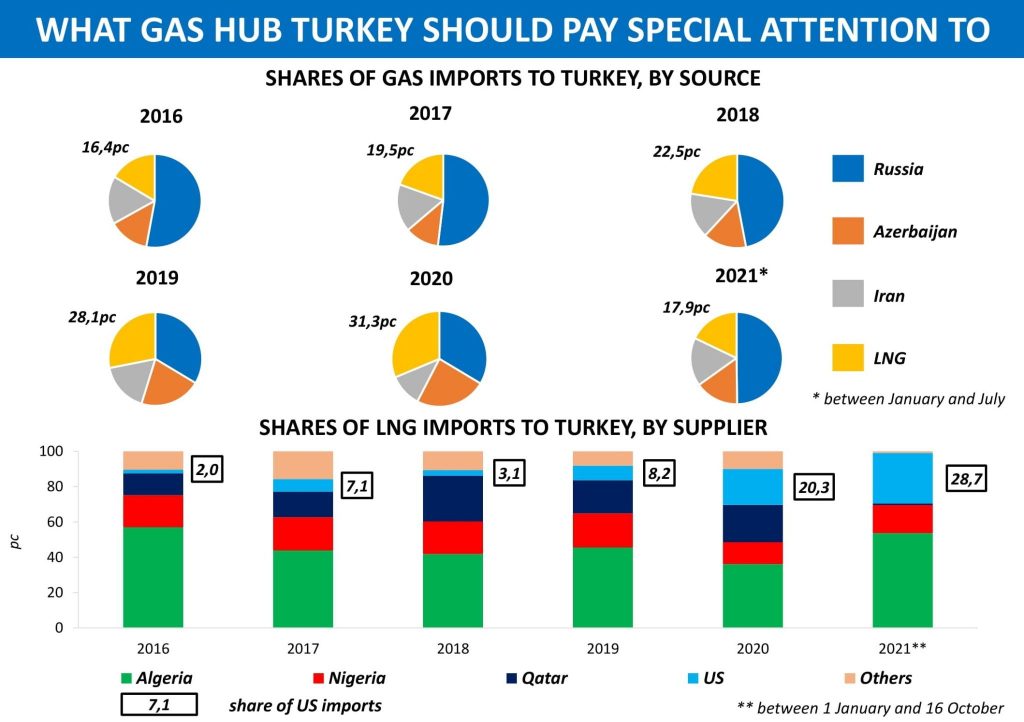

Turkey is one of the most prominent examples of the country that has managed to significantly diversify its energy supply sources in a relatively short time.

As a number of new liquefaction plants came on stream worldwide in the latter half of the 2010s and two FSRUs were put into operation in Aliaga and Dortyol, spot LNG cargoes have become an integral part of the country’s gas imports. And it is the US that now dominates over other suppliers of non-contractual volumes to Turkey.

In recent years, US LNG deliveries at the Turkish regasification facilities were rising at a faster pace than receipts from any other source. As recently as 2019, the share of the US in Turkey’s total LNG imports stood at only 8pc, but already in 2020 transatlantic shipments accounted for more than 50pc, increasing further to almost 30pc in the period from January to mid-October 2021, according to Kpler.

This year, all spot cargoes, except for two that arrived at Aliaga and Marmara Ereglisi terminals from Qatar and Egypt respectively, were delivered to Turkey from the US plants.

Understandably, the Turkish terminals received less US LNG in the first nine and a half months of 2021 as compared to the same period last year. But in the medium term, it is the US that would be best positioned to significantly increase exports to Turkey.

When Calcasieu Pass LNG and Sabine Pass Train 6 enter commercial service, trading companies, which purchase Henry Hub-indexed LNG on FOB basis, will likely have more to offer Turkish buyers.

In that changing context Turkey understands the need to pay special attention to the major US gas hub, going beyond traditional benchmarks such as Brent crude or TTF and PSV prices.

The increased role of US LNG in the Turkish market may be reflected in the inclusion of the Henry Hub into the formula for calculating the reference price while launching gas futures on the Istanbul-based energy exchange EPIAS, ICIS reported in early September.

Turkey’s demand for spot LNG depends heavily on the amount of gas imported under long-term contracts. But with access to non-contractual seaborne cargoes, local buyers can be flexible enough to better adapt their activities to a volatile environment.

Source: Yakov Grabar