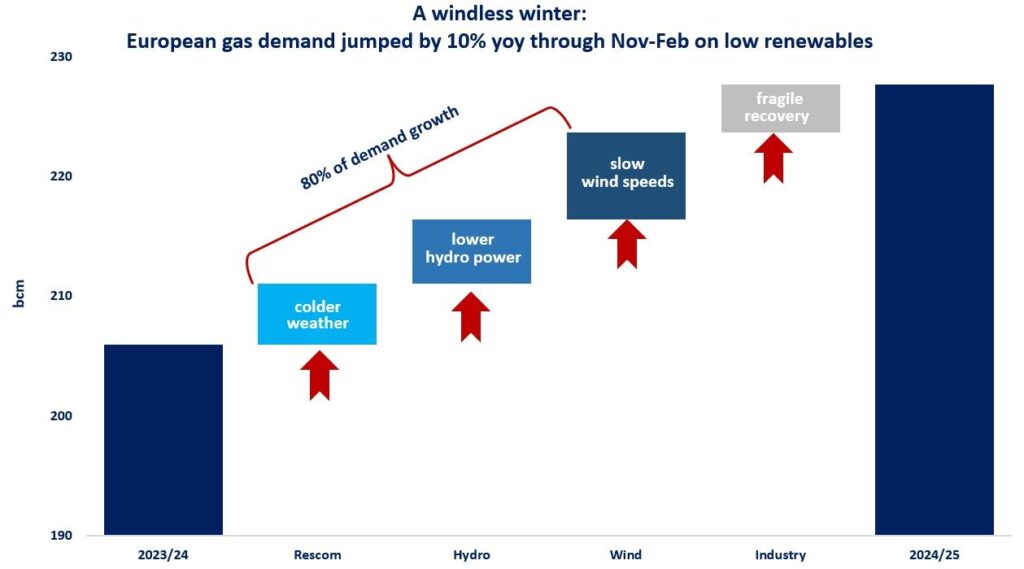

European gas demand soared by 10% yoy through Nov-Feb, with the strongest driver being slow wind speeds and lower hydro availability, leading to a surge in gas-fired power generation.

European gas demand grew by just around 22 bcm yoy since the start of November, leading to a rapid depletion of EU storage sites and tightening up market fundamentals.

Colder temperatures supported higher space heating demand, up by 5% yoy, but the single most important driver was the power sector, where gas burn soared by almost 30% compared to the same period of last year.

And slower wind speeds were a key factor here. Wind power output plummeted by more than 16% yoy, with flexible gas-fired power plants providing back-up and ensuring electricity supply security.

Lower wind power generation alone accounted for almost one-third of incremental gas demand since the start of November.

In addition, lower hydro availability drove-up gas-based generation in the Southern European markets, with both Spain and Türkiye recording a drop of 30% yoy, while Italy’s hydro down by more than 40%.

Altogether, weather-related factors accounted for more than 80% of Europe’s gas demand recovery through Nov-Feb. And most importantly it was not the cold weather, but rather the weather-dependent renewables (wind and hydro) which were driving this strong increase in gas demand.

And this highlights the growing role of natural gas as a key back-up fuel to the European electricity system.

And once again, it begs for the question on how best to ensure that these flexibility services are remunerated and adequate investments into gas supply flexibility are ensured.

The 2024/25 windless winter is a clear reminder that temperature variations are not necessarily the most important demand driver for gas, with variable renewables now a key driver of gas demand volatility patterns…

What is your view? What does it mean for gas markets? How should variable renewables be incorporated in winter preparedness plans? And how do variable renewables influence gas prices?

Source: Greg MOLNAR