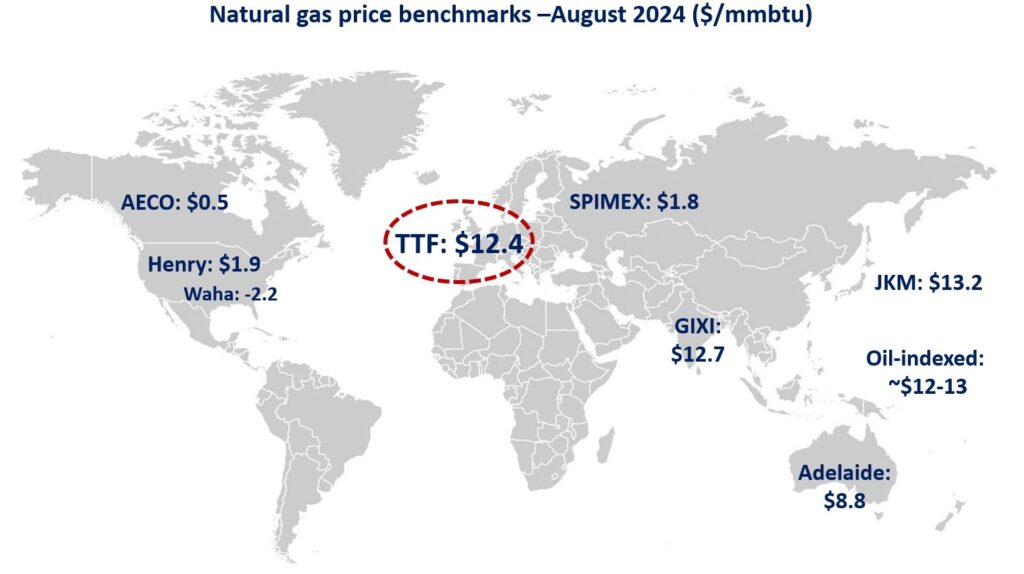

Gas prices moved into different directions across regions, with geopolitics fuelling volatility in Europe and pipeline constraints driving negative prices in the Permian.

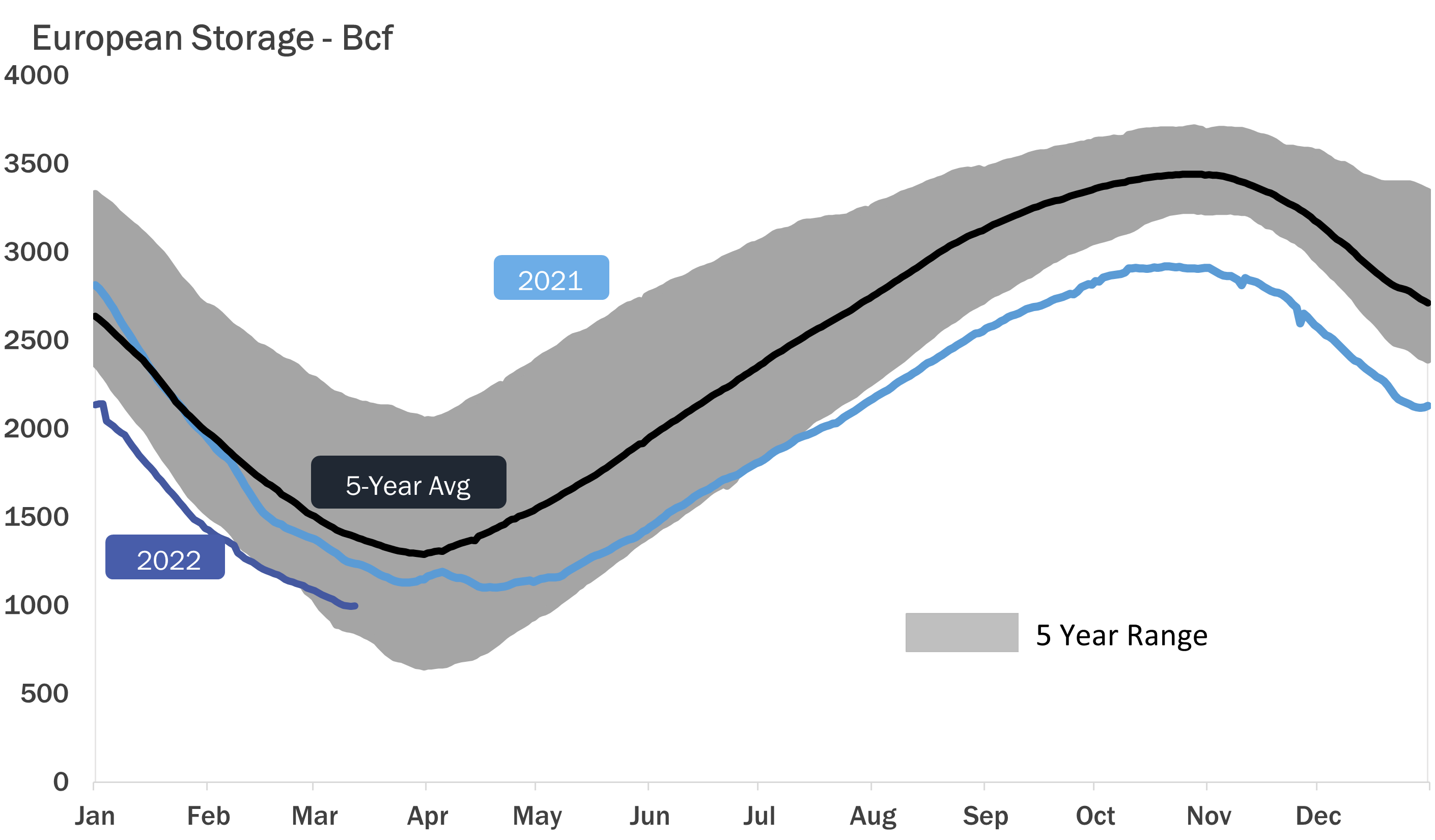

In Europe, TTF month-ahead prices jumped by 20% month-on-month to just overt $12/mmbtu -their highest monthly average since Nov23. prices rose despite weak fundamentals: demand remains muted, Norwegian piped flows were strong and storage is filled up to over 92%.

The strong increase in prices was primarily driven by geopolitics: rising tensions in the Middle East and the intensifying fighting on the Russian-Ukrainian border. all eyes are on Sudzha, the last operational gas interconnection point where Russian gas flows to Ukraine.

In Asia, JKM prices rose by 7% compared to their July levels to an average of $13/mmbtu -their highest level this year. higher European price levels, unplanned outages in Australia and continued demand growth supported stronger prices.

In contrast, in the US Henry Hub prices continued to slide to an average of $1.9/mmbtu -their lowest August level since 1998. lower gas burn in the power sector (down by 4% yoy), together with strong associated gas production and high storage levels (80% filled) provided downward pressure.

In the Permian, Waha prices collapsed to an average of -$2.2/mmbtu -their lowest monthly average on record. the continued surge in associated petroleum gas and pipeline constraints are practically chocking the Waha hub in a gas oversupply. I’m sure, some industrial consumers in Europe are watching this with a certain envy.

Source: Greg Molnar (LinkedIn)