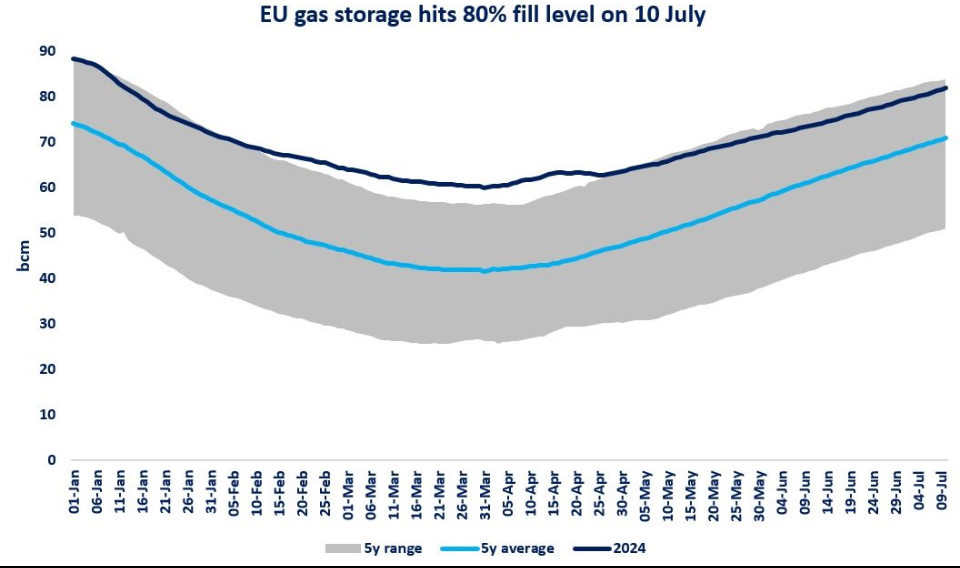

European gas storage levels hit 80% fill levels on 10 July, with inventories now standing 16% (or 11 bcm) above their 5y average.

This is an important milestone in the filling trajectories of storage sites, and shows that there is limited storage space left for the rest of the summer season.

With current injection rates EU storage sites would reach their 90% fill target by mid-August and could be full by the second half of September.

What could be the consequences of this?

(1) weak EU LNG imports: Europe’s LNG imports dropped by around 20% yoy in H1

2024 and high storage levels are expected to continue to limit the EU’s LNG import requirements in Q3 2024. This will leave more LNG to Asia and South America;

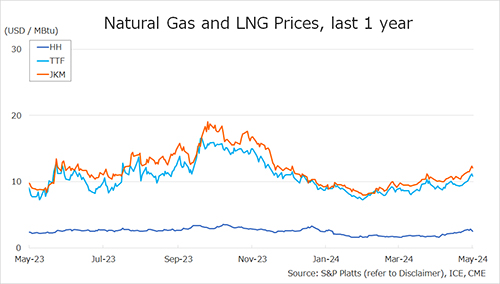

(2) wider JKM-TTF spread: TTF is expected to continue to trade at a significant discount compare to JKM, due to Europe’s lower LNG appetite. The JKM- TTF spread recently widened to $2.5/mmbtu, from just $0.6/mmbtu in Q1 2024;

(3) wider summer-winter spreads: high EU storage levels will weigh more on the summer contracts, which in turn will widen summer-winter spreads;

(4) Ukraine storage: with EU storage sites nearing full capacity, traders and wholesalers might look for storage opportunities in Western Ukraine.

Ukraine is offering 10 bcm of storage capacity to EU companies, which could also benefit from the country’s custom warehouse regime.

High EU gas storage certainly brings some relief to the market, but overall fundamentals remain tight: (1) LNG supply is lower than expected; (2) Asian gas demand came back with full strength (particularly China and India); (3) canals are putting additional constraints on shipping and (4) geopolitical tensions are adding spice to the mix.

What is your view? How will the summer market evolve? What will be the implications of high EU storage levels? Do you see any imminent risks to the global gas balance?

Source: Greg Molnar