For most players in the European gas market, 2021 will be remembered first and foremost as a year of unprecedentedly high level of prices. But there are parts of Europe for which this year has brought not only record gains on hubs but also a fundamental transformation of transport infrastructure, resulting in a reshaping of flow patterns. This year’s developments in Central Europe make it stand out from the rest, with Hungary representing a special case in that regard.

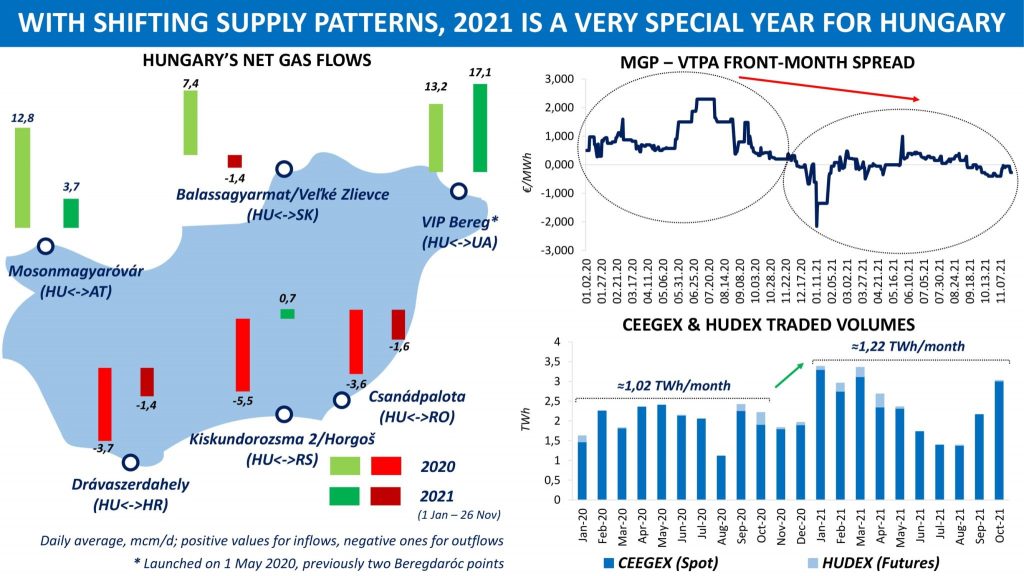

As recently as last year, almost all volumes of gas were imported to Hungary from Ukraine, Austria and Slovakia, which together provided on average 33 mcm/d in 2020. Three interconnection points Hungary had along its southern border with Serbia, Romania and Croatia were being used mainly for exports, with physical flows to the three markets totalling some 13 mcm/d between January and December 2020.

This year has seen a dramatic change in the Hungarian import/export profile. Since the launch of the Krk LNG terminal in January 2021, Croatia’s gas import requirements started to decline which led to an almost twofold decrease in deliveries from Hungary via the Drávaszerdahely point in 2021. Furthermore, in some periods of the year net flows were in the opposite direction as some companies active in the Hungarian market had booked long-term regas capacities at the Krk facility.

Also in early 2021, the Bulgaria-Serbia interconnector was put into service, thus making it possible for Serbia to replace flows coming from Hungary with the Turk Stream pipeline volumes. As a result, already in the first month of the Kireevo/Zaychar point operations Hungarian average intake of Austrian gas fell below 1 mcm/d, from 12.5 mcm/d in January 2020. A solid premium at Hungary’s MGP over the VTPA hub became a thing of the past.

In Q4, contracts in the Hungarian market area were assessed consistently lower than those at the Austrian hub. The MGP front-month discount to the VTPA equivalent reached on average €0.25/MWh between October and late November 2021. After the new Kiskundorozsma 2 interconnector at the border with Serbia came online in October, another section of Turk Stream reached Hungary, contributing to a further reduction in imports from Austria and lower flows transited via Ukraine. With new infrastructure added, MGP liquidity has naturally increased this year compared to the previous one.

It is no exaggeration to say that a new era has come for the Hungarian gas market in 2021. And this is already impacting neighbouring areas in one way or another.

Source: Yakov Grabar (LinkedIn)