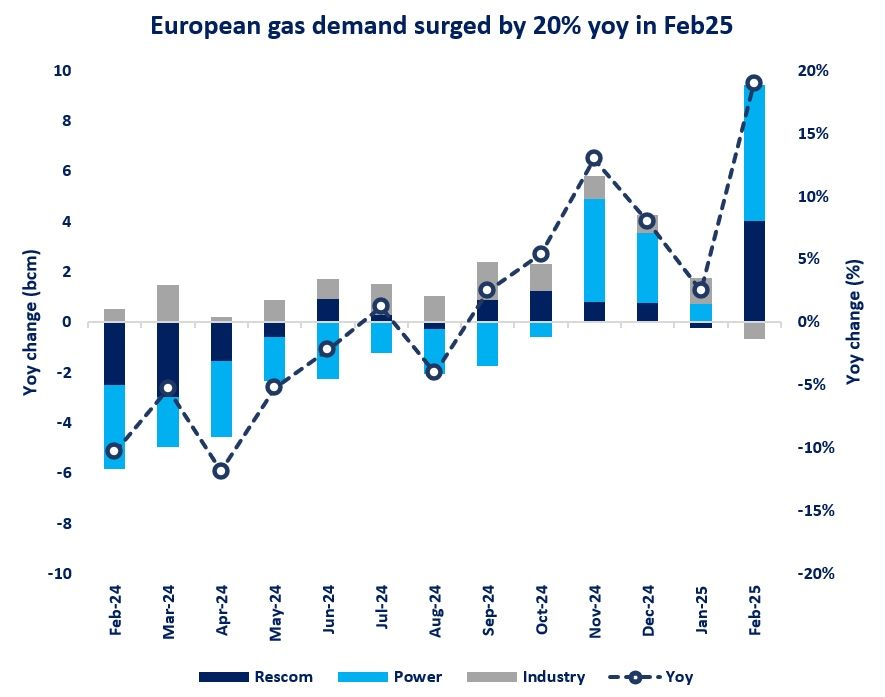

European gas demand surged by 20% in February, its strongest year-on-year increase since Apr21, when the gas market was still recovering from the covid lockdowns.

This very strong increase was only partially supported by colder weather, with rescom (residential / commercial) demand up by around 15% yoy.

The strongest contributor was the power sector, where gas burn soared by a staggering 60% yoy.

And once again, this was primarily driven by lower wind output, which dropped by almost 40% yoy.

Flexible gas-fired power plants stepped in and provided back-up to the power system, ensuring electricity supply security.

Stronger gas demand supported a surge in storage draws, which more than doubled compared to their last year’s levels during February, and pushed down fill levels to below 40% by the end of the month.

In contrast with the rescom and power, industrial gas demand dropped by around 5% yoy, as high gas prices are now incentivising fuel switching and production optimisation in the most gas- and energy-intensive industries.

This winter clearly highlights that wind power is becoming an increasingly important factor for gas demand, and can easily distort the gas balance.

Winter preparedness plans and sensitivity analyses for gas infrastructure requirements will need to take this into account. It is not only about temperatures, wind matters too.

What is your view? What lessons can be learnt from this windless winter? What do you expect from this summer? How will Europe manage its injection season?

Source: Greg MOLNAR