Global LNG liquefaction capacity is set to expand by over 250 bcm by 2030 – equating to almost half of global LNG trade in 2022. This strong growth is underpinned by an unprecedented investment in the global LNG value chain, both on the sellers and buyers side.

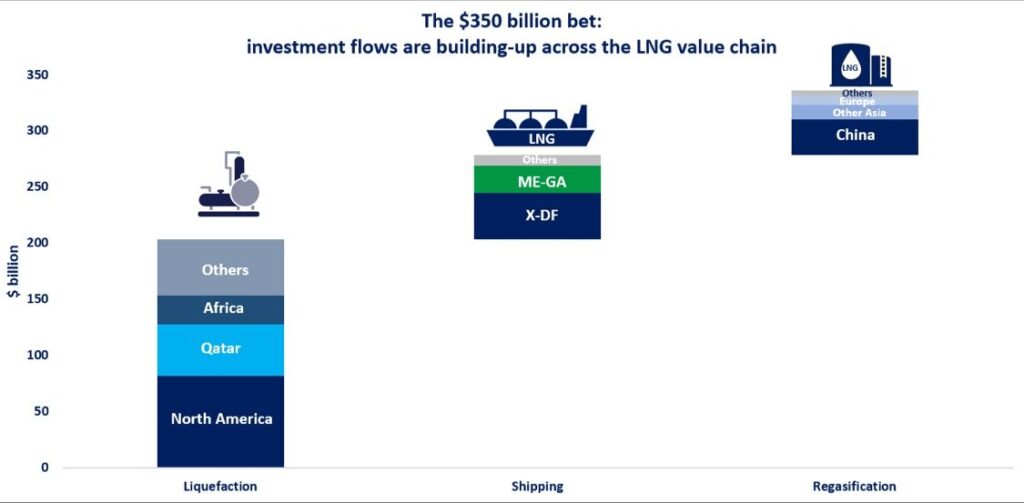

Investments in liquefaction facilities to expected to total at around $200 billion, with North America and Qatar accounting for almost 70% of the overall investments in liquefaction facilities, followed by Africa.

North America and Qatar is expected to have lower unit investment costs, supported by well-developed midstream infrastructure and a competitive service sector.

On the shipping side: almost 300 LNG carriers are currently on order, with a total investment cost of over $70 billion. not surprisingly, the most efficient vessels (X-DF and ME-GA) account for almost 90% of the overall investment cost.

Last but not least, the regasification landscape is dominated by China, with over 100 mtpa of capacity under construction and/or being announced.

What is your view? How will the global LNG market evolve in the coming years? Could we see an inflation of costs considering the record number of projects being developed? How will LNG shipping evolve?

Source: Greg Molnar (LinkedIn)