THE MULTIPLE AND NUMEROUS USES OF THE PPA

The beginning of 2021 coincided with the escalation of the third wave of the COVID19 pandemic. The year, which had to be that of the economic recovery, begins more uncertain than ever.

Faced with such a scenario, the promoters of the renewable energy projects need tools such as the PPAs to manage and mitigate risks and be able to obtain financing. But not only that, the PPA can be a source of savings for the large consumers and the key to a commitment to corporate social responsibility.

Once the period of the Christmas festivities and holidays passed, the recovery scenario from the economic crisis that is beginning is less stable and secure.

The new outbreaks of the COVID19 pandemic that began in early December put many European governments on the ropes, which were forced to impose new restrictions on mobility, meetings and economic activities, at a time of the year which is characterised basically by that, by travel, family gatherings and gift shopping.

The evolution of the energy markets in Europe

The second part of the webinar organised by AleaSoft on “Prospects for the energy markets in Europe from 2021”, which will be held on January 14, arrives at this crucial moment for the energy markets in Europe. The third wave of the pandemic seems to be on the rise as vaccinations, which should return the society to something similar to that old normality, begin.

But it seems clear that the vaccines will not prevent or stop this third wave of the pandemic and that we will have to live with it, at least, until the summer. With this outlook, the energy markets continue their uncertain evolution, waiting for the evolution of the economy and the recovery of the electricity, gas and oil demand.

The vision of the PPA market

Faced with such an uncertain situation regarding the evolution of the electricity markets prices, the PPAs are a tool for the risk management that can be a source of savings while allowing the large consumers to carry out a commitment of corporate social responsibility.

But the PPAs are complex contracts that go far beyond a simple energy purchase price agreement. There are several types of PPA contracts and it is necessary to analyse them according to the risks to mitigate, the fiscal and accounting impacts, and the impact on the buyer and seller operations.

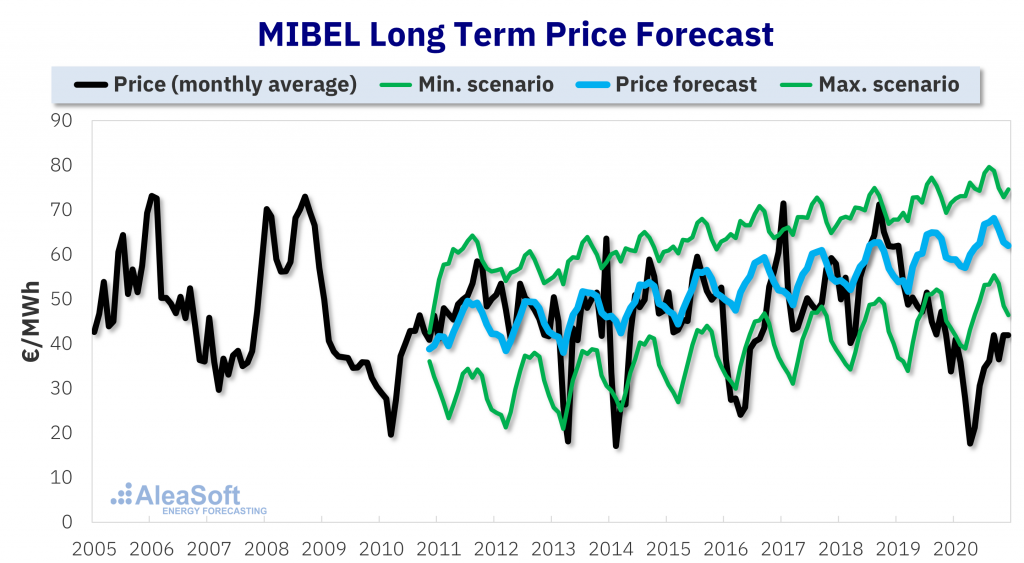

In order to analyse any offer or PPA proposal, it is necessary to have longterm electricity market prices estimates.

We are talking about hourly prices forecasting for the entire duration of the contract, and ideally beyond, to be able to estimate the captured price of the renewable energy project or that of the consumption profile of the offtaker to understand and correctly quantify the mitigation of the market prices.

To comment on all these aspects of the current market of PPA contracts for large consumers in Europe, AleaSoft is holding a webinar on January 14 (see our “Events” section for details)

Source: AleaSoft

Follow on Twitter:

[tfws username=”AleaSoft_EN” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]