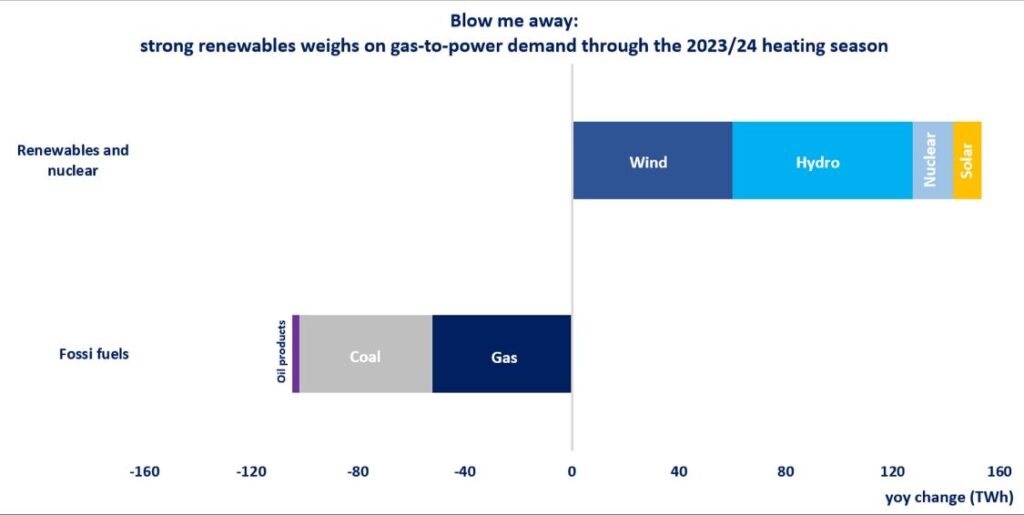

The strong growth in renewables kept European gas demand in check over the 2023/24 heating season, smoothing further market fundamentals and limiting price volatility.

Wind was blowing like a champion, increasing by over 20% (or 60 TWh) compared to the previous heating. in addition, hydro availability improved significantly after two dry years and added almost 70 TWh to the European power mix. and of course, the French nuclear fleet is regaining force after two difficult years. in total, nuclear power generation rose by over 15 TWh yoy.

This strong growth in renewables continued to squeeze out thermal generation, which dropped by 20% (or over 100 TWh) compared to the 2022/23 winter season. gas burn declined by an estimated 14 bcm, which was key to further ease up market fundamentals, lower prices and allow for a stronger gas demand recovery in industry.

Consequently, the share of renewables rose from 36% to near 45% in the European power mix, while fossil fuels dropped from 36% to below 30% during the 2023/24 winter season.

This being said, the back-up role of gas-fired power plants and their importance to electricity supply security continues to increase, well-demonstrated during the January coldspell, when their output surged on high demand, and low wind power output.

Source: Greg Molnar