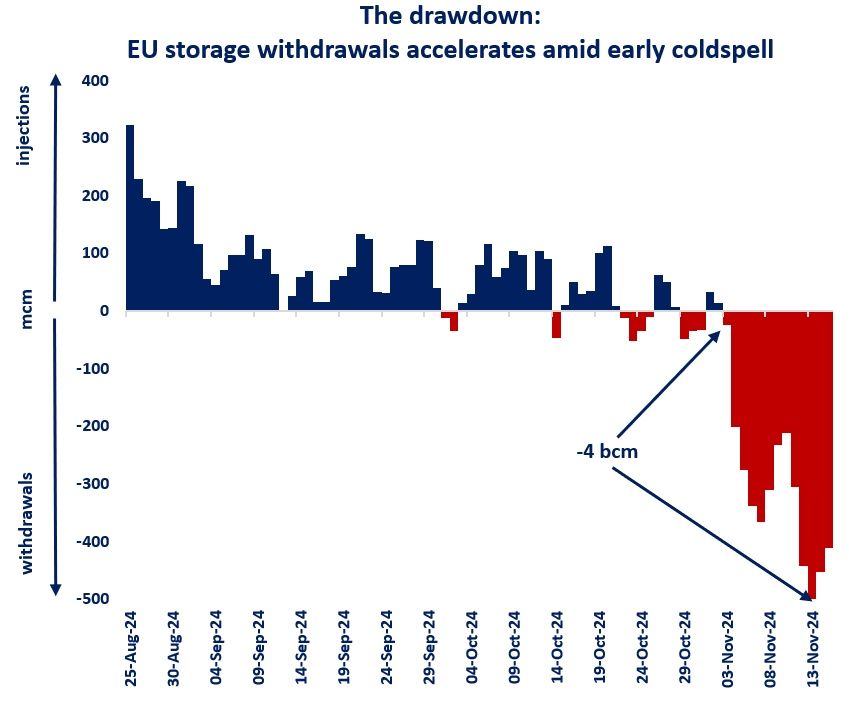

European gas storage withdrawals surged in the last two weeks, with over 4 bcm of gas pumped out since the start of November, as an early coldspell and low wind speeds boosted European gas demand.

European gas demand has been trending well-above its 5y average since the beginning of November, as colder temperatures drove-up space heating demand, while lower wind power output boosted gas-based generation, up by a staggering 85% yoy.

Gas storage sites once again demonstrated their unmatched flexibility, turning promptly to withdrawals and supplying just over 4 bcm of gas to the market. This more than four times above the 5y average for this period of the year.

And to give us some perspective on this flexibility: 4 bcm translates to around 45 TWh -more than the double of the electricity output of the European wind power fleet in 15 days under average wind conditions… but what if the wind does not blow?

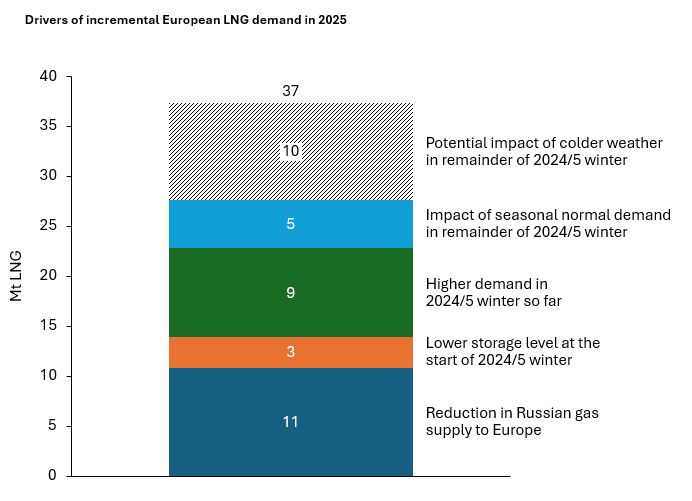

The sharp drawdown means that EU storage levels are now standing 8 bcm below their last year’s levels, which in turn could translate to higher injections needs and stronger LNG imports through the summer.

The outlook for higher injections together with the growing uncertainty around Russian gas supplies is supporting the widening front summer-winter spreads, with the 2025/26 winter contracts now standing at around €3/MWh (or almost $1/mmbtu).

What is your view? What role for gas storage in meeting seasonal and short-term flexibility needs? What is your storage outlook for this winter?

Source: Greg Molnar