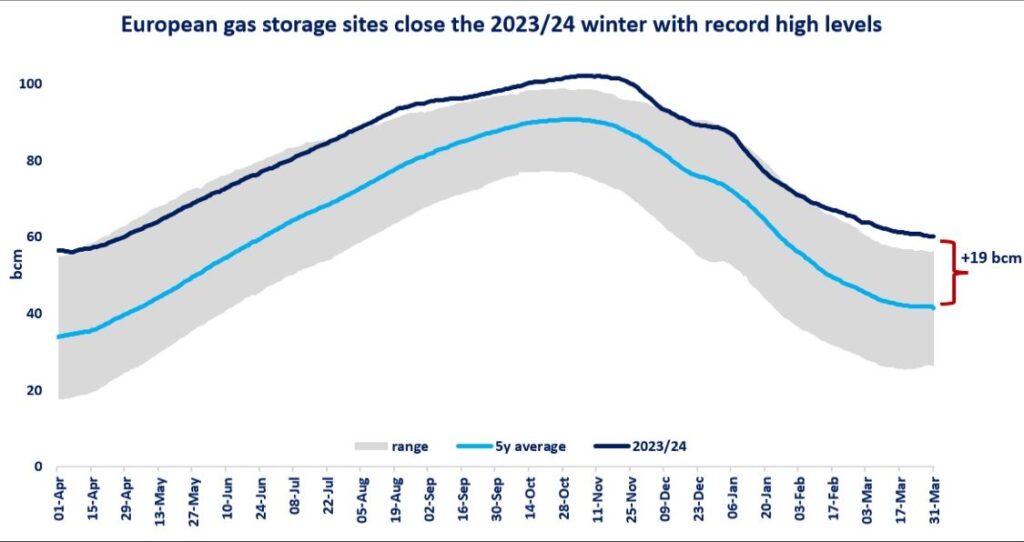

European storage sites closed the 2023/24 heating season with record high inventory levels, which is set to weigh on injection demand and hence could further ease market fundamentals over the gas summer.

EU storage sites are almost 60% full, standing 45% (or 19 bcm) above their 5y average. subdued demand together with healthy LNG availability and stronger piped gas deliveries weighed on storage draws, which stood 20% below their 5y average during the 2023/24 winter.

Record high storage levels are set to weigh on injection demand: the EU would need to inject just 32 bcm (40% below 5y average) to reach the its 90% fill target by 1 November.

Similarly, in the US storage sites are ending the 2023/24 winter with record high inventories, standing 40% (or 19 bcm) above their 5y average.

High storage levels could provide further downward pressure on gas prices in the coming months, if no major unplanned outages or geopolitical surprises…

Source: Greg Molnar