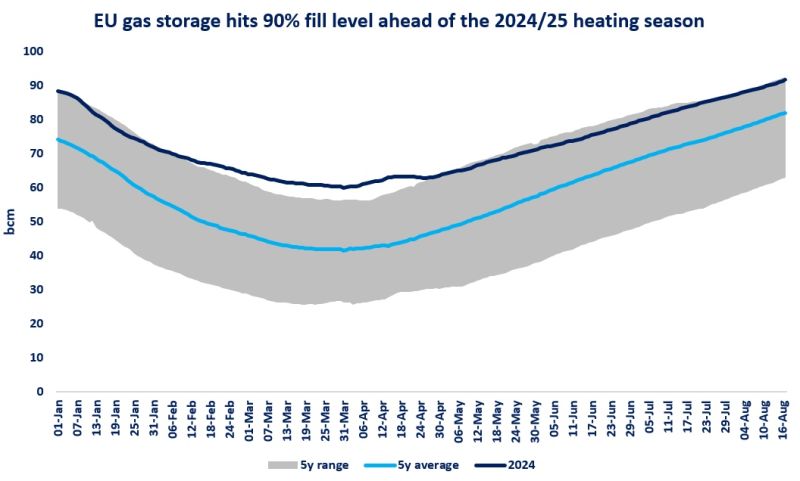

EU storage sites just reached 90% fill levels, more than two months ahead of the official target date of 1 November.

EU storage injections stood 22% (or 9 bcm) below their 5y average since April, as Europe inherited very high inventory levels from the 2023/24 winter, which limited storage filling needs.

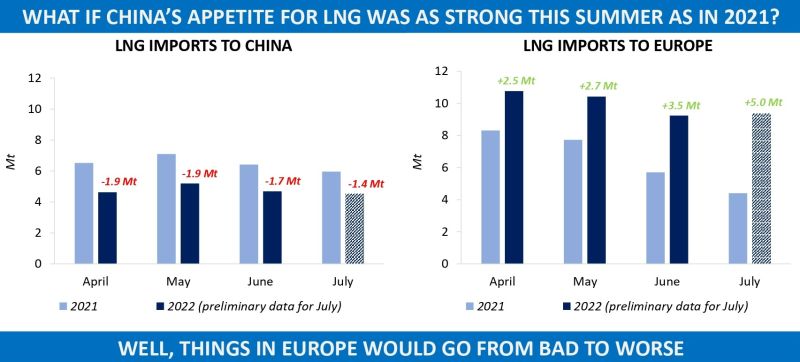

Slower injections were a major factor behind the softening of global gas market fundamentals, as Europe was able to reduce its LNG imports by near 20% yoy, partly because of lower filling rates. without this, the market would have been significantly tighter considering limited LNG supply growth and strong Asian demand.

Assuming that storage injections continue at their average rates, EU storage sites would be full by end of September. this is certainly a bearish outlook, although prices these days are primarily determined by geopolitics and not market fundamentals.

Source: Greg Molnar (LinkedIn)