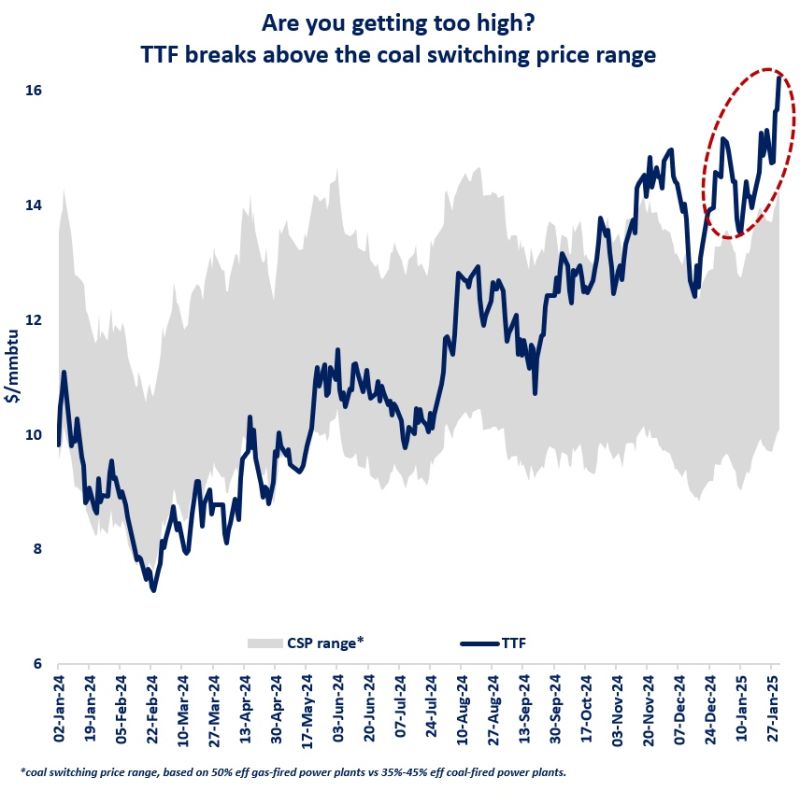

The TTF gas price index surged above the coal switching price range and stayed above this critical resistance band since mid-Dec last year, looking for new resistance levels… but are there any?

TTF prices rose by more than 30% since mid-Dec last year, now trading at a 15-month high at just above $16/mmbtu.

Carbon prices followed a similar trajectory, while coal prices remained broadly flat. Consequently, TTF successfully broke the coal switching resistance band and rose well-above its levels.

This means, that gas-fired power plants are now less competitive than the least efficient coal-fired power plants, which in turn could support stronger coal demand at the expense of natural gas.

Because of its potential impact on gas demand, the coal switching price range is regarded as one of the most important resistance bands in the European market when it comes to gas prices.

But it seems, that TTF does not care about it so much anymore, at least not these days.

In contrast, what seems to matter is to find the price level which would enable to refill the EU’s large storage sites through the summer. There are two key factors at play:

(1) Europe needs to outcompete Asia for flexible LNG: this should drive the TTF-JKM spread through the summer contracts (and could impact also more near term price movements);

(2) industrial demand destruction: would Europe need to reduce its gas consumption in order to refill its storage sites? In the wake of stronger-than-expected demand from the power and rescom sectors, Europe might need to reduce its gas use in industry.

The current price levels, if stay for longer, will inevitably lead once again to demand destruction in the European industry, especially in the gas- and energy intensive industries. Of course, the scale won’t be the same as we had in 2022/23, but I would not be surprised to see some gas-to-oil switching and lower production rates this summer…

What is your view? How will gas prices play out this summer? What does it mean for European industry? And what does it mean for competitiveness?

Source: Greg Molnar