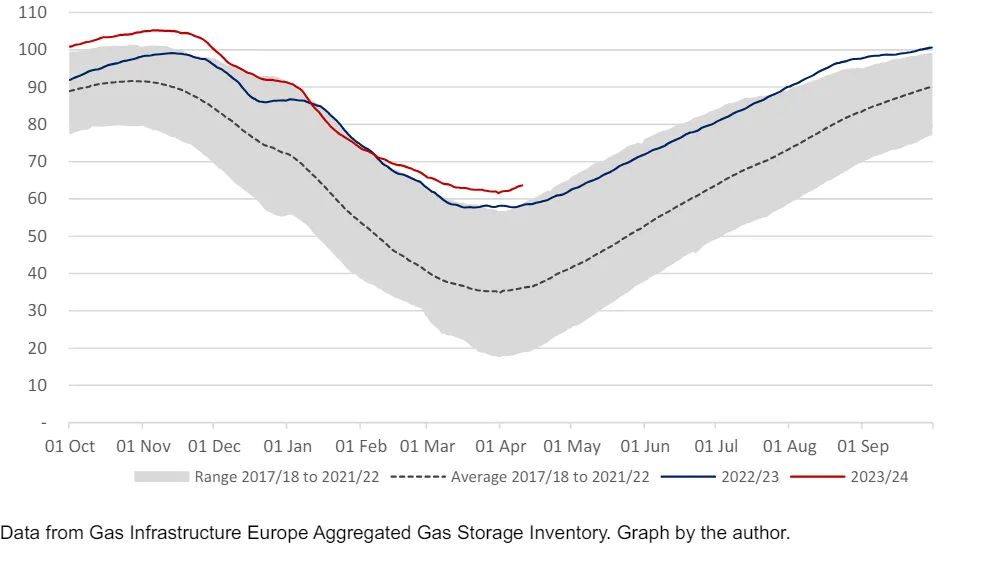

Between November 1st and March 31st, the winter of 2023/24 saw a net withdrawal of 44.0 billion cubic meters. This is the same as the winter of 2019/20, slightly more than the lowest record winter withdrawal of 40 billion cubic meters in the winter of 2022/23, and much less than the winters of 2020/21 (67 billion cubic meters) and 2021/22 (52 billion cubic meters).

Looking ahead, with end-of-winter stocks of 61.6 billion cubic meters as of March 31, 2024, Europe finds itself in a relatively favorable position needing a net restocking of approximately 34 billion cubic meters to reach the EU’s target of stocks representing 90% of capacity by the start of winter. This suggests a reasonably balanced European gas market in summer 2024.

