Unseasonably mild weather continued to drive down gas prices in Feb24, with North American hubs reaching multi-decade lows and European gas prices falling to pre-crisis levels.

In the US, Henry Hub prices averaged at $1.7/mmbtu -their lowest February level since 1995, or almost 30 years. mild weather conditions drove down rescom demand, which dropped by around 15% yoy, while continued strong production and high inventory levels (25% above 5y average) put further downward pressure on prices.

In Canada, AECO fell to $1.35/mmbtu -the lowest gas price on the globe for the moment (and its lowest Feb level in 25 years).

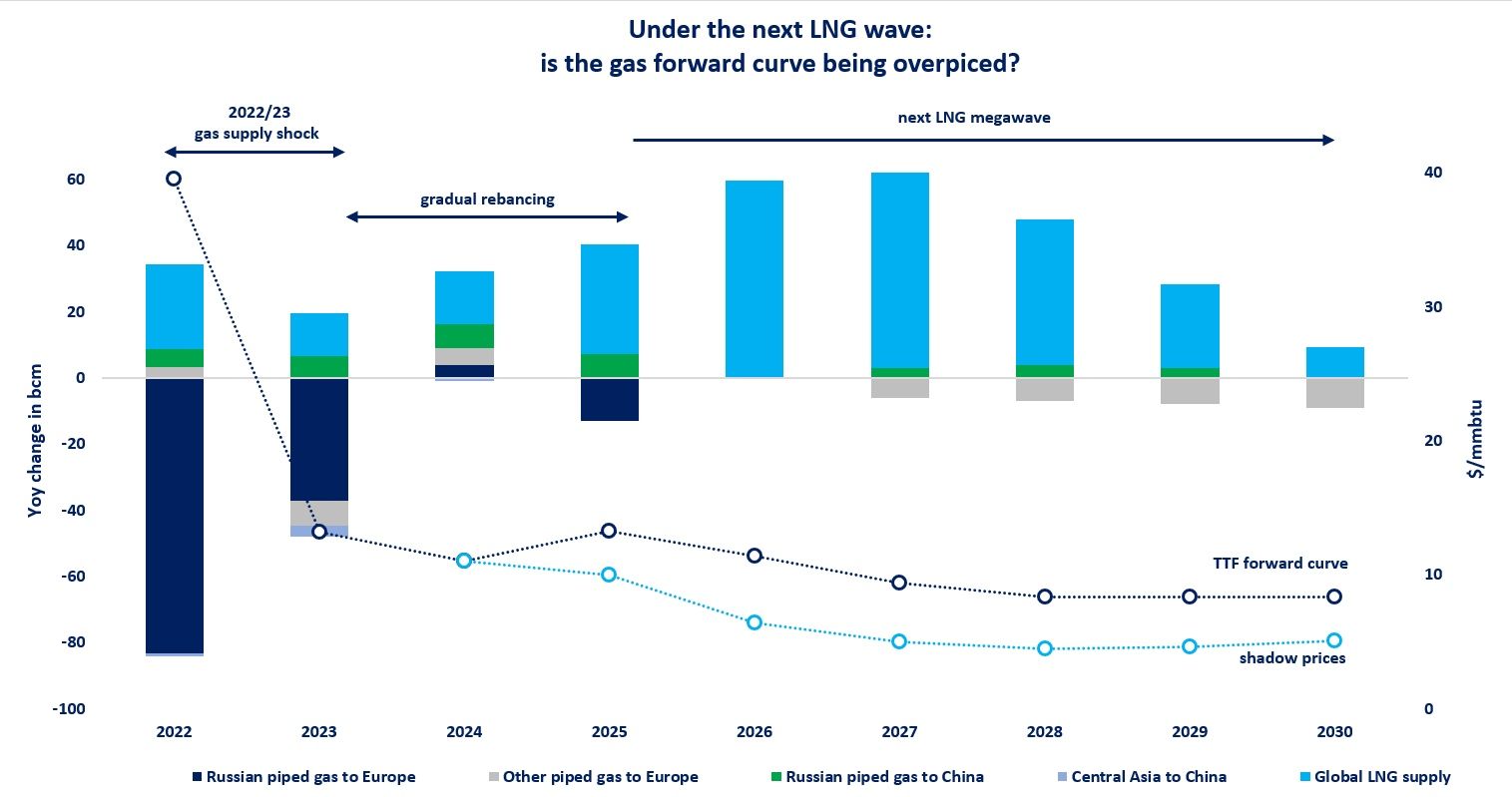

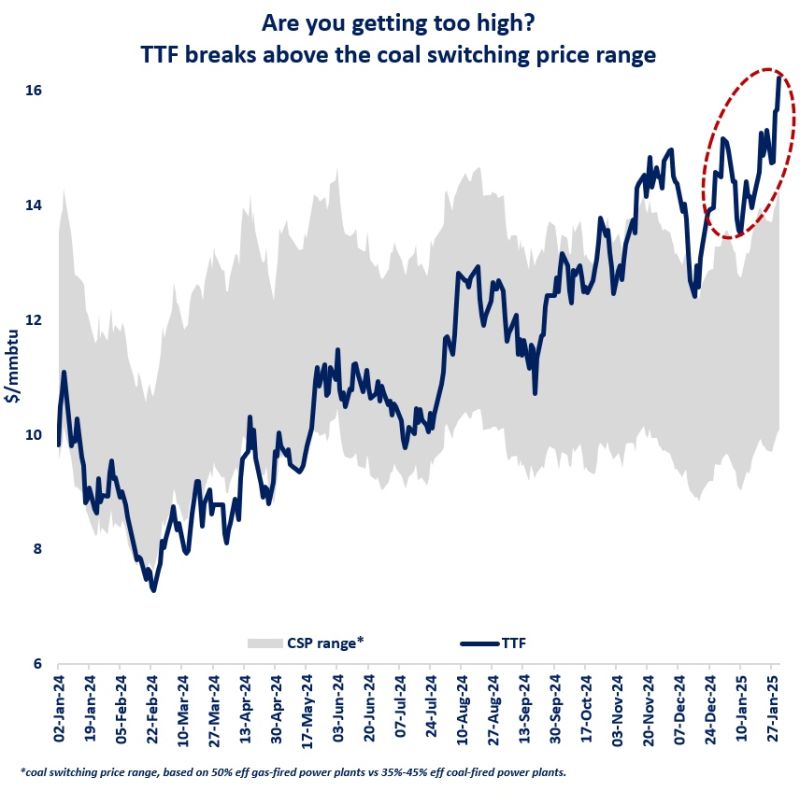

In Europe, TTF prices averaged $8.2/mmbtu -their lowest level since Apr21. demand collapsed (down by almost 20%) amidst unseasonably mild weather and plummeting gas-fired powgen. strong Norwegian flows and high storage levels (standing almost 40% above their 5y average) depressed further European hub prices.

In Asia, JKM followed a similar price trajectory, down by 13% month-on-month, amidst healthy LNG availability and sluggish demand. China remains in the driving seat, with the country’s LNG imports up by 16% yoy. JKM is also now well-below oil-indexed prices, which could mean that spot buying interest might heat up.

What is your view? how will the market evolve through the shoulder season? Could we see some upward correction? Or the bears are too bearish?

Source: Greg MOLNAR