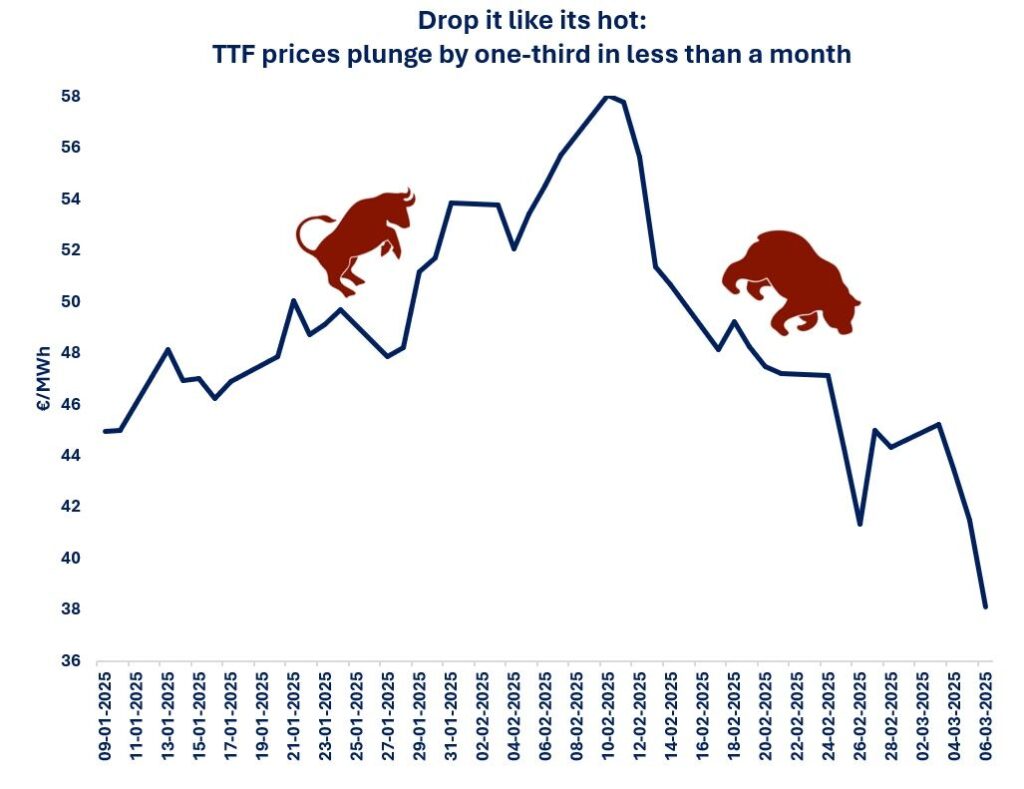

The TTF gas price plummeted by more than one-third in less than a month, falling to below €40/MWh for the first time since November last year.

There are several factors at play, including:

(1) EU could call for the resumption of Ukraine’s gas transit according to a leaked paper: this was the key driver for today’s bear growl, with TTF recording a drop of almost 10%;

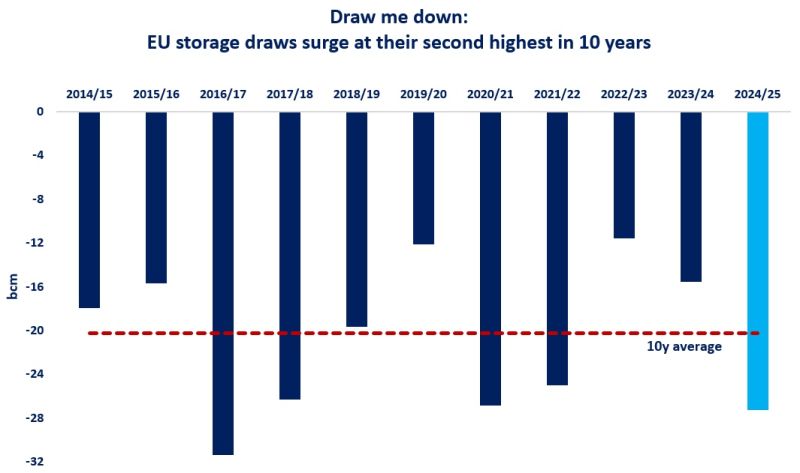

(2) weather matters: spring is hitting early Europe, limiting space heating demand and weighing on storage draws;

(3) weaker Asian demand: China recorded 4 months of consecutive gas demand decline, for the first time since the 2022 gas crisis. but how structural is it?

(4) traders sell-off: closing long positions and taking profits home;

(5) stronger euro: the euro is up by 5% since the start of Feb, which contributes at the margin to lower euro denominated gas prices.

What is your view? How will the summer gas market look like? Any takes on the transit question?

Source: Greg MOLNAR