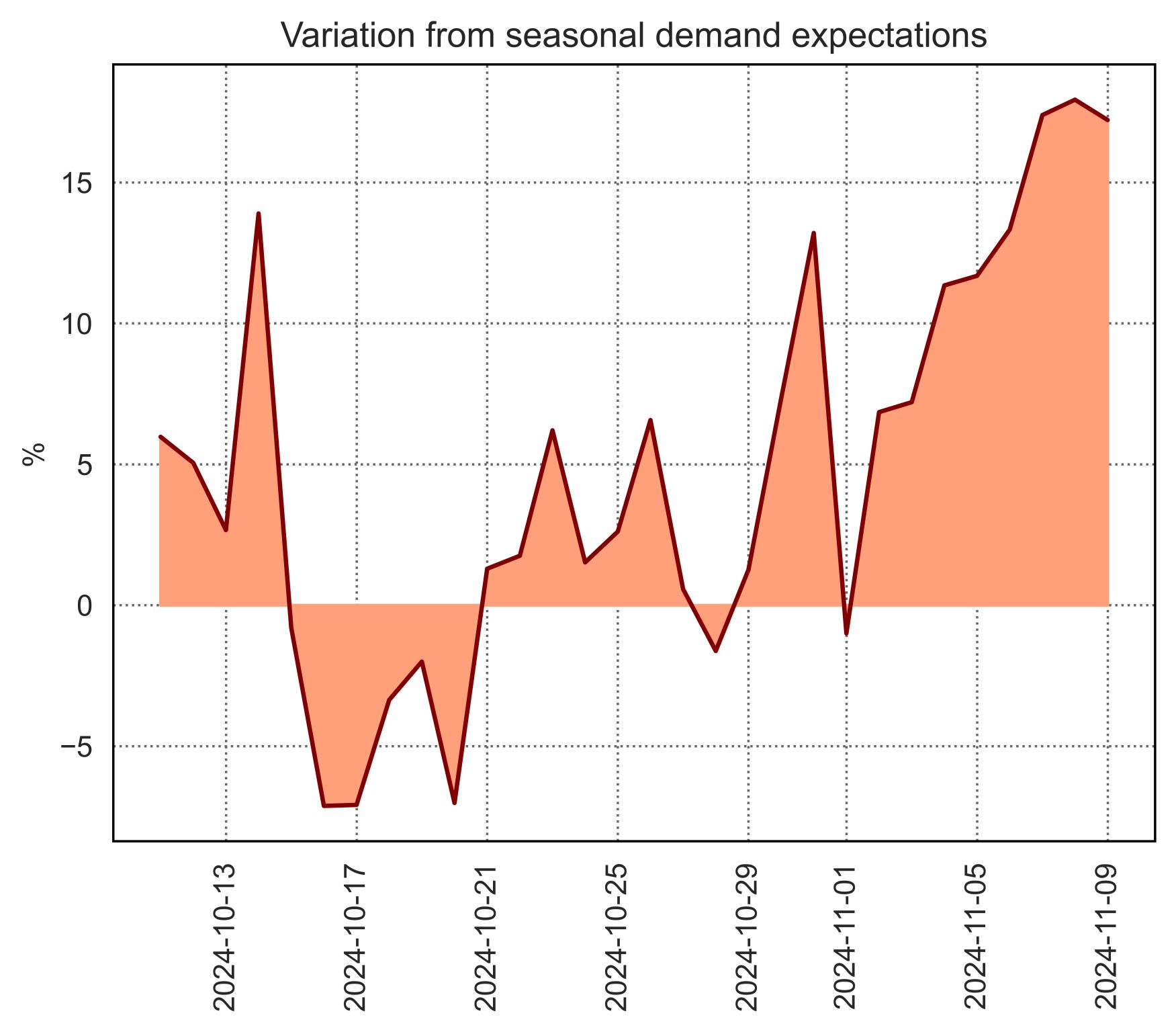

European gas demand at the start of November has been well above seasonal expectations, causing all markets to turn to significant levels storage withdrawals, including those that hadn’t yet started them.

In summary, the consequences of this rapid increase in demand have been:

This is a highly significant development and it has caused an expected strong response in prices. This is especially the case because this increase in demand is happening at the start of the winter season when uncertainty on winter demand (and consequently price volatility) is at its highest.

There should be no cause for panic yet, though, as periods of demand well over 10% higher than seasonal expectations have occurred in the last two years as well without significantly impacting total market balances and storage levels at the end of the winter.

This kind of event is exactly what high storage levels are effective in providing a buffer against. Overall, such a level of demand is likely to become more than a temporary issue for total winter balances only if protracted for more than two-three weeks.

Source: Giovanni Bettinelli