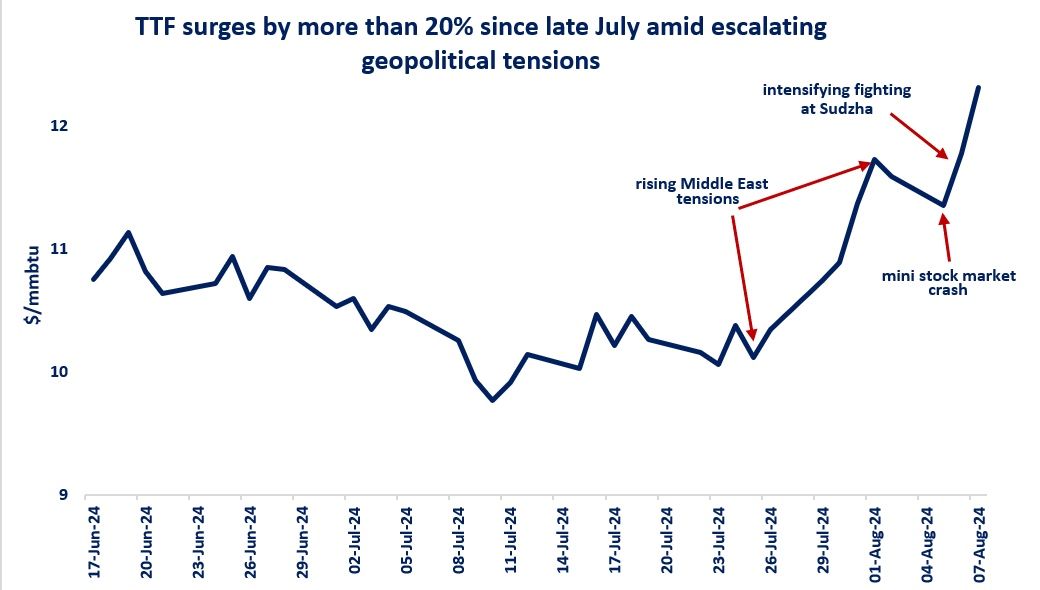

The end of winter in Europe with substantial storage stocks is particularly relevant for forward prices in Europe and Asia, as it implies lower European LNG imports for stock replenishment in summer 2024.

Besides, Europe imported 28% of global volumes in Q1 2024, down from 33% the previous year. European LNG imports in the first quarter of 2024, totaling 30.0 million tonnes, decreased by 14% compared to the first quarter of last year, as the significance of stocks reduced purchases, allowing Asian importers to increase their market share.

Regarding pipeline gas (PNG), the supply of PNG to the region has consistently been higher in 2024 than in the previous year. In fact, during the first quarter of 2024, PNG imports to the EU totaled 40 billion cubic meters, representing a 5% increase compared to the previous year. Russia has been the main driver of the increase in imports in 2024, having increased its supply by 23% this year compared to Q1 2023.

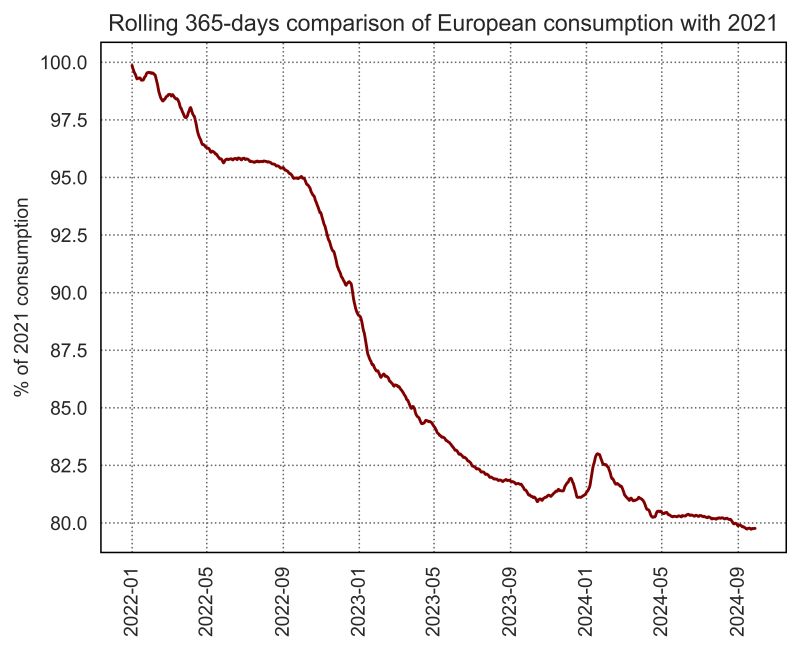

Overall, gas demand this winter has continued the trend with a total decrease of 4 billion cubic meters (1.6%). Consequently, gas demand decreased by 2.9 billion cubic meters (2.2%) year-on-year in Q1 2024, and it is expected to remain stable without a significant recovery in industrial demand.

The EU has continued to accelerate its transition to clean energies, deploying a record 73 GW of renewable energies in 2023, which replaced approximately 13 billion cubic meters of gas imports.

In 2024, the same factors suggest a generally low gas demand for electricity production (down 7% year-on-year in Q1).

Looking ahead to Q2 2024, macroeconomic prospects for Europe suggest that industrial gas demand is unlikely to rebound. In terms of weather-influenced demand, Q2 is generally a period of “limbo,” with notably milder temperatures than in winter but without the peak summer temperatures that could lead to air conditioning load and, by extension, gas-fired electricity generation.

On the supply side, the fact that Europe has quickly begun its stock replenishment (with stocks increasing by 2.7 Bcm between March 31 and April 13 and on track to add over 6 Bcm in April alone) is an early indicator of robust supply relative to demand.

Source: Vincent Barret