European gas storage seasonal price spreads dropped into negative territory by the end of last week, paradoxically at a time when the EU is heavily relying on gas storage sites to ensure gas and electricity supply security.

Last week’s bull run asymmetrically impacted the forward curve: Summer 2026 contracts gained almost 15%, while the less liquid Winter 2026/27 contracts increased by only around 10%. Consequently, the seasonal spread collapsed from around €0.4/MWh to –€0.7/MWh.

While the current negative price spread might not last for too long, such episodes clearly showcase the difficulty of assigning a market-based price tag to the value of gas storage — which is naturally not only a market instrument, but also a strategic asset.

Very importantly, the front seasonal spread has averaged just below €1/MWh since last October, while the majority of storage sites have operating costs above €2/MWh. These tight storage spreads reflect market expectations of higher storage injections this summer, which in turn drive up summer contract prices and tighten the spread versus front winter contracts — a phenomenon often referred to in the industry as the gas storage paradox.

While the gas storage paradox is interesting from an energy economics point of view, its practical implications can be disastrous.

If storage operators cannot even cover their operating expenses, they face a clear risk of closure.

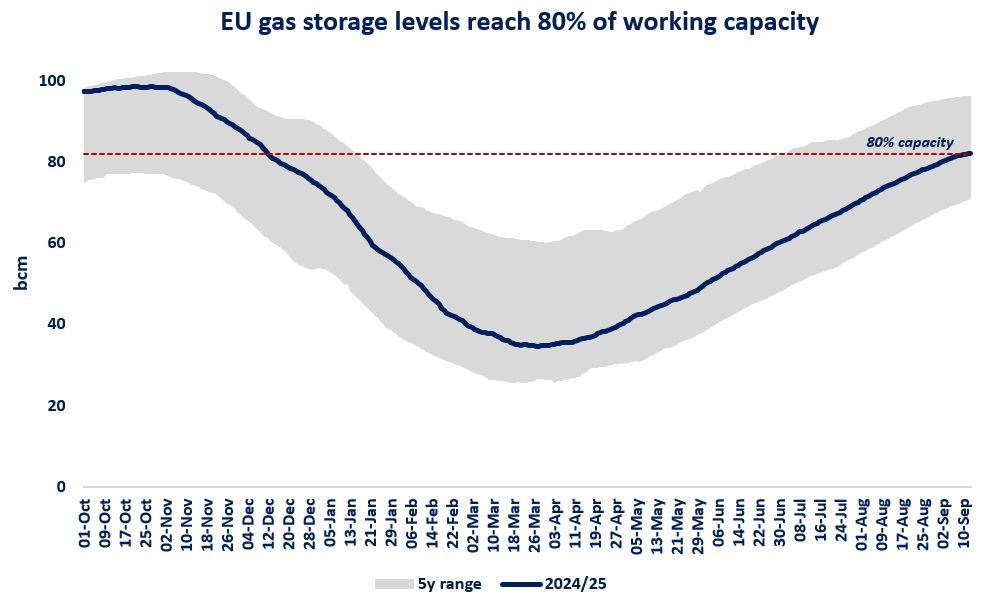

Three major storage sites are set to close in the next few years, reducing EU storage capacity by almost 8 bcm (around 8%), and at least one additional site appears to be at clear risk.

It is sometimes argued that LNG will provide flexibility instead of underground storage sites. This is misleading. LNG and underground storage facilities provide different flexibility mechanisms, which are complementary to one another and both are essential to the safe and secure functioning of natural gas markets.

Europe’s reliance on the global LNG market will continue to grow in the coming years, with all its benefits, volatility and risks. In this context, closing storage assets could expose Europe to greater vulnerability during periods of market stress.

What is your view? What future do you see for European gas storage sites? Is there a way to better recognise their strategic value? What would be the implications of further storage closures?

Source: Greg MOLNAR